Commercial lending stands as a linchpin for economic growth and business expansion. As the financial landscape constantly transforms, businesses and lending institutions must adapt to stay competitive. One innovative solution at the forefront of reshaping commercial lending is FlashSpread.

In this comprehensive exploration, we will dive into the challenges commercial lending institutions face, the pivotal role of technology in future-proofing this sector and how FlashSpread emerges as a transformative force in navigating the complex financial terrain.

Table of Contents

The Evolution of Commercial Lending

Commercial lending has evolved significantly from traditional methods that rely on historical financial statements and collateral. In the contemporary business environment, there is a growing demand for lending solutions that are efficient but also data-driven and adaptable. The rise of fintech and the digital transformation of financial services have prompted lenders to leverage advanced technologies to streamline processes and enhance decision-making.

Challenges

According to Acuity, financial institutions are facing a tough operating environment in 2023, driven by stagnating economic growth, high inflation, a liquidity crunch and heightened geopolitical tensions. Despite technological advancements, commercial lending encounters several challenges. Persistent hurdles include lengthy approval processes, complex documentation requirements, risk assessment intricacies and the need for real-time insights. Traditional methods often fail to provide the speed and accuracy required in the fast-paced modern business environment. As a result, rising demand for innovative solutions can address these challenges and propel commercial lending into a new era of efficacy.

The Role of Technology in Future-Proofing Commercial Lending

Technology plays a pivotal role in transforming commercial lending, offering solutions that make the sector more resilient and responsive to the evolving needs of businesses. Artificial intelligence (AI), machine learning (ML) and data analytics are among the key technologies reshaping the lending landscape. These technologies empower lenders by automating routine tasks, enabling rapid analysis of vast datasets and facilitating data-driven decision-making.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

FlashSpread: An Innovative Solution

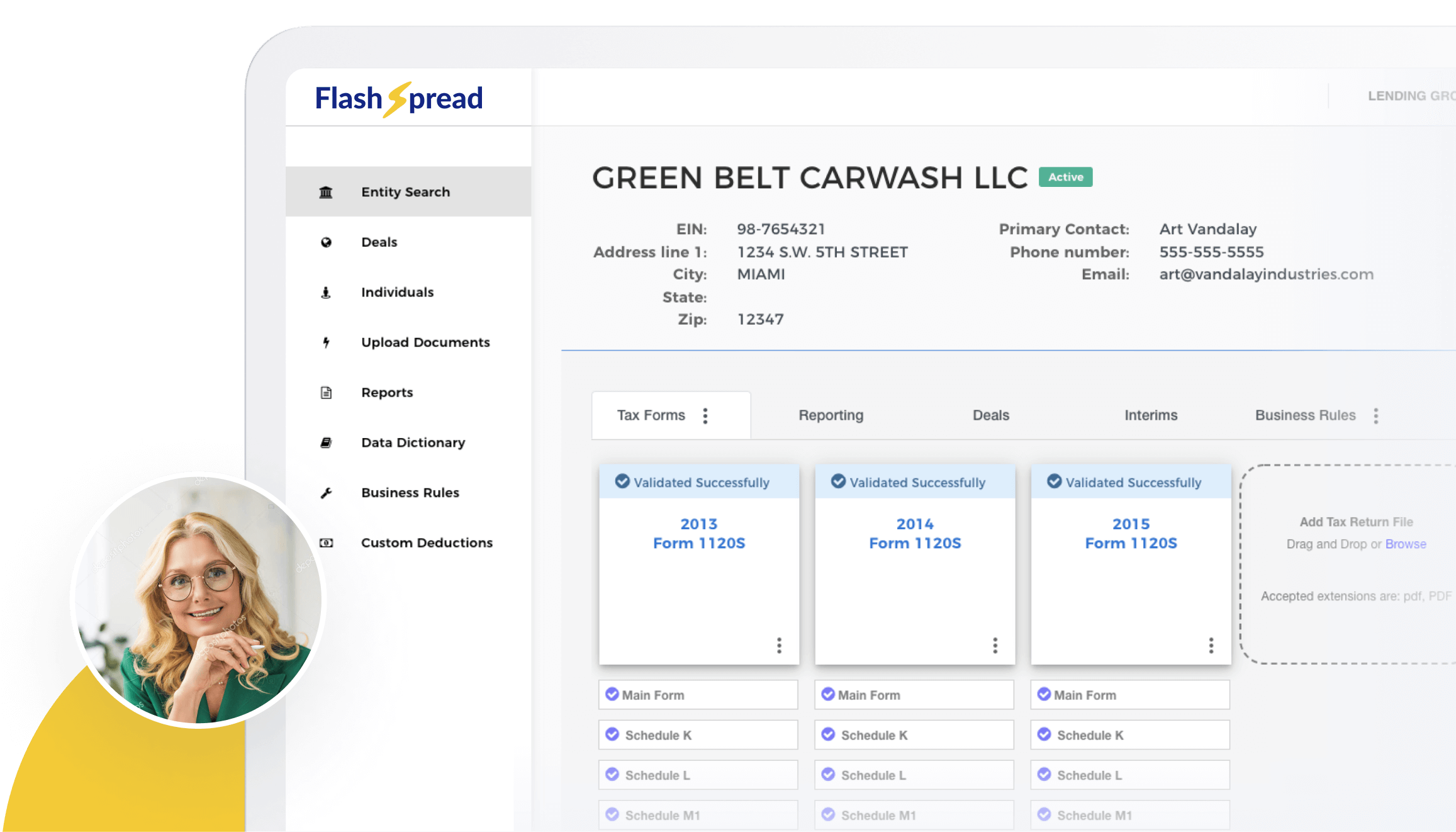

In emerging technologies for commercial lending, FlashSpread appears as a revolutionary tool that combines AI and ML advancements to streamline lending processes. Crafted with a focus on agility, efficiency and precision, FlashSpread empowers lenders and businesses, fostering a symbiotic relationship that drives growth.

Key Features of FlashSpread

- Automated Financial Analysis: FlashSpread employs advanced algorithms to automate the analysis of financial statements, providing lenders with instantaneous insights into a borrower’s financial health. This expedites the approval process and ensures a more accurate risk assessment.

- Real-Time Data Integration: The platform integrates with various data sources, facilitating real-time updates and offering a comprehensive view of a business’s performance. This ensures lenders can access the most up-to-date information when making lending decisions.

- Customized Reporting and Dashboards: FlashSpread provides customizable reporting tools, allowing lenders to tailor the platform to their needs. This flexibility enhances user experience and facilitates better decision-making by presenting relevant information in a digestible format.

- Comprehensive Training and Support: FlashSpread understands the importance of user proficiency. Therefore, it provides comprehensive training modules and robust support to ensure that lenders can maximize the platform’s potential.

- Scalability and Flexibility: FlashSpread is designed to scale with the growing needs of lending institutions. Its flexible architecture allows seamless integration with existing systems, ensuring a smooth transition and adaptability to future advancements.

Roundup

In the rapidly evolving landscape of commercial lending, the key to success lies in embracing innovative solutions that can adapt to the ever-changing needs of businesses. FlashSpread offers a comprehensive and dynamic platform that directly addresses commercial lenders’ challenges today.

As businesses navigate the complexities of commercial lending, FlashSpread provides the tools needed to make informed decisions quickly and accurately. With its emphasis on automation, real-time data and risk mitigation, FlashSpread is poised to redefine how commercial lending is conducted in the digital age.

Future-proof your lending practices with FlashSpread and leap into a more efficient and responsive era of commercial lending. Contact us today to learn more about how FlashSpread can transform your lending processes.