BeSmartee’s FlashSpread and FUNDINGO Form Strategic Partnership to Supercharge Loan Workflow Automation

FlashSpread and FUNDINGO streamline tax spreading and loan management, helping lenders make faster, data-driven decisions.

Stay current on product updates, integration partners and exciting company news!

FlashSpread and FUNDINGO streamline tax spreading and loan management, helping lenders make faster, data-driven decisions.

The strategic shift is designed to drive faster implementation, reduce maintenance overhead, streamline operations, and support lender flexibility.

The best-in-class annual mortgage industry event returns to Las Vegas.

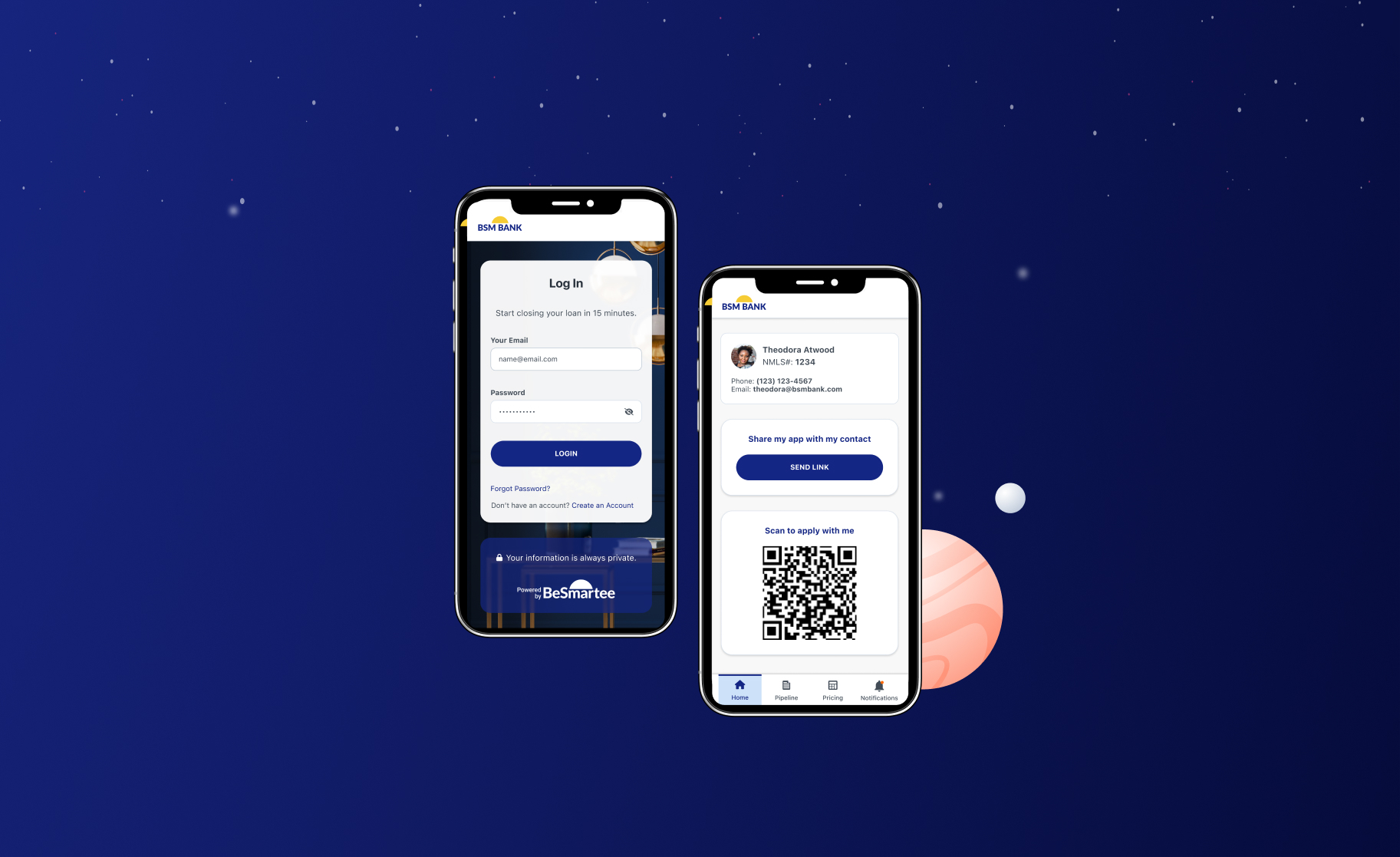

Bright Connect is the ultimate solution for mortgage and real estate professionals in a mobile-first world.

Enhancing efficiency, accuracy, and transparency across mortgage origination and pricing, this advanced API integration benefits both lenders and borrowers alike.

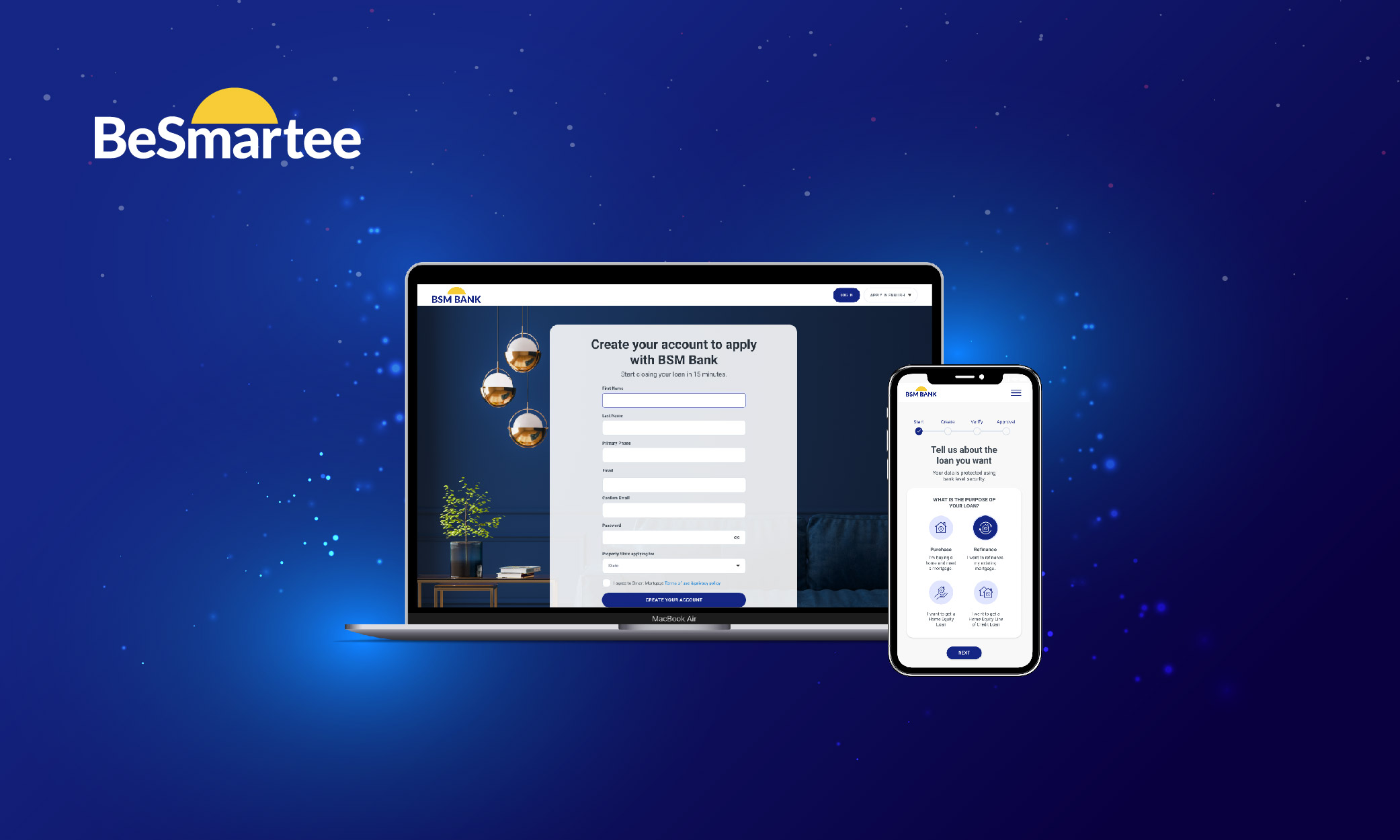

Bright POS signifies a substantial stride in empowering financial institutions and independent mortgage bankers (IMBs) for success in a competitive market.

Go deeper into the origination process, faster.

Contact Us

BeSmartee's mortgage point-of-sale (POS) solution is integral to IMB success and growth in today’s market.

BeSmartee, a leading lendtech solutions provider, has introduced an innovative flexible pre-qualification system for the real estate industry.

BeSmartee and Clear Capital's strategic partnership offers an efficient property valuation solution that streamlines the mortgage and home equity origination process.

BeSmartee enhances its Mortgage POS solution with its Soft-Pull Credit feature to help lenders reduce costs.

BeSmartee®, an award-winning fintech firm and the original founder of modern digital mortgage systems, has announced a partnership with SWBC® Lending Solutions, a leading provider of mortgage services to more than 1,400 financial institutions, to deliver a world-class digital mortgage experience.

BeSmartee’s proprietary feature, “Letters,” empowers borrowers by increasing their home buying potential and lightens the workloads of loan and compliance officers.