Becoming a commercial loan officer opens up a wealth of opportunities, not the least of which are an excellent starting salary and diverse job openings to consider. Getting there, however, takes preparation and time. If you are interested in becoming a commercial loan officer, what are the steps you need to take to get there? Here are the basics, providing you a framework for snagging one of these highly valued positions.

To start, what exactly is a commercial loan officer? In short, a commercial loan officer is a manager for loans to businesses. They monitor the loan process from start to finish, providing guidance during the application stage and assessing the applicant’s financial qualifications for a loan. In some scenarios, commercial loan officers also supervise mortgage loans for businesses that want to purchase real estate.

Table of Contents

Requirements

There are several stringent requirements an individual must meet. A central requirement is having a bachelor’s degree either in finance, business, accounting or a related business field.

Commercial loan officers must also obtain a federal license in order to perform their jobs in some cases. In some states, a state license is required in addition to a federal license. In order to get these licenses, aspiring commercial loan officers must complete at least 20 hours of lending education from a reputable provider. Institutions that offer such courses include the American Banking Association and Independent Community Banks of America. If a job has a mortgage component, a commercial loan officer will also need to be licensed as a mortgage loan officer.

A Day in the Life of a Commercial Loan Officer

One of the primary tasks for a commercial loan officer is to mitigate risk for a bank or financial institution while still providing business customers with the loans they need. This means carefully vetting financial data from the business customer. Documentation required from a borrower can include:

- Tax Returns

- Balance Sheet

- Income Statement

- Cash Flow

- Bank Statements

- AR/AP Documents

All of this documentation must then be analyzed in order to get a thorough picture of the applicant’s financial status. Historically, this meant combing through analog data, most of which would come into the commercial loan officer’s hands in different formats. For example, a business might have financial statements in Excel and tax documentation in PDFs, as an example. Commercial loan officers would then have to work with this data manually, entering essential data points into the origination software so that they could adequately assess an applicant’s qualifications.

Responsibilities

Commercial loan officers play a crucial role in the financial ecosystem by facilitating loans to businesses. Their responsibilities are multifaceted and require a keen understanding of finance, risk assessment, and business dynamics. Here are the key responsibilities that commercial loan officers typically undertake:

1. Assessing Creditworthiness: One of the primary responsibilities is to evaluate the creditworthiness of loan applicants. This involves analyzing the applicant’s financial statements, credit history, and overall financial health. The goal is to determine whether the applicant is a suitable candidate for a loan and to assess the level of risk associated with the loan.

2. Risk Mitigation: Commercial loan officers are tasked with mitigating risk for the lending institution. They must carefully evaluate the financial data provided by borrowers to identify potential risks and make informed decisions. This involves looking for red flags, such as irregular financial patterns or inconsistencies in documentation.

3. Customizing Loan Solutions: Each business has unique financial needs, and commercial loan officers must tailor loan solutions to meet those needs. They work closely with borrowers to understand their specific requirements and propose loan structures that align with the business’s objectives and financial capacity.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

4. Due Diligence: Conducting thorough due diligence is a critical aspect of the job. This includes verifying the accuracy of the information provided by borrowers, assessing the market conditions in which the business operates, and ensuring compliance with lending regulations and policies.

5. Loan Structuring: Commercial loan officers are responsible for structuring loan deals. They decide on the loan amount, interest rate, repayment terms, and collateral requirements. They must strike a balance between offering competitive terms to attract borrowers while ensuring that the lending institution’s interests are protected.

6. Relationship Management: Building and maintaining relationships with borrowers is essential. Commercial loan officers serve as a point of contact between the lending institution and the business seeking a loan. Strong relationships can lead to repeat business and referrals, benefiting both the lender and the borrower.

7. Monitoring Loans: Even after a loan is approved and disbursed, the responsibilities of a commercial loan officer continue. They monitor the borrower’s financial health and compliance with the terms of the loan. This ongoing oversight helps mitigate risks and ensures that the loan remains a sound investment for the lending institution.

8. Problem Resolution: In cases where borrowers encounter financial difficulties or face challenges in repaying the loan, commercial loan officers may be required to work with borrowers to find solutions. This can involve restructuring the loan, providing financial counseling, or, in some cases, initiating collection efforts.

9. Regulatory Compliance: Commercial loan officers must stay informed about financial regulations and compliance requirements that pertain to lending. Staying up to date with these regulations and ensuring the institution’s operations remain in compliance is vital.

Roundup

In summary, commercial loan officers shoulder the significant responsibility of managing the lending process, from assessing creditworthiness to mitigating risks and maintaining strong borrower relationships. Their role is not only critical for the financial institution but also for the businesses seeking financial support to grow and thrive. The ability to balance these responsibilities effectively is what sets a skilled commercial loan officer apart in this challenging and rewarding profession.

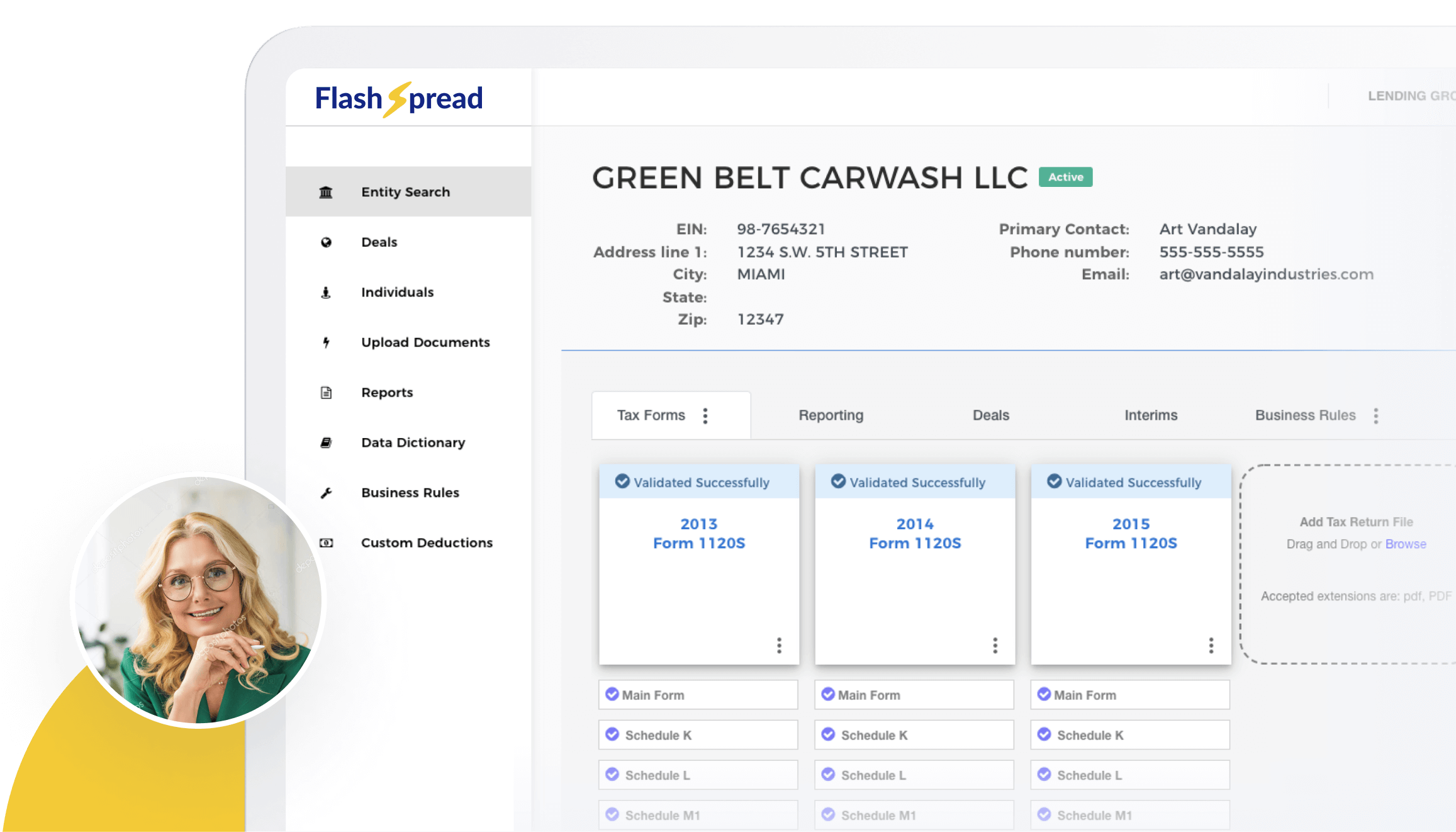

Fortunately, new technologies are making the lives of commercial loan officers much easier. Digital solutions such as FlashSpread enable automatic intake of data from applicants. Automating the analysis process allows commercial loan officers to make accurate credit decisions quickly and with fewer errors.

After the initial analysis stage, the commercial loan officer then oversees all remaining stages of the loan process through to closing day. It’s a key role with wide-ranging implications for business and bank alike. How effective a commercial loan officer is in their job can make a serious impact on the finances of a borrower and a financial institution.