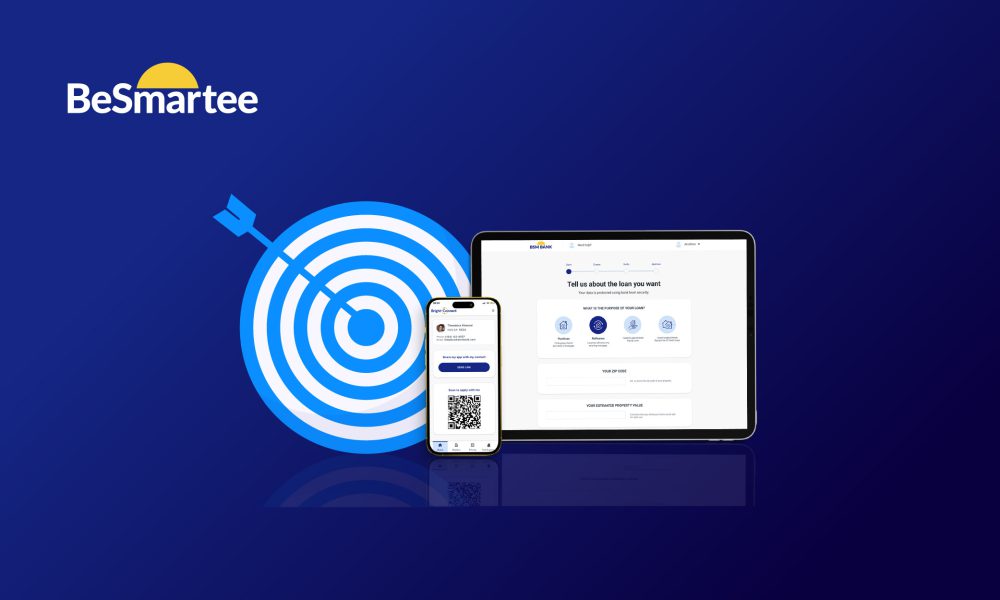

Attracting the Right Borrowers: How Lenders Can Target Quality Applicants

In 2025, attracting the right borrowers matters just as much as volume. Learn how lenders can refine targeting and convert quality applicants into closed loans.

In 2025, attracting the right borrowers matters just as much as volume. Learn how lenders can refine targeting and convert quality applicants into closed loans.

Discover how global economic shifts, from tariffs to interest rates, are redefining mortgage lending, and how lenders can adapt with agile pricing, risk tools, and digital borrower communication.

Discover how transparency, real-time updates, and borrower dashboards help mortgage lenders build trust and boost borrower confidence in a digital-first world.

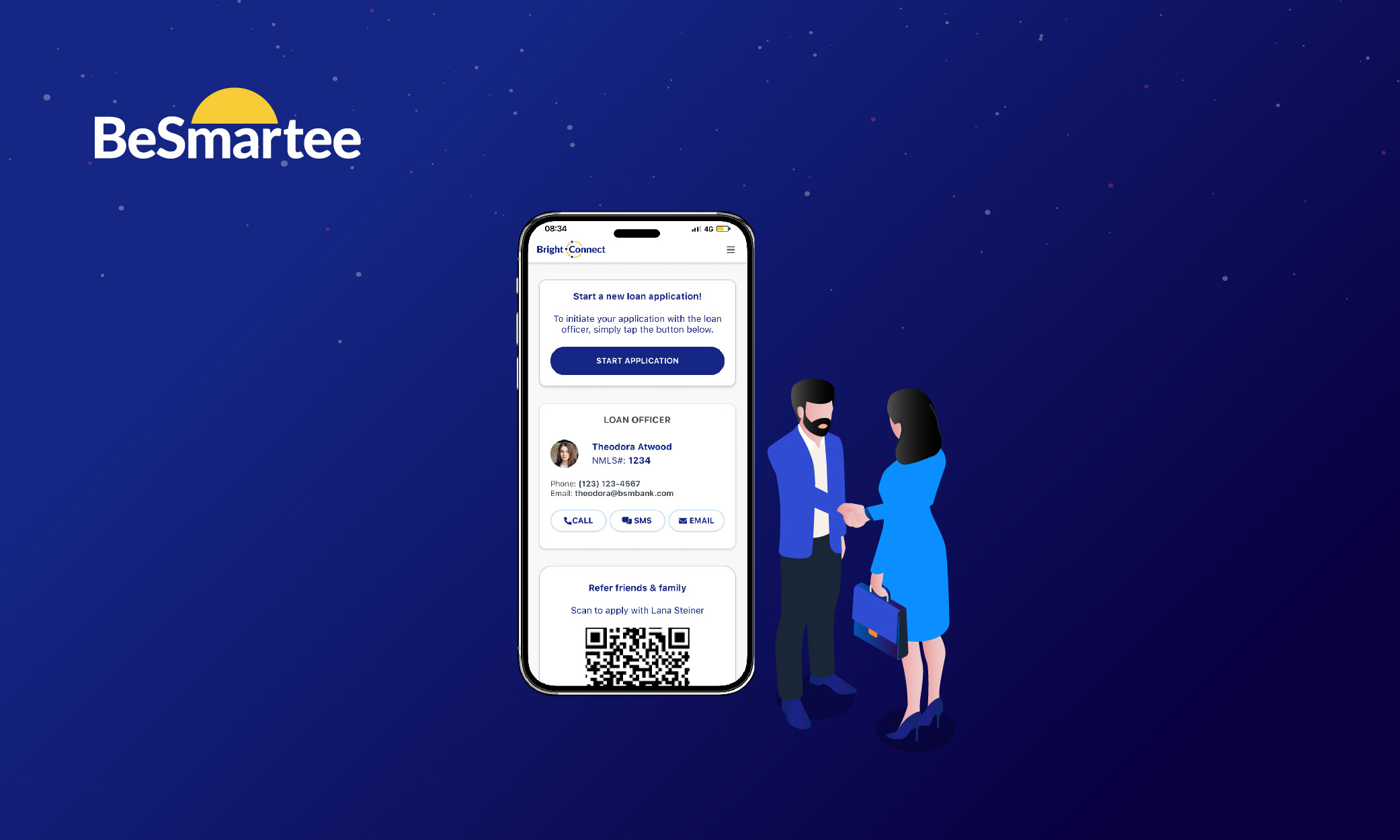

A comprehensive guide for loan officers on generating high-quality leads through modern digital tools. Learn how to leverage mortgage POS systems, native mobile mortgage apps, multi-channel marketing strategies, and strategic partnerships to build a sustainable pipeline of qualified borrowers in today's competitive lending landscape.

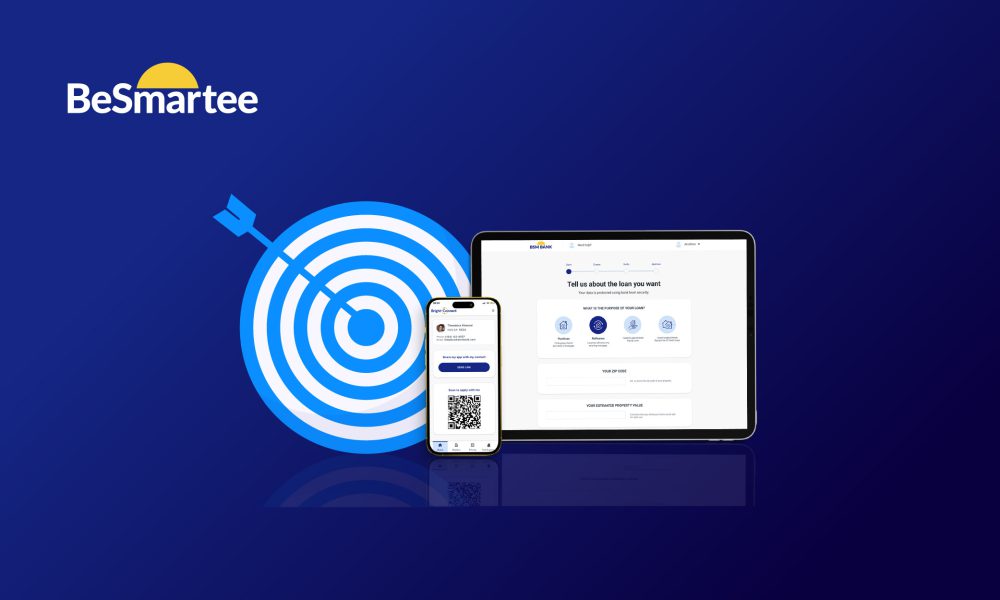

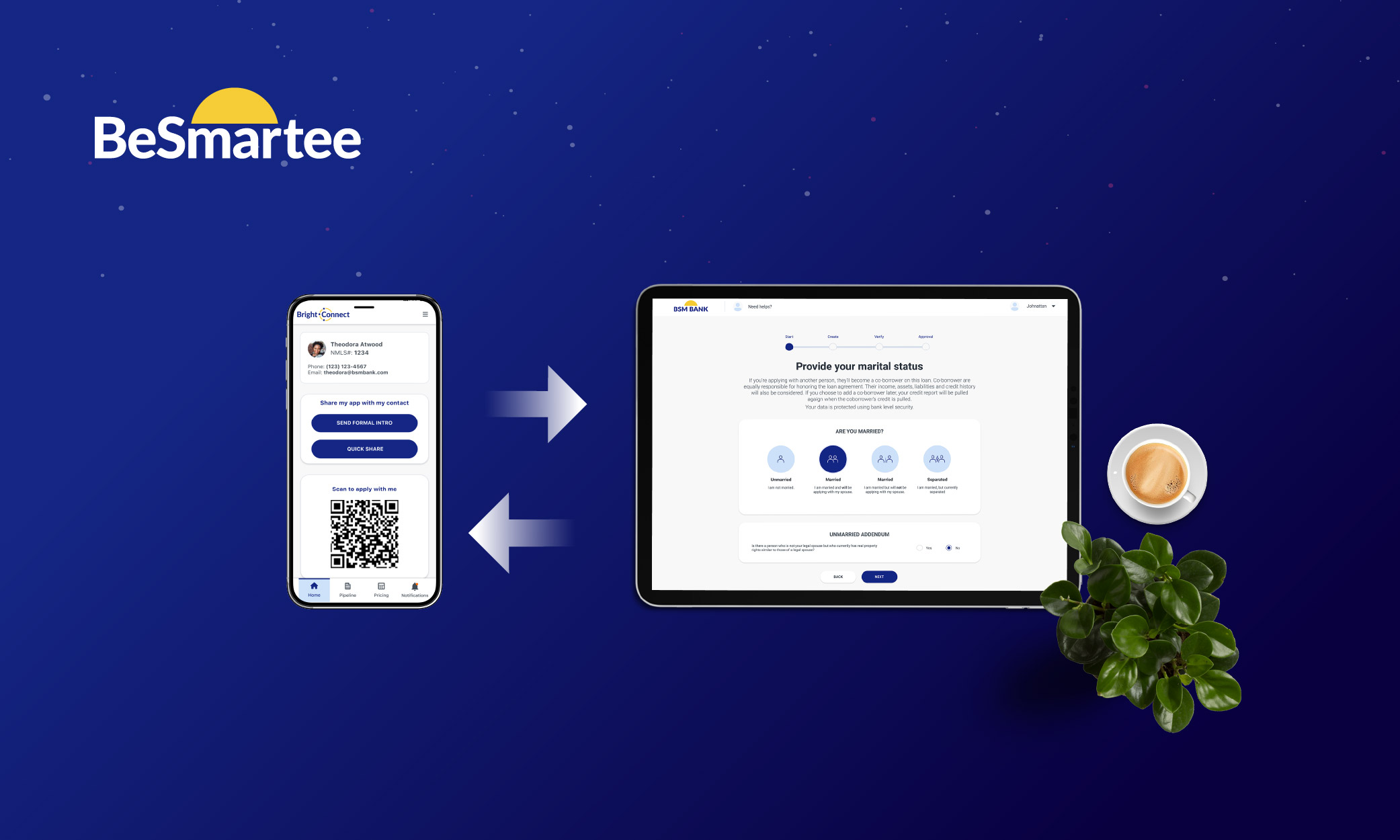

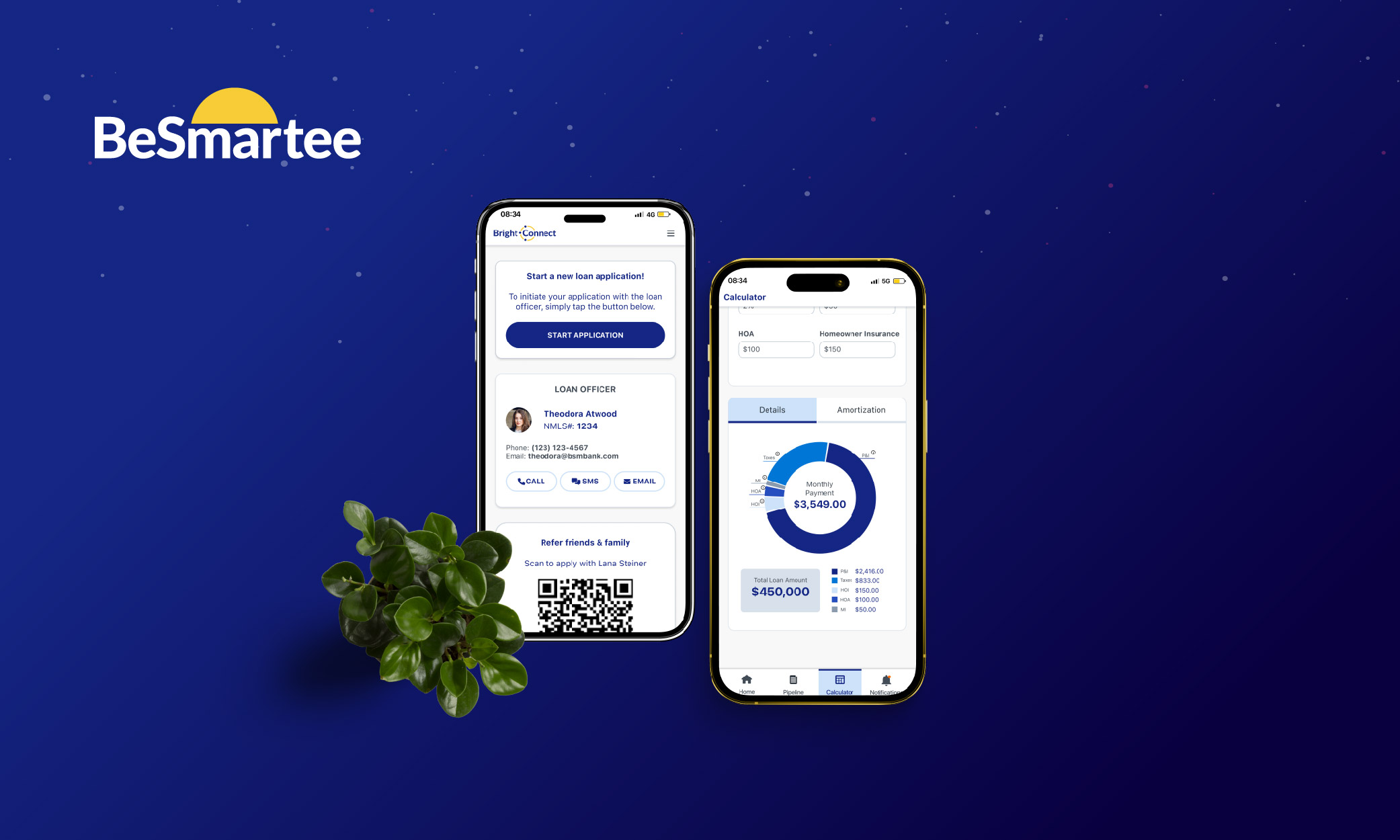

While 82% of credit union executives recognize the importance of digital lending, only 9% offer complete solutions according to CUSO Magazine, creating a critical gap that frustrates applicants and costs business. Bright Connect's mobile mortgage app integrates with BeSmartee's POS solution to deliver the seamless experience members demand, driving conversions and operational efficiency.

Explore key trends from the Q1 2025 Mortgage Lending Report, including rising home prices, shifting interest rates, and market challenges shaping the future of home financing.

Go deeper into the origination process, faster.

Contact Us

Discover how online mortgages are transforming lending. Learn how automation, AI, and digital tools help lenders boost efficiency, cut costs, and stay competitive in a digital era.

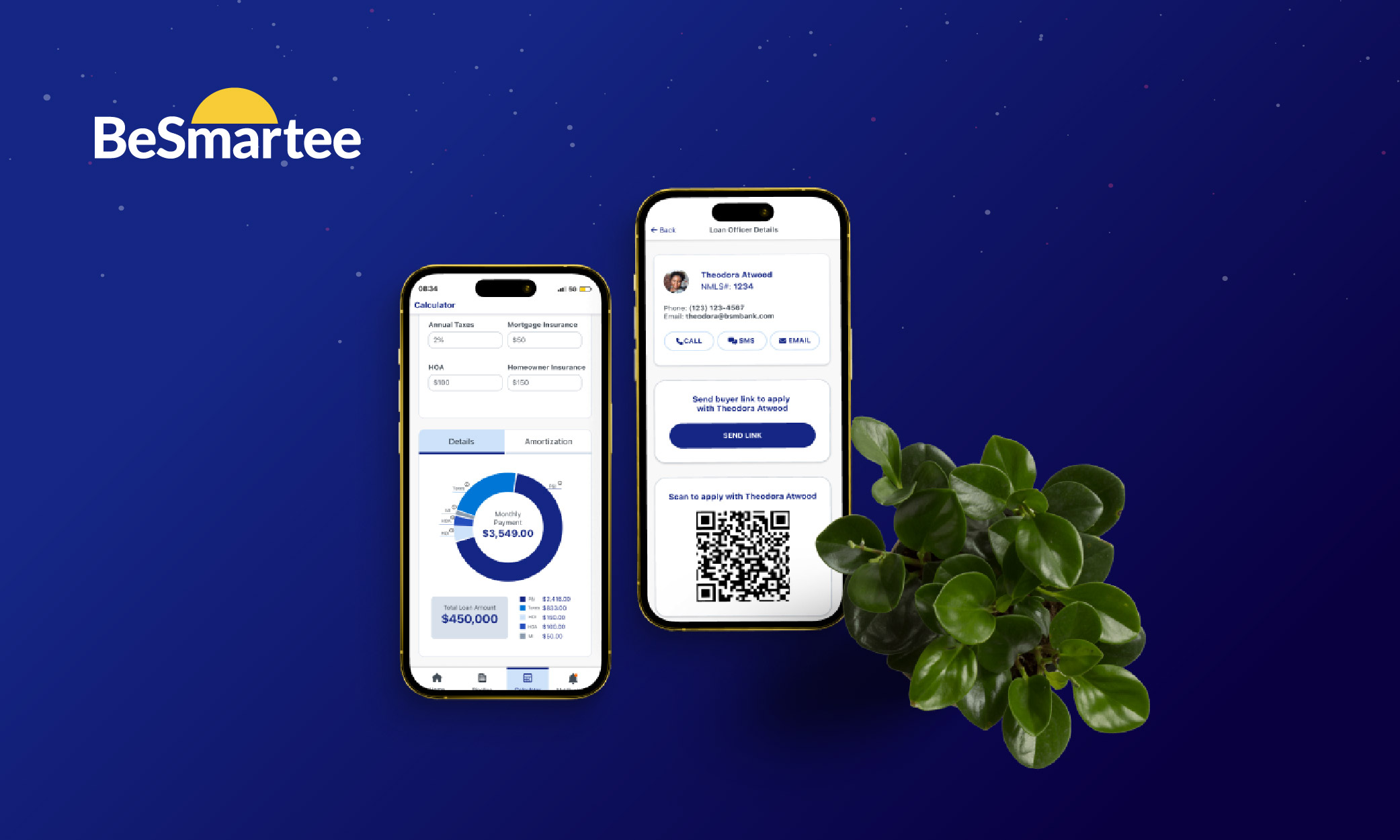

Discover how a mobile mortgage app transforms the borrower experience with speed, convenience, and transparency. Learn why it's essential for modern lenders today!

Discover what real estate agents seek in loan officer relationships—clear communication, expertise, and trust. Learn how to build lasting partnerships for mutual success.

Discover the power of Bright Connect, designed to help independent mortgage bankers (IMBs) thrive in today’s remote-first world. With mobile-first technology and seamless integration into Bright POS, it enables faster workflows, superior borrower experiences, and greater flexibility for a competitive edge.

Exploring the impact of significant mortgage mergers and their influence on the housing and lending industries.

Discover the must-have features every mobile mortgage app needs to boost loan officer productivity, streamline processes, and enhance borrower experiences.