Everything You Need to Know About Reverse Mortgages

Mortgage loan officers need to brush up on their reverse mortgage education to better help seniors make the most out of their retirement.

Mortgage loan officers need to brush up on their reverse mortgage education to better help seniors make the most out of their retirement.

How advances in high-speed technology transformed the mortgage industry.

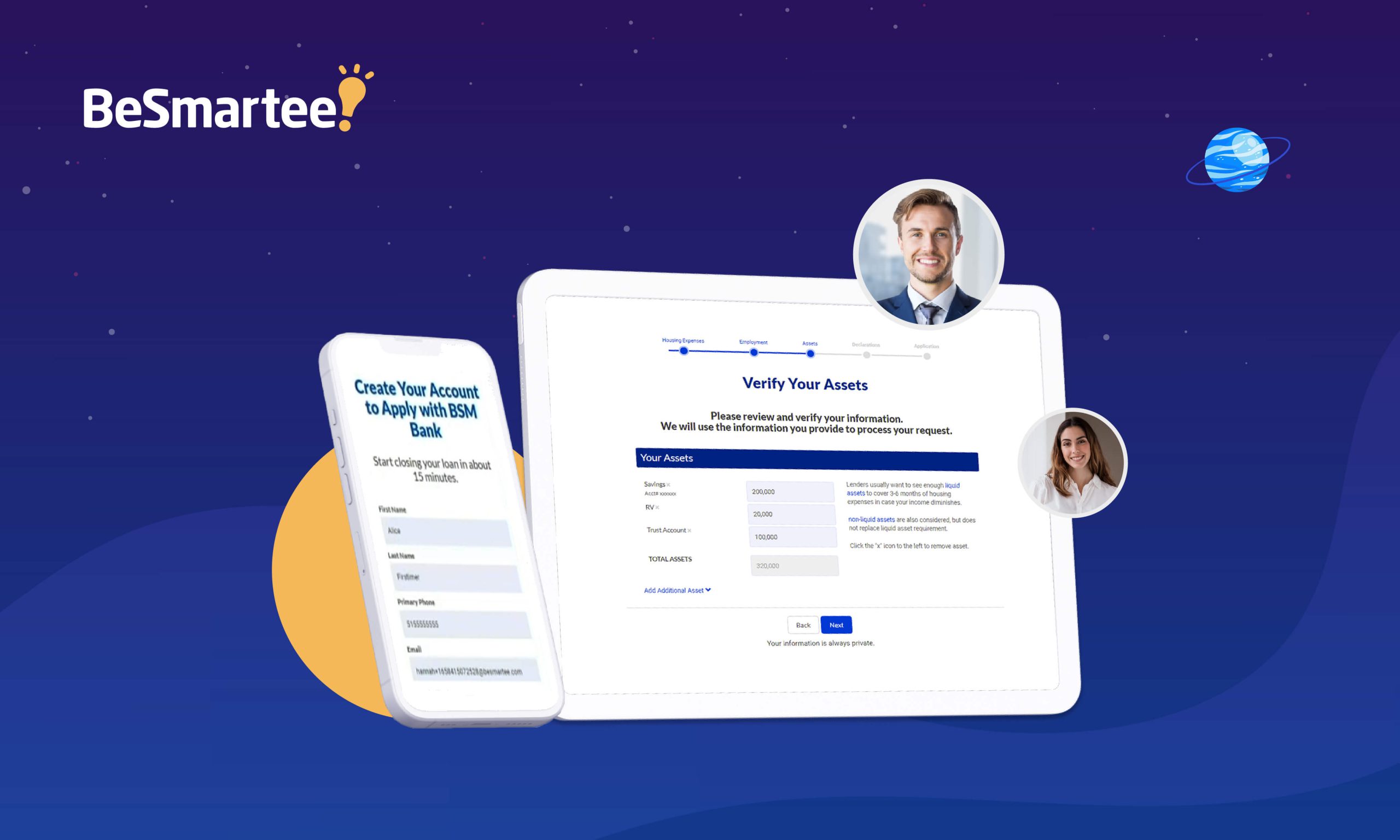

The current market has HELOCs on the rise. BeSmartee's flexible and scalable HELOC automation technology meets today’s digital borrowers, and helps banks, credit unions and non-bank lenders increase their HELOC market share.

BeSmartee CEO and Co-founder Tim Nguyen on ClearCast Real Estate Fintech Podcast.

The premier tech focused event for mortgage industry leaders and professionals will take place in Las Vegas, Nevada.

Making the leap into the 21st century with mortgage technology that checks off all the boxes.

Go deeper into the origination process, faster.

Contact Us

Top trends, hot markets and everything you need to know to end 2022 on a high note.

The LodeStar and BeSmartee integration automates the mortgage fee-quoting process for lenders, guaranteeing 100% accuracy.

Changes in commercial lending regulations can be difficult for small lenders that might not have a dedicated compliance team. But with FlashSpread's financial spreading software, lenders can quickly and easily comply with all new requirements.

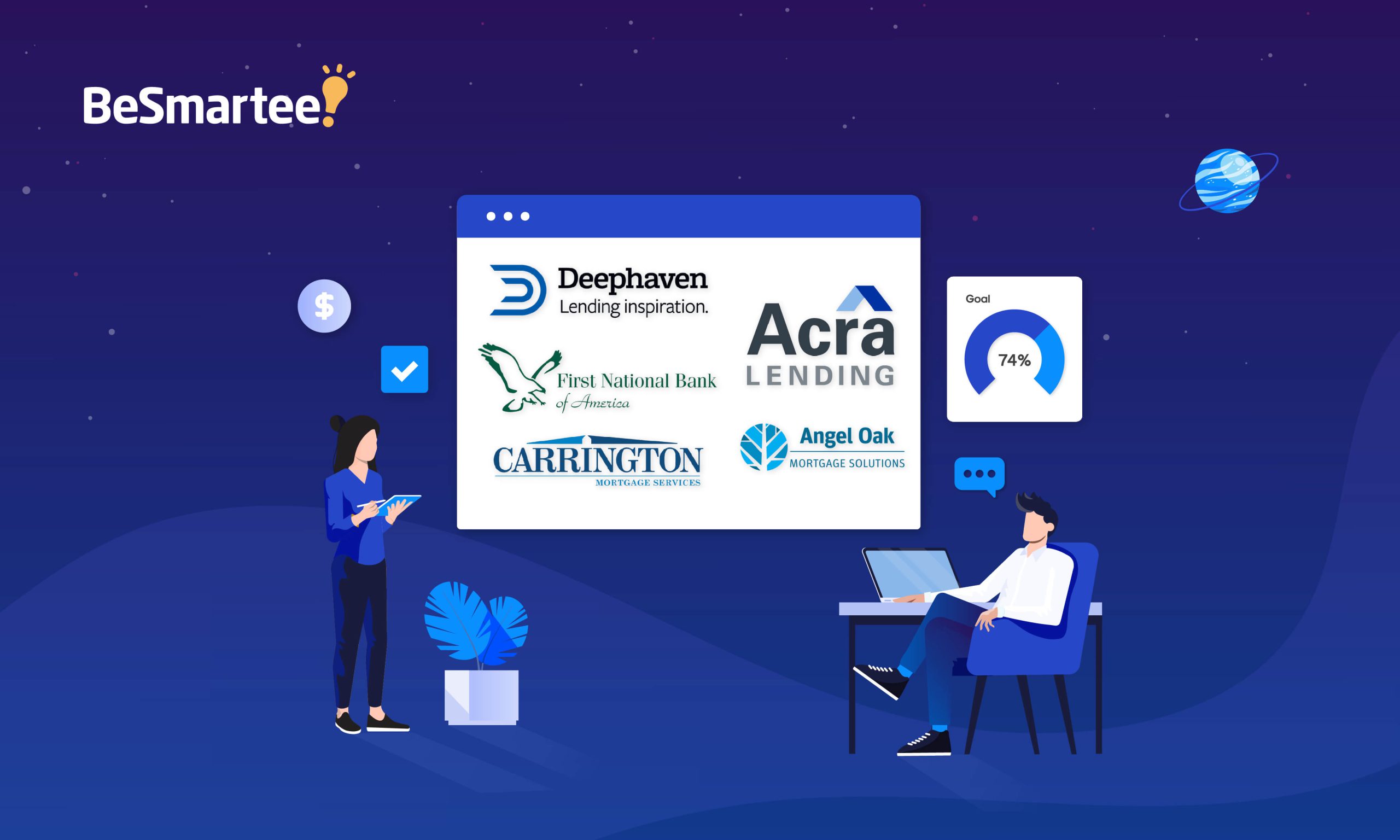

Non-QM mortgage lenders facilitate a competitive market for both buyers and lenders. Here are some of the top non-QM lenders of 2022.

Whereas other digital mortgage POS providers are thinking in the now, we’ve already imagined and built the tools all mortgage lenders will be using in the future. Here’s your roadmap.

Mortgage VOIE solutions increase the speed and accuracy of income and employment data. Origination costs…