Commercial lending is one of the most important aspects of any financial institution. Through this lending practice, banks can provide much-needed capital to businesses to help them grow and expand. Whether it’s acquiring a company that provides financing for small businesses or a fintech startup with cutting-edge financial statement spreading software, commercial bank acquisitions are one of the best ways to grow a commercial lending portfolio successfully.

Table of Contents

Commercial Lending: An Important Aspect of any Financial Institution

At its core, commercial lending is a process that provides secured or unsecured loans to businesses to help them grow and expand.

Banks can utilize acquisitions to grow and expand their portfolio significantly.

By acquiring a company that has a successful SBA lending division or a company equipped with patented technology, banks can add valuable products and services to their clients.

Additionally, commercial bank acquisitions can improve lending operation efficiency. In other words, acquisitions help banks process loan applications much more quickly and approve more loans.

Finally, by growing their portfolios through commercial bank acquisitions, banks can increase the size and scale of their businesses. This allows them to be much more competitive within the cut-throat financial services industry.

Some banks that benefited greatly from acquisitions include:

- Landmark National Bank

- Farmers National Banc Corp.

- CrossFirst Bank

- Rosedale Federal Bank

- First Merchants bank

Freedom Bank Acquisition

Landmark National Bank greatly benefited from its Freedom Bank acquisition. The transaction increased Landmark’s total assets to about $1.5 billion and total deposits to $1.3 billion.

This allowed Landmark National Bank significantly expand its footprint to 31 branches across 24 communities in Kansas.

Freedom Bank was already a well-established financial institution with a strong lending operation. Landmark benefited from this experience by integrating Freedom Bank’s operations into its own.

Emclaire Financial Corp. Acquisition

Farmers National Bank Corp. is a financial services company with a strong presence in the Midwest. The company was looking to expand its commercial lending portfolio and saw Emclaire Financial as a great opportunity to do so.

Before its acquisition, Emclaire Financial Corp. was an FDIC-insured community commercial bank that provided loans to businesses throughout Pennsylvania. The company was a strong player in the commercial lending space and had a well-established operation.

Earlier this year, Emclaire Financial Corp. announced shareholder approval for its acquisition by Farmers National Banc Corp. The result of this transaction leaves Farmers as the surviving bank and will turn any Emlenton Bank branches into Farmers Bank.

The acquisition by Farmers National Bank Corp. allowed the bank to significantly expand its total assets and footprint. Farmers Bank’s total assets increased to approximately $5.2 billion, and its operations to 66 banking offices throughout Pennsylvania and Ohio.

Farmers & Stockmens Bank Acquisition

CrossFirst Bank is set to enter the New Mexico and Colorado markets after its Farmers & Stockmens Bank acquisition. This transaction will widen its already massive footprint.

Before this transaction, CrossFirst Bank already held banking offices in the following locations:

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

- Arizona

- Missouri

- Kansas

- Texas

- Oklahoma

This transaction allowed the bank to expand into Colorado Springs, Denver and throughout New Mexico.

Farmers & Stockmens Bank is CrossFirst Bank’s third acquisition since it acquired Tulsa National Bank back in 2013. CrossFirst benefited from this acquisition because they could leverage Farmer’s specialties.

Farmers & Stockmens Bank already had a successful SBA lending operation and expertise in ranch and agricultural lending. This is especially beneficial because of how big of a market share ranch and agricultural lending have in their other locations.

While this acquisition may not be about innovative software that helps with financial statement spreading, it’s one set to increase CrossFirst Bank’s profitability.

CBM Bancorp Acquisition

The CBM Bancorp acquisition was another notable event this year. Rosedale Federal announced its acquisition of CBM Bancorp earlier this year which was completed in July.

This transaction increased Rosedale Federal’s assets to about $1.3 billion. It also expanded the bank’s existing footprint across Maryland.

It’s safe to say that Rosedale benefited greatly from this acquisition. One of the main benefits is the bank’s ability to leverage CMB’s successful strategy of attracting retail deposits to use as loan origination funds.

Additionally, both banks already held many locations across the state of Maryland. With CBM’s acquisition, Rosedale Federal became much more visible and competitive.

Level One Bancorp Acquisition

First Merchants Bank completed its acquisition of the Michigan-based Level One Bancorp, which was announced late last year. This acquisition was extremely beneficial to First Merchant.

The transaction increased the bank’s assets to about $18 billion and its footprint across four states. First Merchant now has a total of 126 banking offices across Ohio, Michigan, Illinois, and Indiana.

Additionally, this commercial bank acquisition allowed the Muncie-based bank to keep its place as the second-largest bank in Indiana.

Final Thoughts on Commercial Bank Acquisitions

2022 has been a busy year full of banks merging and acquiring other financial institutions to grow their commercial lending businesses. And as you can see, the benefits of commercial bank acquisitions are vast. Often, these benefits come in the form of increased assets, expanded footprints and improved profitability.

But that’s not all.

These acquisitions can also include leveraging an institution’s existing strategy and software, like the ones used for financial statement spreading, to make their processes more efficient.

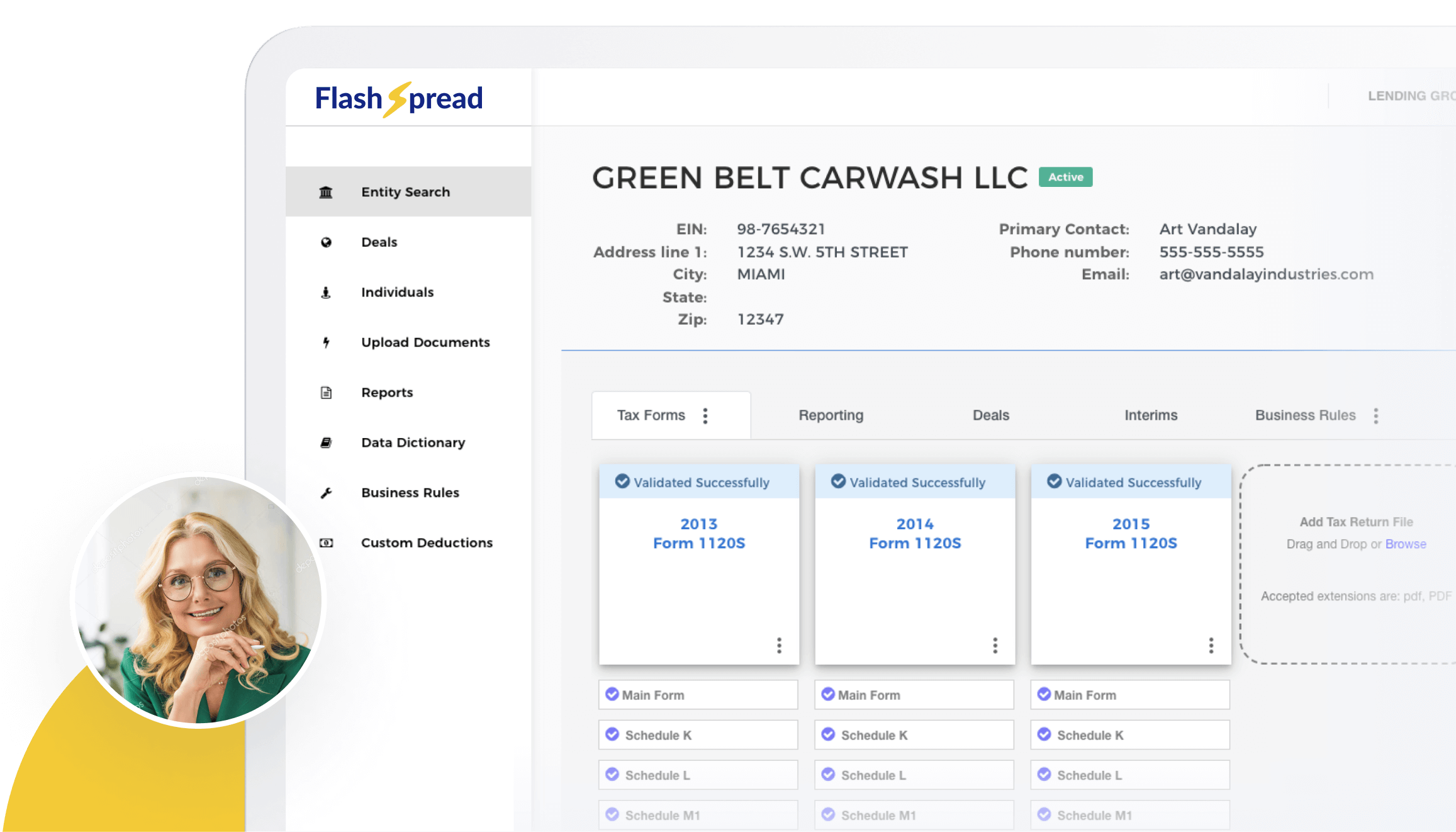

Are you wasting hours or even days tediously converting tax returns into financial reports complete with analysis? Schedule a demo with FlashSpread‘s specialists to start automating your financials spreading process.