Choosing the Right Automated Financial Spreading Tool: The Essential Guide

Evaluating automated financial spreading tools? Learn what features matter, what red flags to avoid, and how to compare vendors with confidence.

Evaluating automated financial spreading tools? Learn what features matter, what red flags to avoid, and how to compare vendors with confidence.

Many lenders still wonder whether automation can accurately process both income statements and balance sheets,…

Boost operational efficiency in commercial lending. Learn how lenders can process more deals, reduce errors, and scale without expanding headcount.

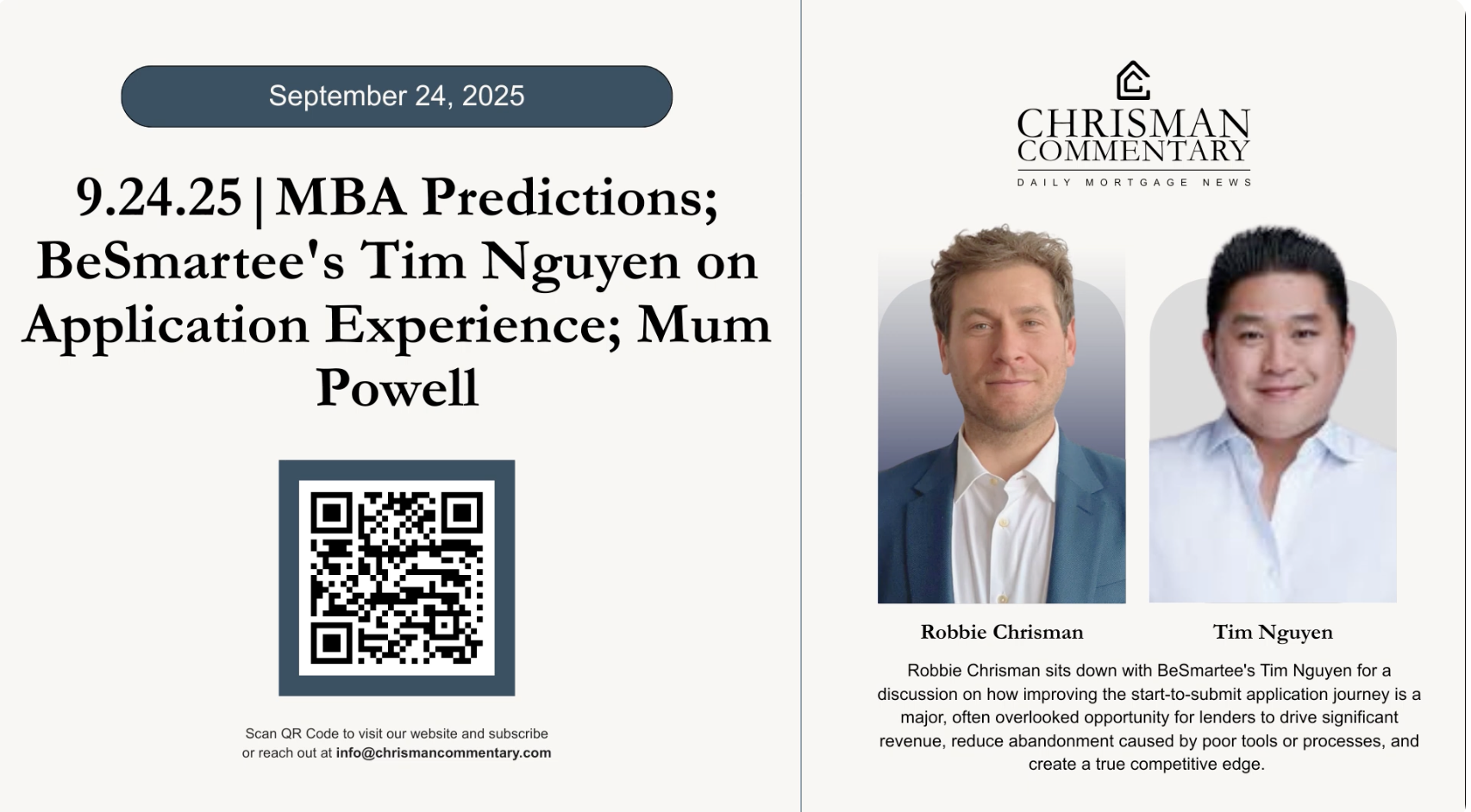

Tim Nguyen discusses how lenders can reduce borrower drop-off and turn the mortgage application into a competitive edge.

Tim Nguyen exposes overlooked metrics that kill mortgage conversions and reveals how to fix the borrower experience.

Tim Nguyen explains how configurable mortgage POS systems help lenders streamline borrower experiences.

Go deeper into the origination process, faster.

Contact Us

Tim Nguyen explores configurable SaaS, vendor fatigue, and digital transformation in lendtech.

BeSmartee sponsors The Chrisman Commentary, featuring Tim Nguyen on innovation and AI in mortgage lending.

Tim Nguyen highlights AI, evolving lender roles, and innovation in the modern mortgage economy.

Tim Nguyen discusses policy shifts, mobile mortgage solutions, and POS innovation on The Chrisman Commentary.

Tim Nguyen discusses AI, efficiency, and the evolving mortgage landscape on Fintech Hunting.

Tim Nguyen introduces BeSmartee’s Bright suite and explains how AI powers the future of mortgage technology.