In commercial lending, business financial statements form the foundation of every credit decision. Yet, for many lenders, these critical documents arrive as PDFs, scanned reports, or handwritten notes are far from the structured, reliable data required for precise risk assessment.

Instead of evaluating clean, standardized numbers, underwriters and analysts often spend hours manually retyping, reconciling, and standardizing figures across multiple entities. This labor-intensive process is slow, error-prone, and creates operational bottlenecks that delay approvals, reduce throughput, and frustrate both staff and clients.

The good news? Automation is changing the game. Modern tools allow lenders to convert disorganized business documents into structured, accurate data in minutes rather than days, reducing errors and accelerating decision-making.

Key Insights at a Glance

- Loan speed is a top factor borrowers use to choose a lender.

- Most delays occur before underwriting even starts—during document intake and data prep.

- Complex borrower filings and inconsistent PDFs create the biggest accuracy headaches.

- Automated spreading converts messy documents into standardized, auditable data in minutes.

- Clean data speeds approvals, reduces risk, and improves borrower experience.

Table of Contents

The Accuracy Problem: Why Borrower Financials Are So Hard to Trust

Borrower financials should be the foundation of a credit decision, but in many files, that foundation is shaky. Lenders receive financials in mixed formats: bank statements, scanned tax returns, Excel exports, PDFs with different layouts, and sometimes handwritten schedules. Each format requires a different approach to extract the same numbers.

Manual extraction creates three main problems: time, inconsistency, and error. Analysts spend hours hunting for the right line items; different people interpret ambiguous entries differently; and rekeying figures invites transcription mistakes. The result: underwriting that’s slow and sometimes wrong.

Add to that the fact that borrowers often operate multiple entities or have nonstandard accounting, and you’ve got a recipe for delays and rework. In short: PDFs are convenient to send, but they’re a lousy format when you need clean, machine-readable financials.

The operational cost of manual data work

The financial case for fixing this is strong. McKinsey’s work on banking productivity shows measurable gains when institutions adopt technology and automation. Banks that implement targeted tech productivity moves can achieve 20–30% productivity improvements within 18–24 months. That lift translates directly into faster processing and lower operating cost per loan.

When data tasks are manual, lenders waste analyst time on repetitive work instead of credit assessment. That increases the time-to-decision, reduces throughput, and raises operating costs—and it’s avoidable.

Why PDFs Are the Silent Culprit

At first glance, PDFs may seem harmless. They’re easy to email, secure, and universally used. But in lending, PDFs create unique pain points:

- They’re not machine-readable without specialized tools.

- Formatting varies widely, even for the same borrower across different years.

- Important details get buried in footnotes, line-item notes, or attachments.

Without automation, lenders are forced to manually extract and clean these details. This creates not only inefficiency but also data integrity risks that cascade into lending decisions.

A Better Path: Automated Financial Spreading

The solution is clear: lenders need a faster, more reliable way to transform borrower PDFs into clean, standardized data. This is where automated spreading comes in.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Automated financial spreading tools use OCR (optical character recognition) and intelligent data mapping to extract, standardize, and validate borrower financials. Instead of hours of manual work, data is processed in minutes, freeing up analysts to focus on credit judgment rather than data entry.

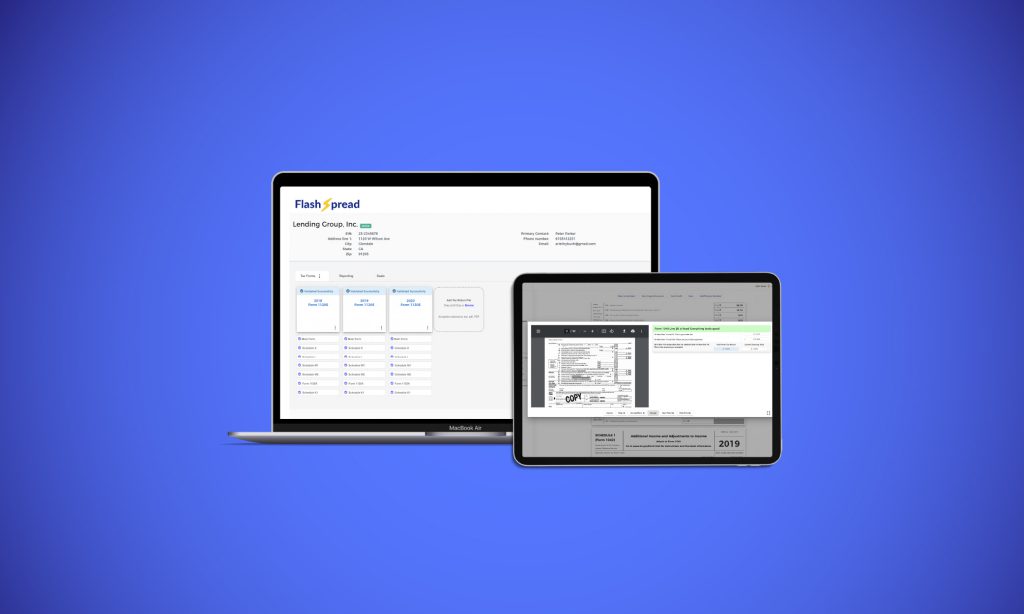

FlashSpread in Action: From Documents to Decision-Ready Data

FlashSpread is purpose-built to tackle the challenge of accurate business financials. By automating the spreading process, FlashSpread gives lenders confidence that their credit decisions are based on accurate, consistent, and auditable data.

What FlashSpread delivers:

- Instant document standardization: PDFs, scans, or paper statements are quickly converted into a uniform format.

- Error reduction: Automated extraction minimizes data entry mistakes, improving decision accuracy.

- Global debt service & monthly monitoring: Automatically calculates global debt service and supports monthly monitoring, enabling faster, data-driven credit assessments.

- Seamless integration: FlashSpread connects with LOS and underwriting systems for immediate data access.

- Scalable efficiency: Teams can process more loans without additional headcount, increasing throughput and productivity.

By addressing these pain points, FlashSpread can reduce errors, shorten cycles, and enable faster, more confident credit decisions.

Competitive Edge in Practice: Accuracy + Speed

Clean data is a growth lever. When underwriting teams receive consistent, validated borrower financials, they can move faster and make better decisions. That translates into:

- Faster yes/no decisions: Cases that used to require days in data prep can be credit-reviewed in hours.

- Improved win rates: Faster timelines and fewer document rounds keep borrowers engaged and reduce the chance they will take competing offers.

- Higher analyst productivity: Staff spend their time on credit evaluation, not busywork.

- Lower operational cost: Removing manual steps reduces FTE burden and the risk of costly downstream errors.

A short example: imagine a loan package with three years of financials delivered as PDFs. Manually spreading that file might consume 4–8 analyst hours. With FlashSpread, extraction and standardization are complete in minutes, and underwriters receive an auditable spread ready for decisioning, accelerating the whole pipeline and increasing capacity.

Roundup

Borrower financials will always arrive in messy, unstructured formats, especially PDFs. But lenders don’t need to let that chaos undermine credit quality, speed, or borrower trust.

By embracing automated spreading tools like FlashSpread, lenders can turn unreliable borrower documents into clean, accurate, and standardized data. The result is faster lending decisions, improved compliance, and a stronger competitive position in the market.

It’s time to leave manual data chaos behind. The future of commercial lending belongs to lenders who turn borrowers’ financials into a reliable foundation for growth.

Talk to us today to see FlashSpread in action and learn how it can help your team turn hours of manual work into minutes of confident decision-making.