The collaboration between real estate agents and loan officers is pivotal. A recent survey from Investopedia highlights this significance, revealing that 96% of top loan officers consider real estate agents their best source of origination referrals. This statistic underscores the mutual dependence between these professionals, emphasizing the need for strong partnerships to enhance client satisfaction and drive business growth.

Real estate agents rely on loan officers to navigate the financial aspects of home purchases. In contrast, loan officers depend on real estate agents for consistent referrals. But what exactly do real estate agents want from loan officers? Let’s explore the key elements real estate agents value in a loan officer and how strengthening this partnership can yield long-term success.

Table of Contents

Clear and Consistent Communication

Real estate agents value clear and consistent communication above all else. In real estate, timely updates can make or break deals. Loan officers who proactively keep real estate agents informed about the status of their client’s loan applications, potential hurdles, and estimated timelines demonstrate professionalism and reliability.

For example, a quick email or text message updating a real estate agent on the pre-approval status or the loan underwriting stage reassures them that everything is progressing as planned. Real estate agents appreciate loan officers who anticipate questions and provide regular updates, reducing the need for constant follow-ups.

Actionable Tip

Implement a structured communication system, such as automated status updates or scheduled weekly check-ins, to keep real estate agents informed without overwhelming them.

Speed and Efficiency

Time is of the essence in real estate transactions. Real estate agents often work under tight deadlines, especially in competitive markets where properties sell quickly. Loan officers who process applications efficiently and ensure quick pre-approvals are reliable partners.

Real estate agents want to work with loan officers who can expedite processes without compromising accuracy. This efficiency helps close deals faster and reinforces trust between the real estate agent, the loan officer, and the client.

Actionable Tip

Invest in technology that streamlines loan processing and pre-approval. Tools like digital mortgage solutions and eSignature software can significantly reduce turnaround times.

Problem-Solving Expertise

Challenges are inevitable in the mortgage process. Real estate agents value loan officers who can anticipate potential issues and resolve them quickly. Whether addressing credit score concerns, navigating unique financial situations, or finding alternative loan products, problem-solving expertise is a critical skill.

A resourceful loan officer offering creative solutions, such as recommending down payment assistance programs or alternative financing options, adds immense value to the relationship between the real estate agent and buyer. Real estate agents want to know that their loan officer partners can handle complexities and deliver results.

Actionable Tip

Stay updated on loan products, market trends, and financial tools. Offer tailored solutions that meet diverse borrower needs, showcasing your ability to adapt and overcome challenges.

Strong Borrower Relationships

Real estate agents want loan officers who treat borrowers with respect and empathy. Buying a home is often an emotional journey; borrowers need reassurance and guidance. Loan officers who prioritize the borrower experience, communicate clearly and address their concerns build trust with borrowers and their real estate agent partners.

When a loan officer creates a positive experience for the borrower, it reflects well on the real estate agent who recommended them. This positive feedback loop strengthens the real estate agent-loan officer relationship.

Actionable Tip

Develop strong interpersonal skills and make an effort to connect. Show genuine care for their needs and ensure they feel supported.

Industry Knowledge and Expertise

Real estate agents rely on loan officers to be experts in their field. A deep understanding of mortgage products, interest rate trends, and regulatory changes instills confidence in real estate agents and clients. Real estate agents value loan officers who can explain complex financial concepts, helping clients make informed decisions.

Loan officers well-versed in niche markets or specialized loans, such as VA loans or jumbo mortgages, provide added value to real estate agents working with a diverse clientele.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Actionable Tip

Commit to continuous learning through industry seminars, certifications, and networking events. Share your expertise by hosting workshops or webinars for real estate agents and clients.

Marketing Support

Today, real estate agents appreciate loan officers who go above and beyond by offering marketing support. Co-branded marketing materials, joint seminars, or social media campaigns can help both parties reach a wider audience and generate leads.

Collaborative marketing efforts demonstrate a commitment to the partnership and provide tangible benefits to the loan officer and the real estate agent. Real estate agents are more likely to refer clients to a loan officer who actively contributes to their success.

Actionable Tip

Offer to collaborate on open houses, provide flyers showcasing loan options, or co-host community events. These initiatives strengthen your partnership and enhance visibility for both parties.

Transparency and Honesty

Real estate agents want loan officers who are upfront and honest about what is possible. Overpromising and underdelivering can harm the loan officer’s and the real estate agent’s reputations. Transparency about rates, fees, and potential challenges is essential for building trust.

Real estate agents respect loan officers who set realistic expectations for clients and provide clear explanations for any delays or complications. This transparency ensures a smoother process and reinforces the partnership.

Actionable Tip

Establish a habit of clear and honest communication from the beginning. Provide detailed loan estimates and set achievable timelines for each process stage.

Accessibility and Responsiveness

Real estate agents often work irregular hours and appreciate loan officers who are accessible when needed. While it’s unreasonable to expect 24/7 availability, prompt response to urgent queries—after hours or on weekends—sets exceptional loan officers apart.

Real estate agents want to feel confident that their loan officer partner will be there when it matters most, whether answering client questions during an open house or addressing last-minute concerns before closing.

Actionable Tip

Set clear boundaries for availability while being flexible during critical moments. Utilize tools like auto-responders or virtual assistants to acknowledge inquiries promptly.

Mutual Respect and Partnership

At the heart of every successful real estate agent-loan officer relationship is mutual respect. Real estate agents want to feel valued and appreciated, just as loan officers do. A strong partnership is built on trust, collaboration, and a shared commitment to client satisfaction.

Loan officers who take the time to understand a real estate agent’s business goals and challenges create a stronger bond. This mutual respect paves the way for long-term collaboration and shared success.

Actionable Tip

Regularly check in with your real estate agent partners to understand their needs and provide tailored support. Celebrate joint successes and acknowledge their contributions to the partnership.

Roundup

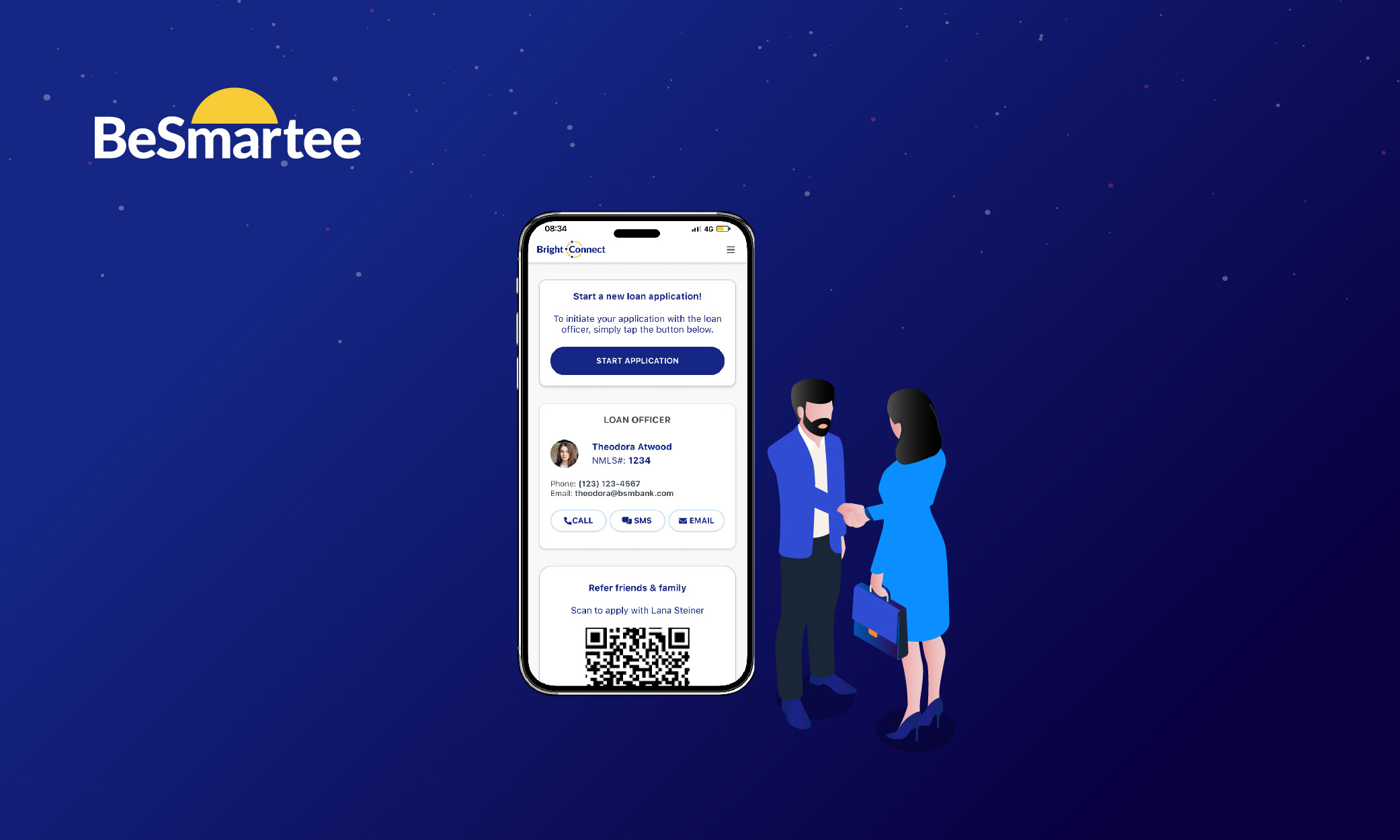

Building successful real estate agent-loan officer relationships takes effort, communication, and the right tools. At BeSmartee, we empower loan officers with cutting-edge digital mortgage solutions like Bright POS that enhance efficiency, streamline communication, and provide unparalleled client experiences.

With BeSmartee, you can elevate your partnerships with real estate agents and stand out as a trusted, go-to professional in the industry. Contact us today to learn how our innovative solutions can help you succeed. Together, we can make the borrower journey seamless for everyone involved.