Every commercial lender knows that time is money when it comes to business. That means saving time in any and all areas you can will positively impact your bottom line.

Automation for statement spreading software has become available in recent years, and it offers a whole series of advantages for commercial lenders. This software can quickly and accurately manage your spreadsheets, perform complex tasks and create business forms.

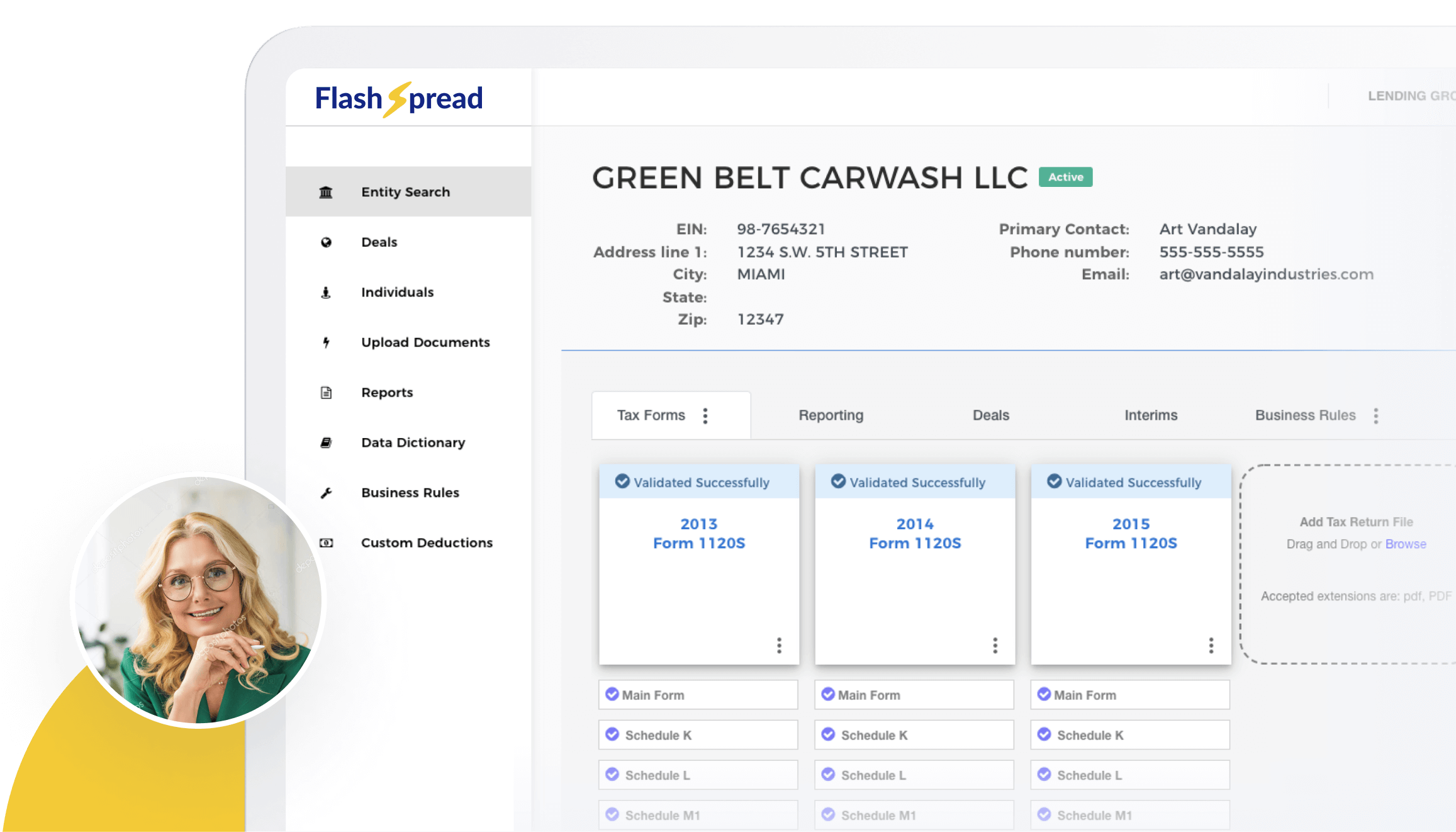

Discover FlashSpread’s leading automated financial statement spreading software and learn how it can be a significant benefit for your lending business.

Table of Contents

Top 3 Ways Automation Can Help Manage Your Bank Statements

Did you know that 57% of organizations plan to use automation to boost employee productivity and performance?

Automated statement spreading software continues to evolve, offering a greater array of creative features with each evolution. Never before has there been a tool that can completely handle some of your most time-consuming yet important processes.

If you’re a commercial lender, then producing accurate reports and bank statements is an important part of your day. Odds are, managing reports and bank statements is one of the most time consuming tasks your employees must do.

Automation can cut the time it takes to produce perfect reports, while keeping them secure and accurate. Learn more about these primary advantages of automation software:

1. Built-in Fraud Protection

A 2022 mortgage fraud report revealed that .76% of all mortgage applications contained fraud, or approximately 1 in 131 applications.

Fraud can be devastating for a lender and everyone involved with the loan, so it’s crucial to take every measure to prevent it.

By using automated statement spreading software, you automatically defend against common types of fraud. Automation solutions are designed to uncover signs of file tampering, letting you work with more confidence than ever before.

Whether you choose an automated tax statement spreading software or a tool that handles your lending processes, ensure that it provides some protection against fraud and it can save you a lot of stress and money in the future.

2. Significantly Reduce Human Error

Consider all of the fields on a bank statement, tax report, or other lending document. Each of these text fields is another opportunity for an employee to make a mistake.

Employees are human, and it’s expected that even the best members of your staff will make a typo every now and then. But depending on the placing and timing of the typo, the results can ruin an entire report and may even affect the reputation of your firm if not caught in time.

This is another area where automated statement spreading software provides major benefits. Automated tools use formulas to perform accurate calculations and, ultimately, leave little to no room for human error.

Increased accuracy is a major benefit for any type of lender. No longer will you have to worry about someone typing in a wrong number or making a mistake in their calculations.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

3. Cut Serious Time from Your Spreadsheet Processes

Whether it’s your project manager entering data into a spreadsheet or a commercial lender using it to track a client’s loan payments, there’s no doubt spreadsheets have been a critical tool for many years.

While automated statement spreading software doesn’t completely replace spreadsheets, it makes creating them exponentially faster.

Imagine the time you’ll save when you can upload a tax statement, and within seconds, see the data perfectly organized on a spreadsheet. That’s the power of generating automated spreads in an instant.

This extra efficiency combined with the accuracy and fraud protection, it’s easy to see how automated software can be well-worth your time.

How Can Automated Software Help You Verify Bank Statements?

The traditional method of verifying bank statements involves an underwriter and can take time as documents are exchanged. This time can be bad for business because lenders can have second thoughts and back out of a deal when it seems stagnant.

The solution to this can be found in automated statement spreadingsoftware. Automating the process of verifying bank statements means less time spent trying to get the document to the right people and a decreased chance of anyone backing out of a loan.

Picture a stack of bank statements that must be processed accurately and efficiently. It would take a lender a substantial amount of manhours to manually verify these bank statements. But by using automated statement spreading software, you can simply upload the documents and verify them in minutes.

With those extra days and weeks saved from automating your bank statements, your team of commercial loan officers and underwriters can focus on critical tasks, like helping business borrowers.

FlashSpread Can Automate Your Spreadsheet Processes

As a leading spreadsheet automation software that produces detailed reports within seconds, FlashSpread may be the tool you’ve been looking for.

Shave hours off of tedious spreadsheet tasks by simply uploading tax returns and watching them accurately fill out a spreadsheet.

Notable features of FlashSpread include:

- Instant tax spreading with just one click

- Make intelligent credit decisions in a flash

- Underwriting is easier than ever with pre-qualified deals

FlashSpread is a tool that will save significant time for any kind of lender. If you’re curious about how it can improve your organization, simply click the link to schedule a demonstration.

FlashSpread Can Save Hours For Your Team of Lenders

Automated software can’t do everything, but what it can do is save serious time on your most time-consuming processes.

FlashSpread is a tool that will save significant time for any kind of lender. If you’re curious about how it can improve your organization, simply click the link to schedule for a free 15-minute demonstration.