As you know, a major part of your job is determining whether or not a borrower is capable of repaying a loan. To do this, you will typically review the borrower’s current financial statements and compare them to previous ones to see how the business has changed over time.

But it’s not just about comparing numbers. Borrowers often provide projections and pro-forma financial information, which can be incredibly useful for you in determining whether they will be able to meet their financial obligations. By comparing planned performance to actual financial results, you can get a much clearer picture of the borrower’s ability to repay.

It’s also important to look at industry comparisons when analyzing financial statements. By comparing a borrower’s business operation results to others in the same industry, you can gain valuable insights into how the borrower is performing relative to their peers.

In short, financial statement analysis is a crucial part of your job as a commercial lender. By carefully reviewing financial statements, comparing planned and actual performance, and looking at industry comparisons, you can make more informed lending decisions and help ensure the long-term success of your borrowers.

Table of Contents

Financial statement analysis by lenders involves the use of several balance sheet ratios and statistics.

Among these, five ratios are commonly used to assess a borrower’s financial health and capability to meet its obligations. These ratios include the current ratio, quick ratio, working capital, inventory turnover ratio, and leverage ratio.

The current ratio, which is widely used to evaluate financial strength, is determined by dividing current assets by current liabilities. A higher ratio indicates a higher likelihood of a borrower meeting its obligations.

On the other hand, the quick ratio focuses more on the borrower’s liquid assets and is calculated by dividing the sum of cash and accounts receivable by current liabilities. This ratio excludes inventory and other current assets that may have questionable liquidity. Once again, a higher ratio indicates the borrower’s ability to meet short-term obligations.

Working capital is also a crucial factor for lenders as it deals with cash flow more than a ratio.

To calculate working capital, lenders take the difference between current assets and current liabilities. Some lenders even set a minimum working capital requirement in the borrower’s loan agreement to ensure they have enough cash flow to repay the loan.

Business Owner Example:

Let’s say a business owner named John wants to apply for a loan to expand his business. The bank requires John to provide his financial statements for the past three years to assess his ability to repay the loan. The bank’s loan officer then reviews John’s financial statements and calculates the current ratio, quick ratio, working capital, inventory turnover ratio, and leverage ratio to determine John’s financial strength.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

The current ratio is calculated by dividing John’s current assets (such as cash, inventory, and accounts receivable) by his current liabilities (such as accounts payable and short-term loans). If John’s current ratio is high, the bank will view him as more financially stable and may be more likely to approve his loan.

Similarly, the quick ratio is calculated by dividing the sum of John’s cash and accounts receivable by his current liabilities. If John’s quick ratio is high, the bank will see him as having a strong ability to meet short-term obligations.

Finally, the bank also considers John’s working capital, which is calculated by subtracting his current liabilities from his current assets. If John has a positive working capital, it means he has enough cash flow to cover his short-term obligations. The bank may require John to maintain a certain minimum level of working capital as a condition of the loan.

Inventory turnover ratio is used for businesses that sell products from their inventory.

The ratio is calculated by dividing net sales by average inventory, and it tells the banker if inventory is turning over fast enough.

The leverage ratio is closely monitored by bankers to make sure the borrower continues to be creditworthy. This ratio shows the extent to which the borrower’s business is reliant upon debt to keep operating. The ratio is calculated by dividing total liabilities by net worth, and the higher the ratio, the riskier the borrower’s situation is.

There are three profit and loss ratios commonly used in income statement financial analysis:

- Gross profit ratio, which is calculated by dividing gross profit by net sales. This ratio can be compared to others in the borrower’s industry, as well as to projections and pro-forma information to see if the borrower is meeting its benchmarks.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which is one of the most important ratios used. This ratio is calculated by dividing EBITDA by net sales and shows how well the borrower’s business is actually running without including non-operating costs.

- Net profit ratio, which is net pre-tax profit divided by net sales. This ratio is used to track the borrower’s financial profitability trends over time.

Are you tired of spending hours poring over financial statements? Look no further! Our financial statement analysis services can help you save time and focus on what really matters – growing your business. Not only will our analysis provide you with valuable insights, but it will also satisfy the needs of bankers, creditors, company management, and regulatory authorities.

Whether you need to prove your ability to repay loans, showcase financial results to shareholders, or ensure compliance with accounting standards, we’ve got you covered.

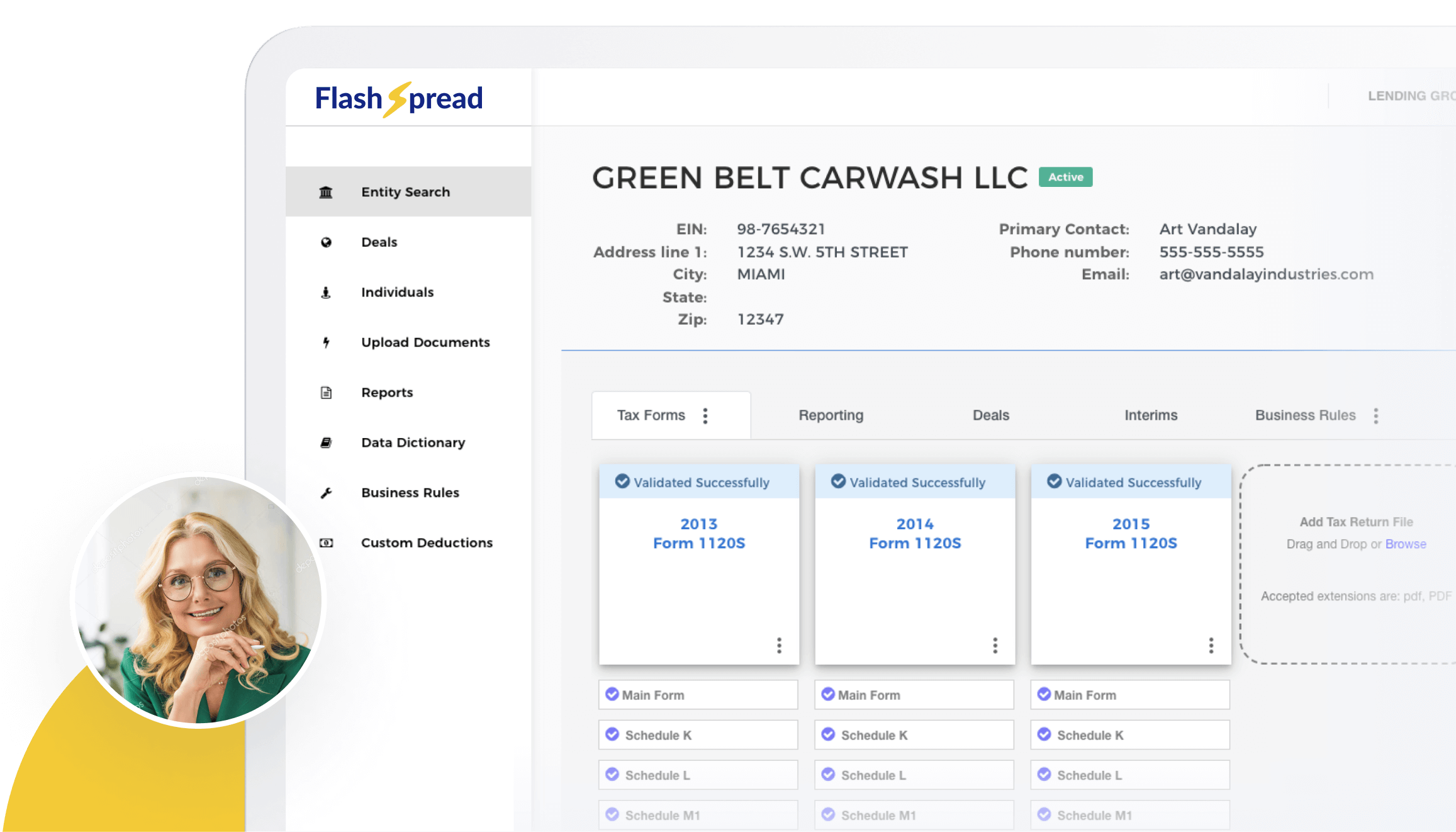

Contact FlashSpread and let our technology help you move your business forward today!