Credit unions are known for personalized service, but when it comes to digital mortgage lending, many are falling behind. In a market where members expect convenience and transparency, outdated or overly customized systems are slowing down credit union growth and member satisfaction.

Here’s what you need to know.

Quick Take: What This Blog Covers

- Why modernizing your POS matters more than ever for member loyalty and retention

- How overly customized tech is hurting credit unions instead of helping them

- What a configurable SaaS POS solution offers in terms of speed, scalability, and service

- Actionable steps to simplify your lending stack and serve members better in 2025

Table of Contents

The Member Expectation Gap

Today’s mortgage members expect fast, transparent experiences, whether they’re applying with a bank, fintech, or credit union. But many credit unions still rely on legacy POS systems or tools that were heavily customized over the years. These solutions weren’t built for rapid change, and it shows.

According to Fannie Mae’s Q4 2023 Mortgage Lender Sentiment Survey, member satisfaction with digital mortgage processes continues to influence lender choice, especially for younger and first-time homebuyers. Credit unions that don’t modernize risk losing potential members to more agile competitors.

And it’s not just about speed. Today’s members want:

- Self-service options with real-time status updates

- Seamless transitions between mobile and desktop

- Clear, simple document uploads and e-signing

- Responsive communication throughout the loan process

The problem? Many current credit union systems can’t deliver all of the above without patchwork solutions or workarounds.

What Credit Unions Are Missing

1. Flexibility Without the Code

Custom systems might have worked 5 years ago, but today, they’re a liability. Credit unions using custom-built POS solutions often wait weeks or months to update disclosure logic or loan document types.

A configurable SaaS POS lets you manage those changes in settings, not code. It’s faster, cheaper, and easier to maintain.

2. Consistent Multi-Channel Experience

Members expect the same experience across devices. Too many legacy POS systems still rely on patchwork mobile views or outdated forms.

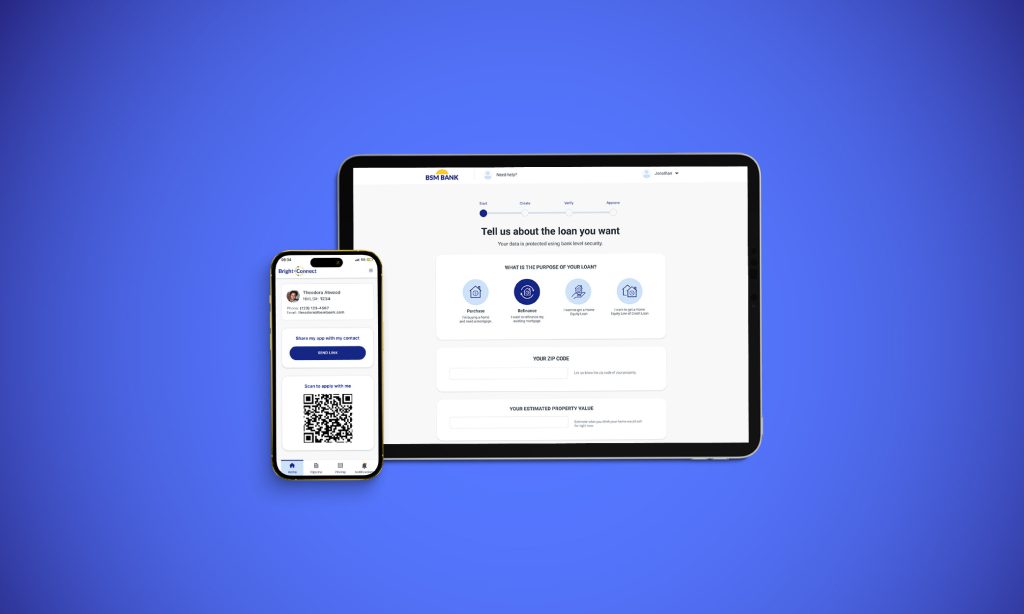

Solutions like Bright Connect offer a native mobile experience, keeping members in the loop with push notifications, secure chat, and real-time task lists.

3. Transparent, Self-Service Dashboards

Members hate silence. The more confusing the process, the more anxious they get. Credit unions that still rely on email or phone updates alone miss an opportunity. Modern POS solutions offer members a dashboard that shows progress, outstanding documents, and next steps, all of which build trust and reduce call volume.

4. Integrated e-Sign & Automated Disclosures

Even small delays in signature collection or document delivery create compliance risks. A modern POS offers integrated e-sign capabilities and auto-triggered disclosures so members get the right forms at the right time, and the credit union can avoid disclosure mistakes or delays.

How Configurable POS Delivers Value

Bright POS and Bright Connect combine speed and service through:

- Flexible configuration tools that enable credit unions to set automated document requirements, alerts, and workflow triggers—no custom development needed.

- Mobile-native member app with messaging and push updates.

- Configurable disclosures and checklists, so credit unions stay compliant and members can track progress.

- Real-time dashboards for both members and branch staff, reducing email chains and follow-up calls.

These features empower staff while keeping members informed, speeding up the entire mortgage lifecycle.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

How Configurable Solutions Deliver Measurable Outcomes

A configurable POS isn’t just a tech upgrade; it’s a performance engine. Credit unions that adopt a modern SaaS model are already seeing results where it matters most:

- Faster Loan Cycles: Automated workflows reduce time spent chasing documents and clarifying member status, allowing lending teams to move applications forward more efficiently.

- Higher Member Satisfaction: Transparency and timely updates build trust, particularly among digital-first members who expect real-time communication and intuitive self-service tools.

- Increased Loan Completion Rates: Streamlined workflows reduce drop-offs and abandoned applications, helping credit unions fund more loans with the same staff capacity.

These gains translate directly into better relationships, higher productivity, and scalable member growth.

Tiered Member Journeys: A Smarter Approach

Not all members need the same experience. A salaried member may benefit from largely automated processing—upload, e-sign, and approval. Meanwhile, a complex member (e.g., self-employed or with gift-funded down payments) might need more hand-holding.

With Bright POS’s configurable SaaS, credit unions can easily tailor which features and workflows are turned on or off to match their unique lending processes and member needs. This flexibility ensures your POS adapts seamlessly to your operations, helping you deliver the right level of service for every member without unnecessary complexity.

Empowering Staff, Not Just Systems

Technology alone doesn’t create great experiences, but trained and confident teams do. Your POS should guide your staff just as much as it supports members.

That includes showing when to step in with guidance, offering pricing insights, and reviewing disclosures before they go out. The right solution makes it easy to balance automation with empathy.

What’s Next: Join the Playbook Webinar

On Wednesday, July 23 at 11:30 a.m. PT, credit union mortgage leaders are invited to a live webinar with BeSmartee’s CEO Tim Nguyen and COO David King to explore the urgent shift happening in mortgage technology and what it means for your team.

With rising costs, economic pressure, and member expectations at an all-time high, many credit unions are struggling to maintain outdated or overly customized systems. This session will break down why standardized, configurable tech is the smarter path forward, and how it can help you compete in 2025 and beyond.

You’ll hear how other lenders are accelerating go-to-market timelines, reducing technical debt, and delivering better member experiences by moving away from legacy POS solutions. Plus, get a firsthand look at how BeSmartee’s Bright POS and Bright Connect mobile app is evolving to support credit union growth.

Reserve your spot and see how simplicity and scale can work together.

Roundup

Credit unions that treat the POS as merely a funnel are missing the point. Today, the POS isn’t just about originating; it’s your member’s gateway to confidence, clarity, and control. A configurable SaaS POS equips members with transparency, empowers staff with clean workflows, and positions credit unions as community leaders in digital lending.

Ready to turn your POS into a driver of member experience and efficiency? Contact us now to see how Bright POS and Bright Connect are built for credit unions.