Here’s Why Bypassing Mortgage Efficiencies Can Hurt Lender Profits

Mortgage technology investments are helping lenders increase efficiency and build a more profitable business.

Mortgage technology investments are helping lenders increase efficiency and build a more profitable business.

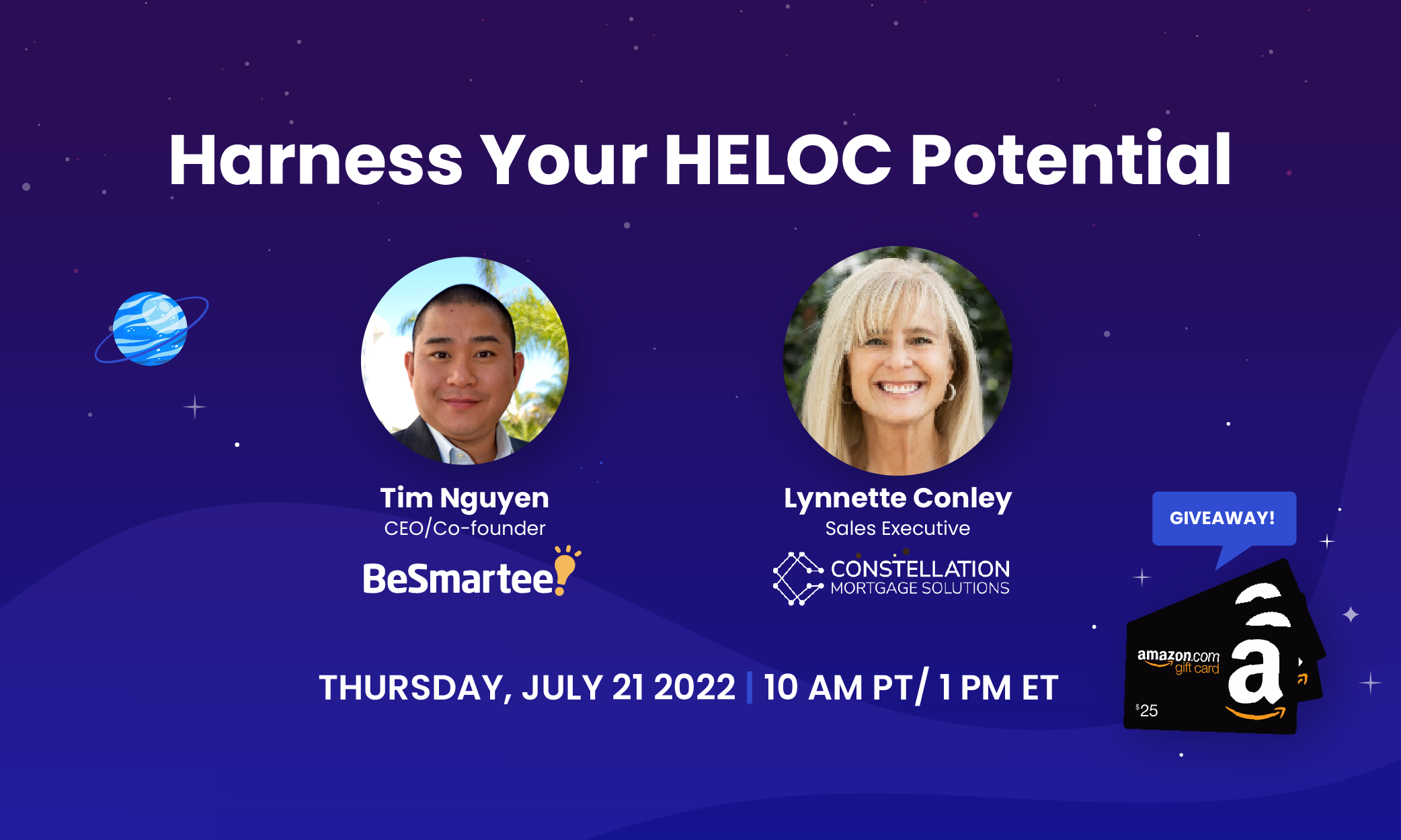

BeSmartee CEO and Co-founder Tim Nguyen and Constellation Mortgage Solutions Director of Sales Lynnette Conley Nuese on Harness Your HELOC Potential Webinar.

As an independent mortgage broker, you can’t afford to waste a single second of your…

Discover Tax Form 1120's importance in commercial lending. Learn how digital solution FlashSpread streamlines the review process for lenders, making informed credit decisions effortlessly.

Two of the most important systems in the mortgage ecosystem are the POS and LOS. Here’s how a tight integration can help your lending business.

Mortgage POS platforms bring efficient data management to lenders while delivering the online experience borrowers want.

Go deeper into the origination process, faster.

Contact Us

The mortgage ecosystem requires interconnected solutions working together to bring a loan from application to close.

The last two years were a heady combination of meteoric success and anxiety to get it all done. The mortgage industry enjoyed unprecedented origination, with total volume (refinance and purchase money) soaring to over $4T in 2020 and squeaking in just below at $3.9T in 2021.

Digital mortgage solutions help eliminate the friction involved in the lending process.

BeSmartee Wins Two Gold Awards at The 2022 TITAN Business Awards.

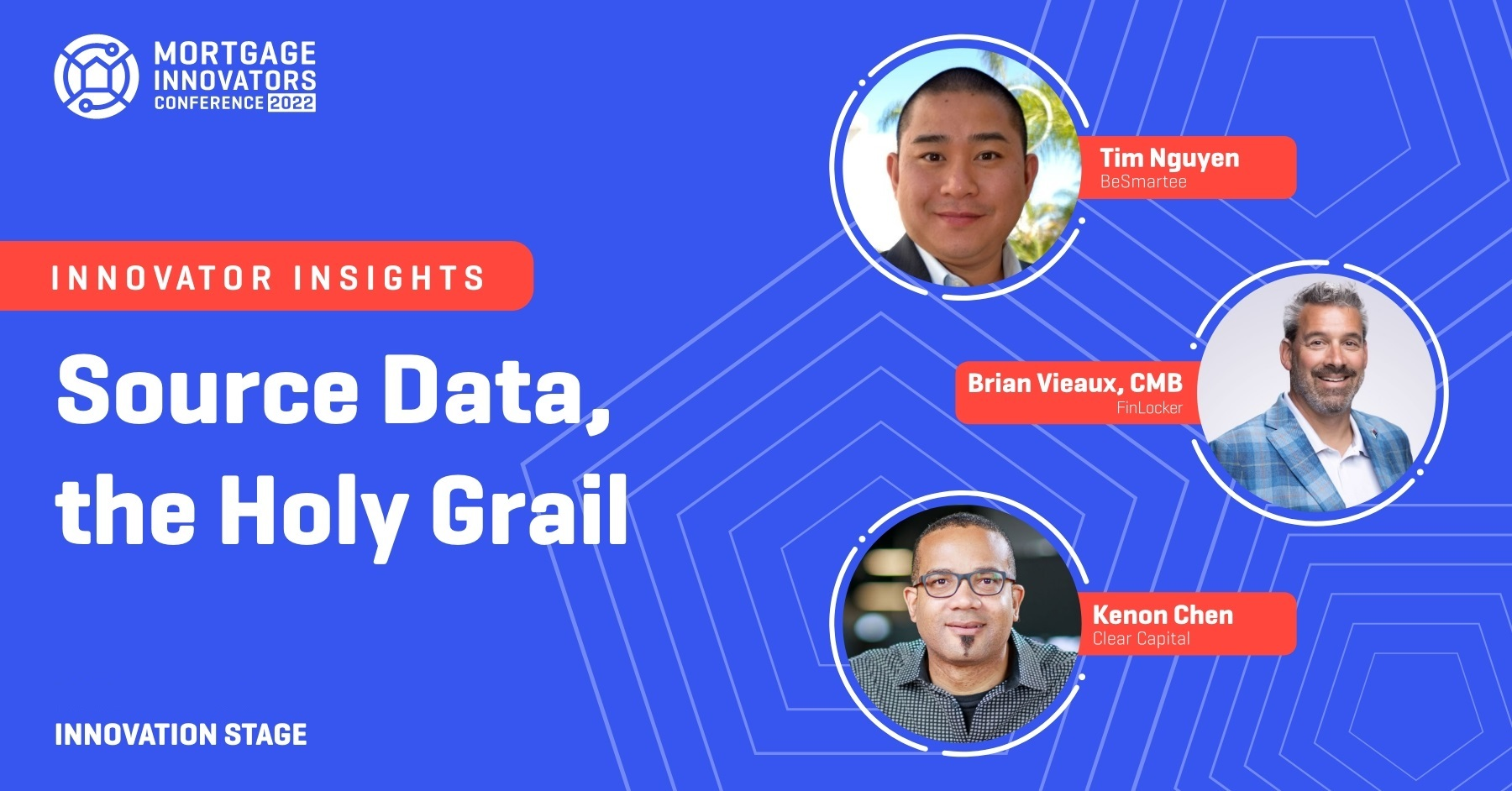

BeSmartee CEO and Co-founder Tim Nguyen on the Mortgage Innovators Panel for Source Data, The Holy Grail.

New products and services nominated in The American Business Awards® were included in a public vote for favorite new products. The winners of each category received a crystal People's Choice Stevie Award. BeSmartee won for the category of Digital Process Automation.