Mortgage Rates Insights from the State of Hispanic Homeownership Report

Key insights on mortgage rates, empowering lenders to tailor strategies for the diverse Hispanic community.

Key insights on mortgage rates, empowering lenders to tailor strategies for the diverse Hispanic community.

Discover the must-attend 2024 mortgage conferences – unlocking insights, networking opportunities and cutting-edge innovations.

Find out how top mortgage originators technology innovations, client-centric approaches and community engagement to close more loans in 2023.

Explore the key trends, technological shifts, market responses, regulatory impacts and the future outlook of Mergers and Acquisitions in the mortgage sector.

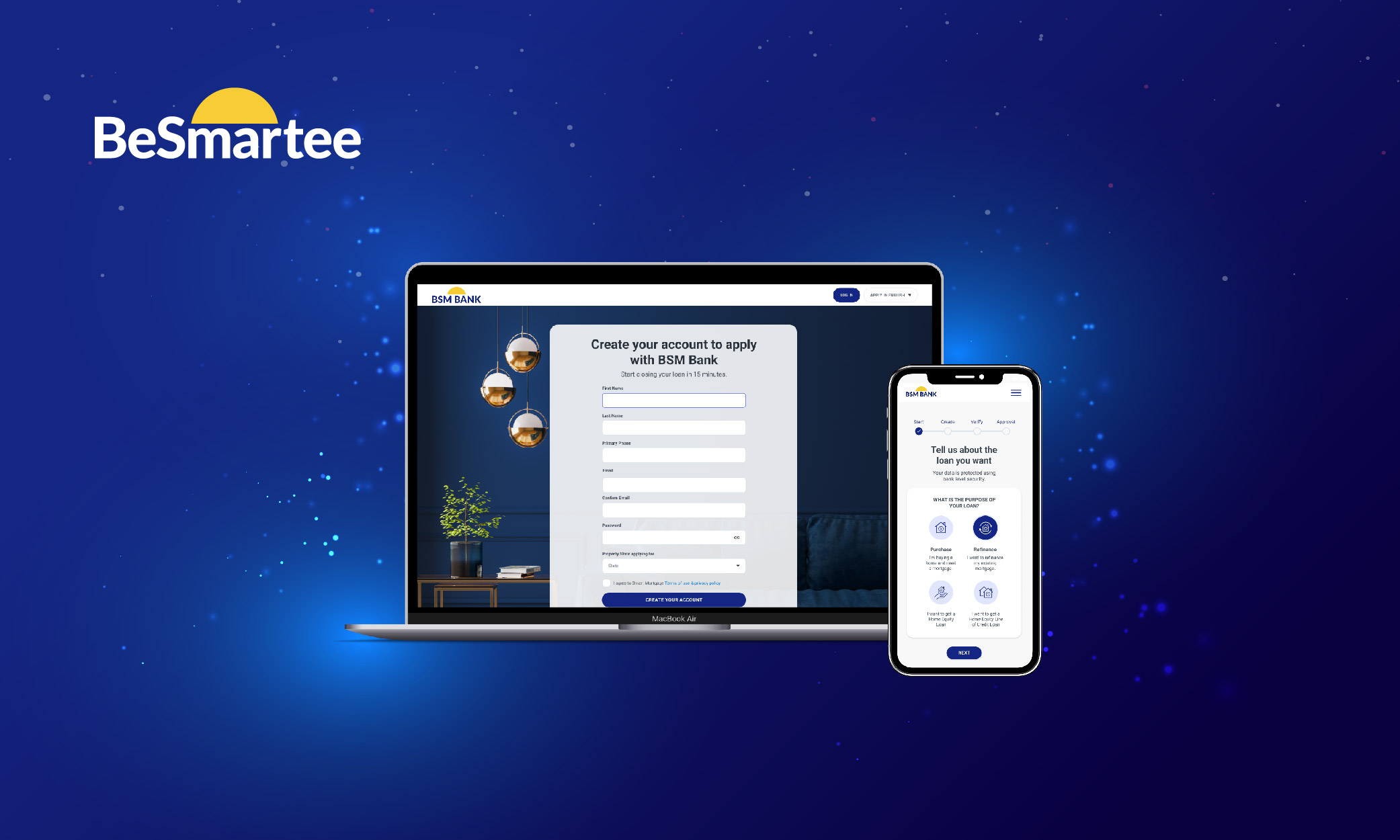

Experience the future of mortgage lending with BeSmartee’s Bright POS - a powerfully simple mortgage POS solution.

Explore the power shifts and positive insights from the 2023 mortgage landscape.

Go deeper into the origination process, faster.

Contact Us

Explore the mortgage lender's landscape in 2024 as industry leaders embrace innovation and responsibility. From digital transformation to sustainable practices, discover the power play shaping the future.

An overview of the highs and lows of the mortgage landscape in 2023.

Learn how economic indicators, housing trends and technology will influence the trajectory of mortgage rates.

Learn how women are transforming the credit unions landscape, driving innovation and empowerment.

This article explores which American states have the most credit unions and the criteria, challenges and the importance of them.

Discover the positive impact of mortgage technology at the MBA's 2023 Convention.