The global cash flow serves as a tool that breaks down barriers, revealing the amount of money available to bankers once the individual’s and the company’s fundamental needs have been met.

Now, more than ever, it is imperative for lenders to thoroughly assess the comprehensive financial circumstances of borrowers, encompassing both their business and personal finances, when evaluating requests for small business loans remember that:

- Owners often lend their personal money to business

- Income can be overstated

This process should involve integrating these factors into a GCF. Failure to do so significantly increases the likelihood of obtaining an incomplete and potentially highly inaccurate understanding of the true financial state of both the business and its owner.

When examining the global cash flow of a guarantor, it is crucial to consider not only the incoming cash flow but also all the required and discretionary cash outflows from various activities.

This comprehensive analysis may entail integrating multiple partnership and corporate tax returns, business financial statements, K-1 forms and individual tax filings. Failing to conduct a thorough global cash flow analysis undermines confidence in assessing the strength of the guarantor, even if they possess substantial liquid assets. This is because such liquidity might be necessary to cover contingent liabilities and address any deficits in the global cash flow.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Table of Contents

What Global Cash Flow Includes?

Including all of the owner’s business activities, personal activities, debts, financial obligations and liquidity is of utmost importance. This crucial information should be gathered from personal and business tax returns, along with any supporting financial documents.

Avoid Common Mistakes

- One of the most common errors is likely related to accounting for Dividends/Distributions. This error occurs when they are included in the owner’s Cash Flow Available for Debt Service figure without being deducted from the business’s EBITDA.

- Another common mistake occurs when a business owner has two interconnected businesses that rely on each other, but this interdependency is not appropriately factored into the cash flow analysis.

Failing to recognize the intertwined nature of these businesses can lead to an inaccurate estimation of the cash flow generated by each entity, potentially resulting in an overestimation of their financial capabilities.

Regulators are adopting an extremely cautious stance when it comes to risk rating your loans. In the event they identify any inconsistencies in your calculations, they will delve even deeper into the matter. So, you want to avoid this and make sure that the loans are not risky.

How Can You Avoid Those Errors?

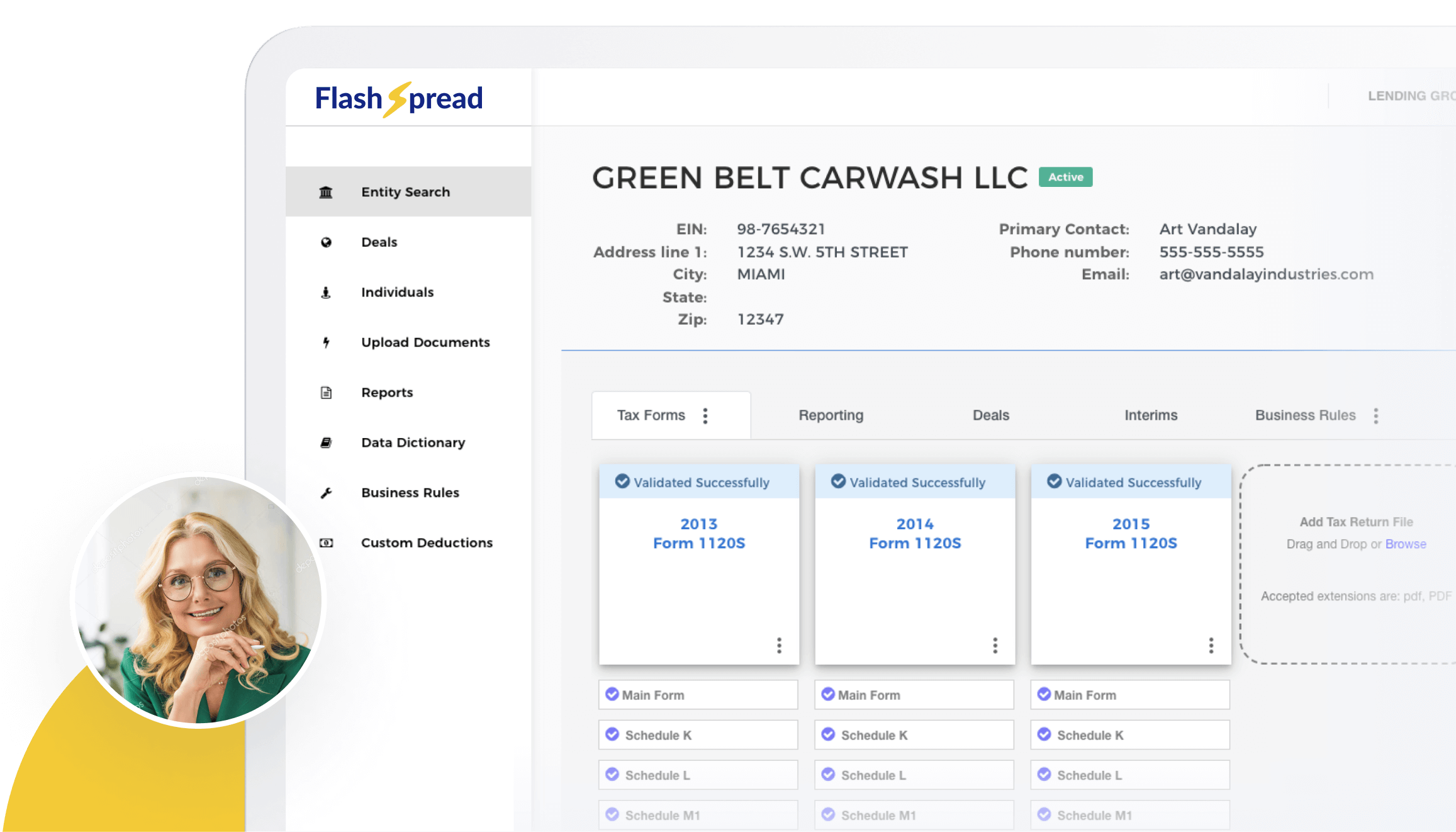

Humans make errors so let automation help you reduce the risk of miscalculations. With Flashspread you can let the software automate in seconds so you can focus on making faster credit decisions. Contact us today!