Loan Officer Secrets: Unlocking the Key to Thriving Real Estate Agent Relationships

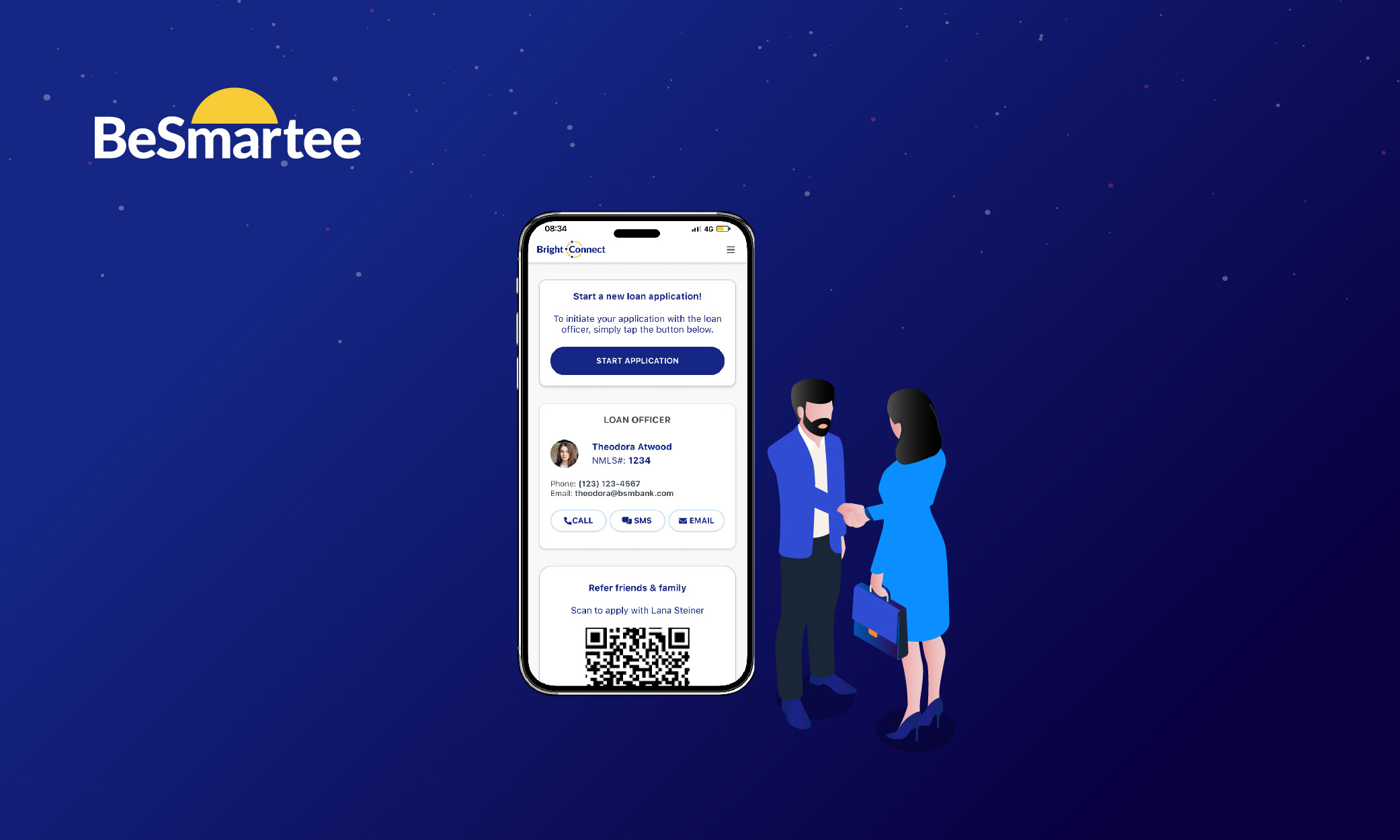

Discover what real estate agents seek in loan officer relationships—clear communication, expertise, and trust. Learn how to build lasting partnerships for mutual success.