If you’re a commercial lender doing your part to grow a business, you need every advantage you can get. Sometimes those advantages will come in the form of a new idea from a talented staff member and others, effective new commercial lending platforms that save time on critical processes.

FlashSpread is partnered with all four of the commercial lending platforms discussed in this article. They each have the power to vastly improve some aspect of your commercial lending processes. From the automatic spreadsheet technology of FlashSpread to the ability to automate your loan processes provided by Loan Vantage, these are powerful platforms that can accommodate any fintech business.

Learn more about how these four innovative commercial lending platforms are revolutionizing the lending industry as we know it and how each can save significant time and money for your business.

Table of Contents

1. FlashSpread: The Powerful Spreadsheet Automation Software

Spreadsheets are a useful tool for just about any business, but they can often be time consuming and a source of confusion. For example, if a co-worker mistakenly deletes a column of data from your company spreadsheet, it’s easy to see how recovering it could cost valuable time.

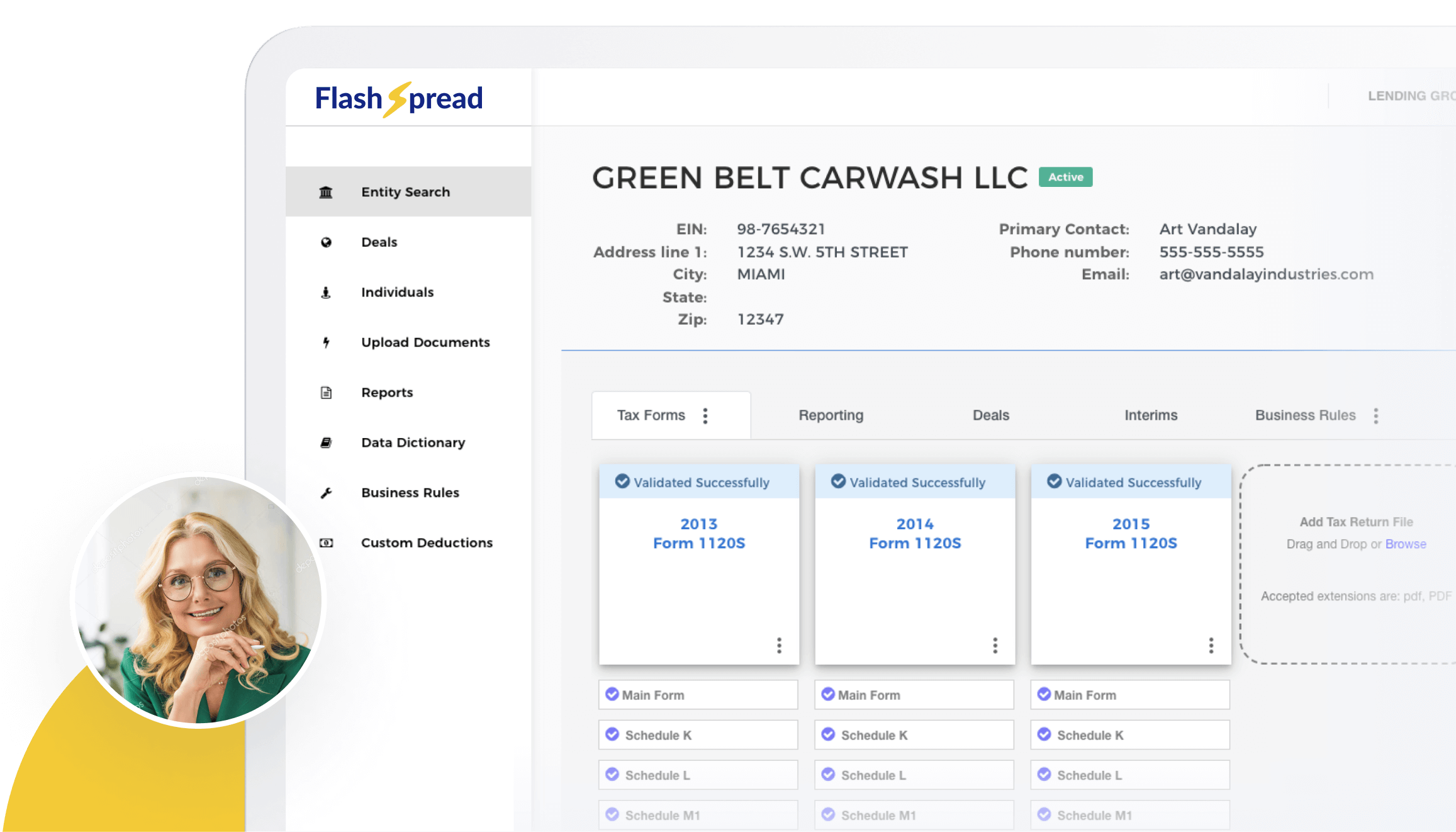

That’s where FlashSpread comes in. FlashSpread is an automated financial statement spreading software that takes the stress and wasted time out of working with spreadsheets. Discover how FlashSpread makes your spreadsheet tasks easier and more streamlined than ever before.

What Can FlashSpread’s Commercial Lending Platforms Do For Your Business?

The main advantage of FlashSpread is that it allows you to execute normally complex processes with the touch of a button. Tasks like converting PDF tax returns into complete financial reports are done instantly with FlashSpread.

If adding speed and efficiency to your spreadsheet processes sounds appealing to you, FlashSpread may be the optimal tool for enhancing your business. The power of automated spreads can save a lot of time for your business.

2. Finastra: Truly Innovative Universal Banking Solutions

For lenders, improving the customer experience is always a concern. This means making it easier, faster and more convenient for clients to get the loans they need for their lives and businesses.

Finastra streamlines the lending process for banks, credit unions and other types of lenders. By connecting lending institutions across the world, Finastra enables secure loans to be given in record time. Using automated tax-return spreading software, Finastra can save time and money for any finance business.

How You Can Benefit From Finastra’s Commercial Lending Platforms

Using cloud-enabled software solutions for lenders, Finastra provides a smart, highly-personalized experience for your customers. From targeting customers for new programs via actionable insights to easy and user-friendly access to all of their financial data, Finastra strives to make the lending process easier than ever for both lenders and customers alike.

3. Loan Vantage: The Future of Credit Management

Loan Vantage takes each part of the loan process from application to approval and automates it, making it quicker and easier than ever. This tool is so advanced it even controls risk while automating every critical function performed by your lending team.

How Can Loan Vantage’s Commercial Lending Platforms Benefit Your Business?

Imagine the time you can save by combining all of your loan-related work in a single platform. That’s what Loan Vantage does for each part of the process. If your company spends excessive time prospecting or managing your pipeline, Loan Vantage can cover these processes within seconds.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

The result of this automation is more time for your employees. Since they won’t be busy dealing with basic processes, they’ll now have more time to help customers, giving them the peak customer service they deserve.

Loan Vantage is a massive program that handles a wide range of loan-related tasks. To discover if it can help your company, check out their website to learn more.

4. Baker Hill: Improve the Efficiency of Your Loan Processes

Could your commercial lending company benefit from a holistic platform that centralizes all of your banking processes in one place? Baker Hill does just that, covering all of the services a lender provides, including auto decisioning, document preparation and third-party integration.

Three Key Benefits of Baker Hill’s Commercial Lending Platforms for Your Business

Baker Hill provides a wide array of services that help your lending business, but all of these services contribute to these key advantages:

1. Gain Efficiency

By automating all of the key tasks involved with providing loans, the Baker Hill platform drastically improves your company’s efficiency. Whether it’s offering a client portal or automating your tax returns and financial processes, these services save time for your business, freeing up staff to work on more important work.

2. Reduce Risk

Assessing risks is a crucial function for any lender, and this is where Bakers Hill really shines. Bakers Hill helps reduce risk by completely automating the account review process.

This means that the days of an individual mulling over the details of a prospective customer’s account are over–Bakers Hill handles the entire process, thereby saving time and reducing risk for your team.

3. Drive Growth & Profitability

By automating many of the key processes involved in providing loans, you’re also removing the human error and guesswork element from the process. Automated technology relies on data, and when you make decisions based on data rather than biased human opinions, you can trust that you’re getting true results, each and every time.

Try a Free Demonstration of FlashSpread Today

FlashSpread is a rapidly-growing technology that allows users to automate one of their most time-consuming tasks: Managing spreadsheets.

Recently acquired by BeSmartee, FlashSpread is poised for growth in 2023 as it provides a service that’s useful for every type of lender. Discover if it’s the solution your business needs with a free demo.