Reducing Borrower Drop-Off in the Application Journey

Tim Nguyen discusses how lenders can reduce borrower drop-off and turn the mortgage application into a competitive edge.

Learn everything you need to know about digital mortgage lending.

Tim Nguyen discusses how lenders can reduce borrower drop-off and turn the mortgage application into a competitive edge.

Tim Nguyen exposes overlooked metrics that kill mortgage conversions and reveals how to fix the borrower experience.

Tim Nguyen explains how configurable mortgage POS systems help lenders streamline borrower experiences.

Tim Nguyen explores configurable SaaS, vendor fatigue, and digital transformation in lendtech.

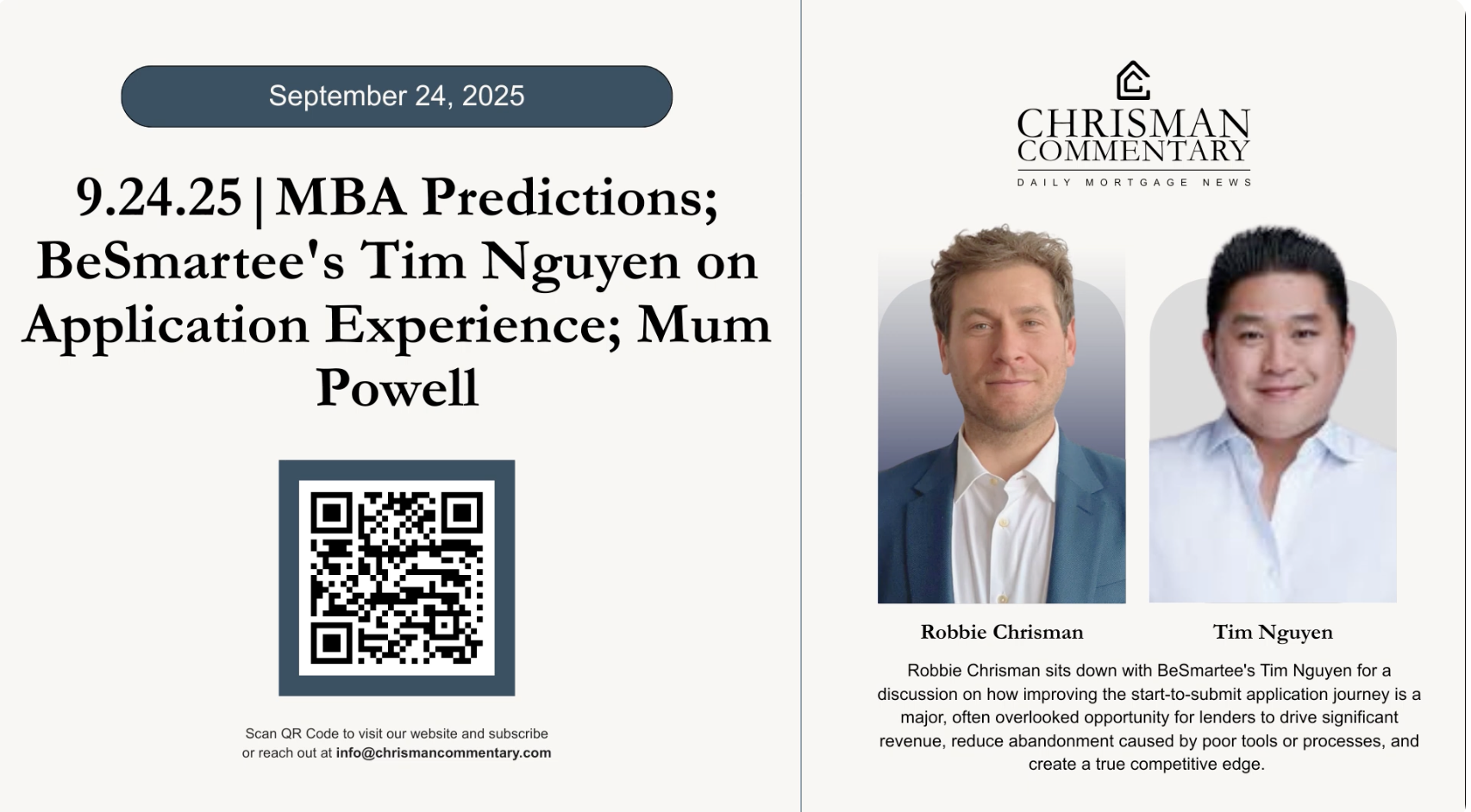

BeSmartee sponsors The Chrisman Commentary, featuring Tim Nguyen on innovation and AI in mortgage lending.

Tim Nguyen highlights AI, evolving lender roles, and innovation in the modern mortgage economy.

Go deeper into the origination process, faster.

Contact Us

Tim Nguyen discusses policy shifts, mobile mortgage solutions, and POS innovation on The Chrisman Commentary.

Tim Nguyen discusses AI, efficiency, and the evolving mortgage landscape on Fintech Hunting.

Tim Nguyen introduces BeSmartee’s Bright suite and explains how AI powers the future of mortgage technology.

Tim Nguyen shares how BeSmartee uses AI and automation to transform the borrower experience in mortgage lending.

Discover why leading lenders are ditching custom-built mortgage tech in favor of configurable SaaS. In this BeSmartee webinar, learn how standardization helps reduce complexity, cut costs, and accelerate growth.

Truv has seamlessly integrated with BeSmartee’s mortgage POS platform, Bright POS, to automate manual verification processes and transform the mortgage experience for lenders and borrowers.