Mortgage Rates Surge in 2024: Essential Predictions & Insights

Explore key predictions for mortgage rates in 2024, including economic influences, technological impacts and regional variations.

Explore key predictions for mortgage rates in 2024, including economic influences, technological impacts and regional variations.

Enhancing efficiency, accuracy, and transparency across mortgage origination and pricing, this advanced API integration benefits both lenders and borrowers alike.

Jim Paolino talks with CEO and Founder of BeSmartee, Tim Nguyen, about what’s ahead for…

From AI and blockchain to green mortgages, discover mortgage technology which is shaping a secure, efficient and customer-centric future.

Discover the power of automated spreading in commercial lending.

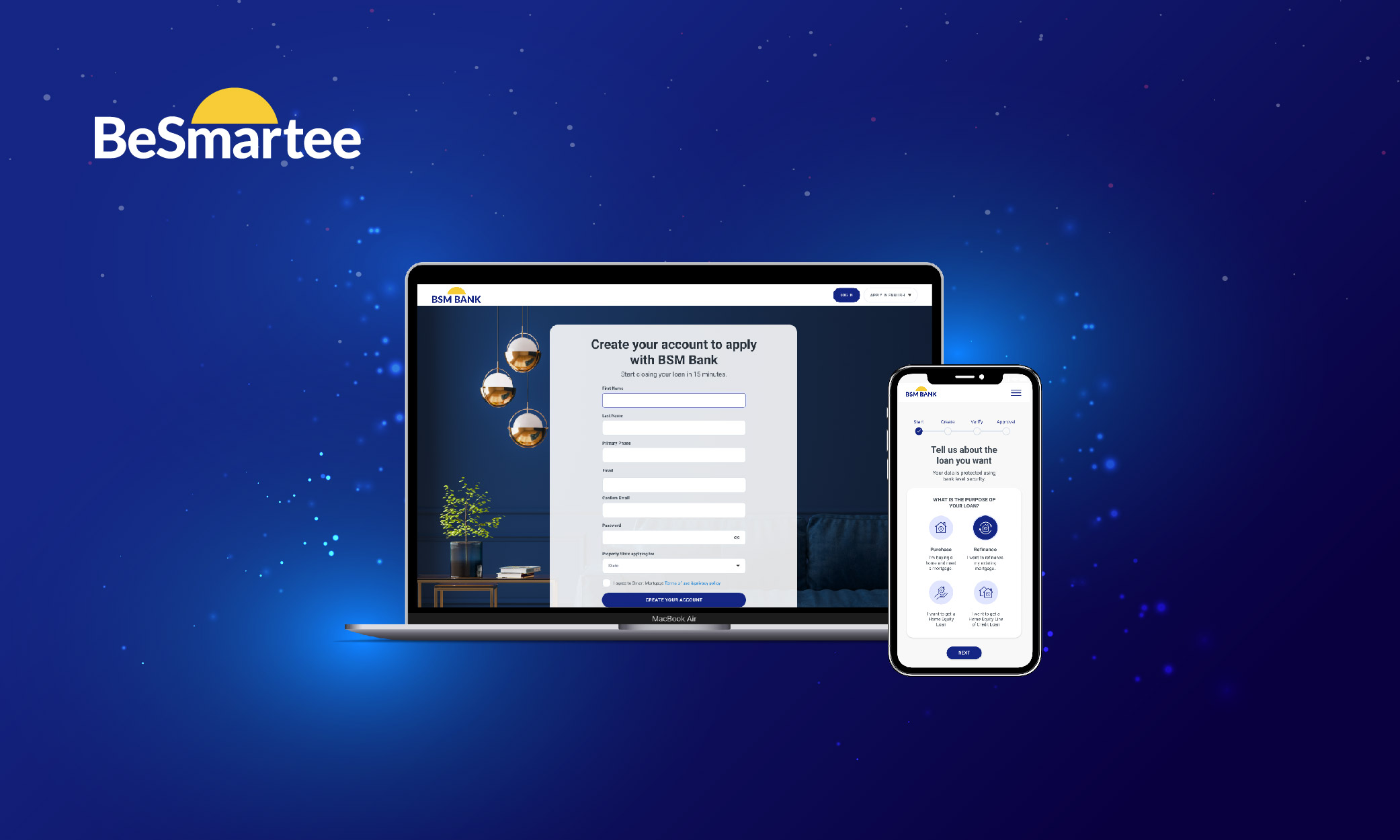

Bright POS signifies a substantial stride in empowering financial institutions and independent mortgage bankers (IMBs) for success in a competitive market.

Go deeper into the origination process, faster.

Contact Us

Key insights on mortgage rates, empowering lenders to tailor strategies for the diverse Hispanic community.

Discover the must-attend 2024 mortgage conferences – unlocking insights, networking opportunities and cutting-edge innovations.

Unlock efficiency in finance with automated financial statement spreading. Discover benefits, navigate challenges and transform with FlashSpread's innovative technology.

Find out how top mortgage originators technology innovations, client-centric approaches and community engagement to close more loans in 2023.

Explore the key trends, technological shifts, market responses, regulatory impacts and the future outlook of Mergers and Acquisitions in the mortgage sector.

Explore the dynamic evolution of automated financial statements spreading in commercial lending.