Mortgage Point of Sale (POS) solutions have become the backbone of the industry, streamlining complex processes and enhancing customer experiences.

BeSmartee, the original founders of the modern digital mortgage, has embarked on an exciting journey with their HOLA project to reshape their Mortgage POS solution.

The Pinnacle of the Mortgage POS

Before we dive into the details of the HOLA project, let’s establish the significance of Mortgage POS systems. These platforms are instrumental in simplifying and expediting the mortgage origination process. They offer a one-stop solution for lenders and borrowers alike, making it easier to apply for and secure a mortgage.

BeSmartee has long been recognized as an industry innovator and the company’s Mortgage POS solution has been a testament to their commitment to excellence. The HOLA project represents BeSmartee’s bold step toward improving their solution, offering a superior user experience to lenders.

A Fresh Perspective: A New Look for BeSmartee’s Mortgage POS

HOLA aims to improve the user experience, making it more efficient, intuitive and visually appealing. Let’s delve into the key elements of this transformation.

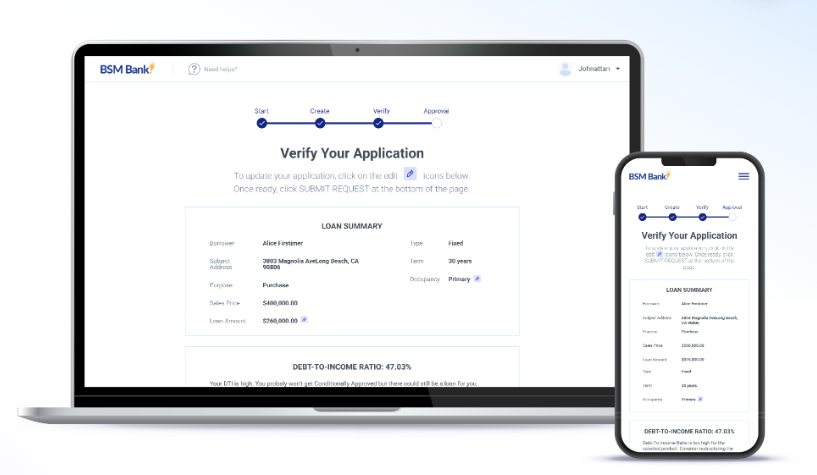

1. A Modern and Intuitive User Interface

One of the most noticeable changes in HOLA is its contemporary user interface (UI). BeSmartee has reimagined the look and feel of their platform, focusing on simplicity and functionality. The redesigned UI is clean, user-friendly and optimized for both lenders and borrowers. The result is a platform that is not only aesthetically pleasing but also easy to navigate.

2. Seamless User Experience

HOLA places a strong emphasis on user experience (UX). The platform has been fine-tuned to ensure that every interaction, from loan application to approval, is as smooth as possible. Borrowers can easily navigate through the application process, while lenders benefit from an efficient and organized workflow. This seamless experience not only saves time but also reduces the potential for errors, enhancing the overall quality of service.

3. Personalization and Customization

Every mortgage transaction is unique and HOLA acknowledges this fact. The platform offers a high degree of personalization and customization options. Lenders can configure the platform to match their specific workflows and branding, providing a consistent and personalized experience to borrowers. This flexibility is a game-changer in an industry where one size does not fit all.

4. Enhanced Document Management

In the world of mortgage lending, document management is a critical aspect. HOLA integrates advanced document management features, making it easier than ever to upload, share and review documents securely. This not only speeds up the approval process but also reduces the risk of lost or misplaced paperwork.

5. Improved Communication

Effective communication is the backbone of successful mortgage transactions. HOLA features enhanced communication tools, allowing borrowers and lenders to interact seamlessly within the platform. Real-time messaging, document sharing and notifications keep all parties informed and engaged, fostering transparency and trust.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

The HOLA Advantage in Mortgage POS

Now that we’ve explored the various facets of the HOLA project, let’s discuss the advantages it brings to the Mortgage POS landscape.

1. Increased Efficiency

Efficiency is the cornerstone of HOLA. By streamlining processes, automating tasks and offering a unified platform for all stakeholders, it significantly reduces the time and effort required for mortgage origination. This translates to faster loan approvals and happier borrowers.

2. Competitive Edge

In an industry as competitive as mortgage lending, standing out is essential. HOLA’s modern and personalized approach gives lenders a competitive edge. It allows them to differentiate themselves by offering a superior experience to borrowers.

3. Compliance and Security

Compliance and data security are non-negotiable in the mortgage industry. HOLA adheres to the highest industry standards, ensuring that sensitive information is protected and regulatory requirements are met. This peace of mind is invaluable to lenders and borrowers alike.

4. Enhanced Decision-Making

HOLA doesn’t just make processes more efficient; it also empowers lenders with data-driven insights. The platform offers robust analytics and reporting tools, allowing lenders to make informed decisions and optimize their operations.

Shaping the Future of Mortgage POS

BeSmartee’s HOLA project represents a pivotal moment in the evolution of Mortgage POS systems. It’s not just a cosmetic makeover but a holistic transformation that redefines how lenders and borrowers engage with the mortgage origination process.

With a modern UI, seamless UX, personalization options, document management and enhanced communication, HOLA empowers lenders to be more efficient, competitive and compliant. It also offers borrowers a more convenient and transparent mortgage application experience.

As the mortgage industry continues to evolve, solutions like BeSmartee’s Mortgage POS are instrumental in shaping its future. Contact our experts today to experience the new look and feel of BeSmartee’s digital lending solution.