How the Right Verification of Income and Employment Solution Can Reduce Costs

Manual verifications are costly and time-consuming. Here’s how a VOIE solution helps originators make informed lending decisions quickly.

Manual verifications are costly and time-consuming. Here’s how a VOIE solution helps originators make informed lending decisions quickly.

For loan originators, the key to staying in business is to keep profit margins high. Here are three ways to remain profitable as originator profitability is decreasing.

Net profits are on the decline in the mortgage industry, but automation capabilities can save…

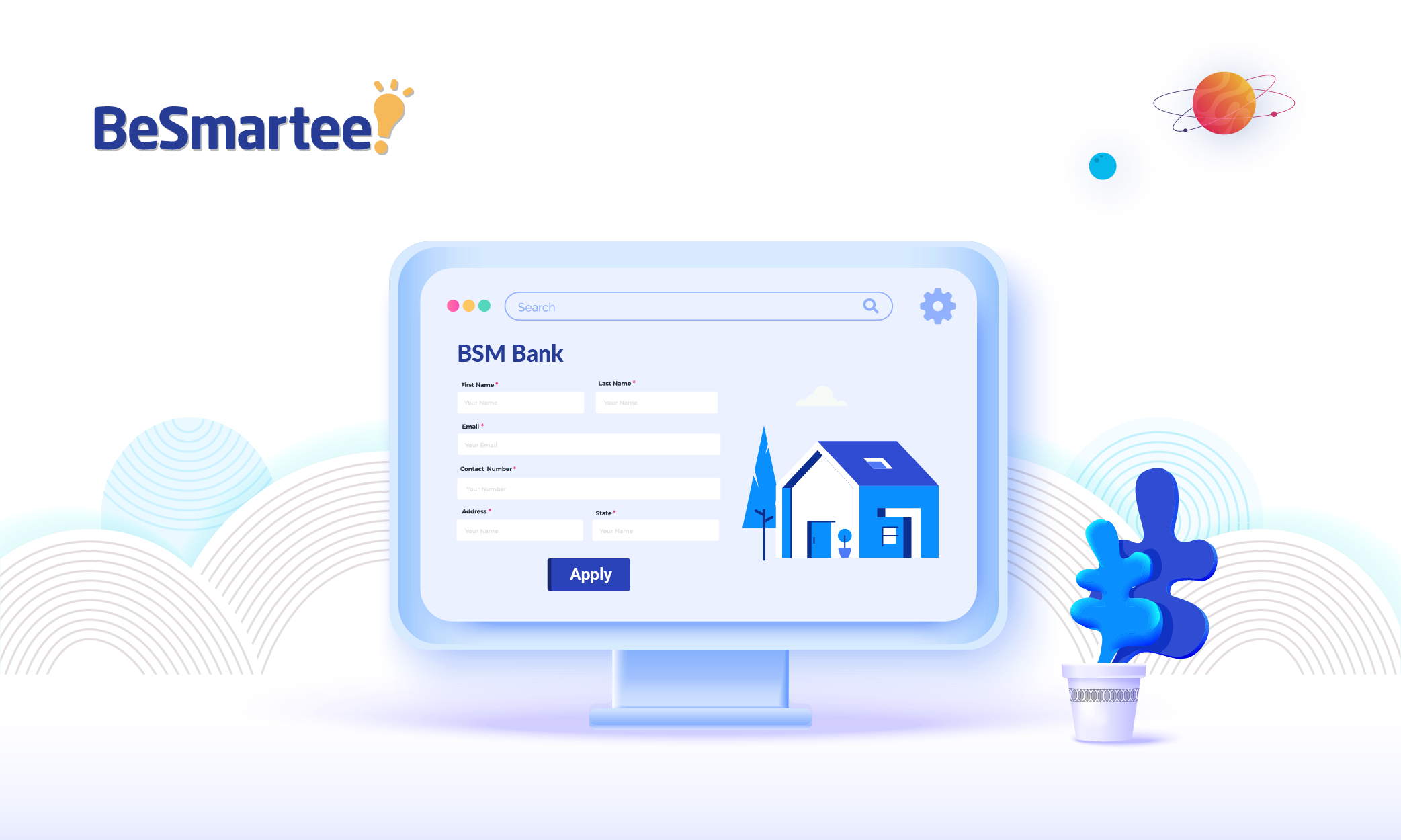

Generating leads doesn’t have to be difficult or time-consuming. Here is how you can use the BeSmartee Mortgage POS platform to help drive high-quality leads directly to your LOs.

Credit unions have the opportunity to automate and diversify their product offerings to increase their loan portfolio. Learn how the right HELOC technology can help.

Mortgage automation is a must-have to grow your lending business today. Those who don’t adopt automation technologies risk falling behind the competition.

Go deeper into the origination process, faster.

Contact Us

The ideal loan submission platform can help wholesale lenders grow TPO networks, increase referrals and achieve market leadership.

There’s more to win from collaboration and partnership than from rivalry. Join BeSmartee as we discuss the benefits of bank-fintech partnerships.

In today’s mortgage market, your customers expect a seamless, digital, home loan process. Here are three benefits to using a dedicated platform to automate your mortgage lending process.

As one of the best ways to quickly build brand awareness, the mortgage industry can no longer ignore the power of influencer marketing.

Not every customer can be served by traditional mortgage lending. For these customers, utilizing a wholesale lender or third-party originator may be the best option.

Technology has fundamentally changed the way that people buy and sell homes, as well as the role of the mortgage broker. Here are three tech tools that every independent mortgage broker should have.