Lenders exploring automation usually have one big concern: how do you know if a spreading tool will actually reduce manual work rather than add more? With more platforms claiming automation, AI, or LOS integration, it can be difficult to understand what is genuinely valuable versus what simply looks good in a demo.

This guide breaks down the essential criteria lenders should prioritize when evaluating an automated financial spreading solution. It also highlights the common pitfalls to avoid and clarifies where modern spreading tools fit within a commercial lending workflow.

The goal is not to sell a product but to help lenders make confident, informed decisions based on the realities of their day-to-day underwriting process.

Key Insights at a Glance

- A strong spreading tool should reduce manual data entry, not shift the work into a different part of the process.

- Accuracy depends on OCR quality, machine learning capabilities, and how well the tool handles scanned or imperfect documents.

- Flexibility matters. A tool should support multiple tax forms, entity types, and statement formats.

- Standardization across analysts improves consistency and portfolio quality.

- LOS systems handle intake, but spreading tools fill the critical gap between document upload and risk assessment.

- Avoid solutions that require heavy template maintenance or produce inconsistent outputs.

- Automation should complement human judgment and enhance the borrower experience.

Table of Contents

Why Lenders Are Re-examining Spreading Tools Right Now

The pressure on lenders to move faster without sacrificing credit quality continues to grow. Teams are expected to take on more deals, reduce turnaround times, and keep risk controls tight, all without adding headcount. This shift exposes the shortcomings of legacy spreadsheet workflows and early automation tools that handled only partial financial data or required analysts to double-check everything manually.

Modern spreading platforms have matured significantly, and lenders now have more options than ever. The challenge is knowing what actually drives efficiency and what simply adds another tool to the workflow.

This guide focuses on practical selection criteria that align with real underwriting needs rather than marketing promises.

What Matters Most: The Core Features to Look For

Below are the essential capabilities that determine whether a spreading tool will meaningfully reduce manual prep time or simply become another system in the stack.

1. Accurate Tax Document Extraction

Most commercial and SBA deals rely on tax returns, supporting schedules, and scanned statements. A reliable tool must handle structured and unstructured documents without requiring perfect formatting.

Look for solutions that:

- Extract data from 1040, 1120, 1120-S, 1065, Schedule C, K-1, and related schedules.

- Recognize scanned or lower-quality PDFs.

- Maintain high accuracy across page variations.

- Reduce the need for manual corrections.

This is the foundation of spreading automation. Without accurate extraction, the rest of the workflow falls apart.

2. True Time Savings

A spreading tool should cut preparation time significantly. If a platform takes almost as long as a manual spread or requires multiple correction loops, it will not provide real value.

Ask vendors:

- How long does it take to process a typical tax return?

- How many manual corrections are usually needed?

- How consistent are outputs across the team?

Time savings should be visible in daily work, not just in a demo environment.

3. Standardized Outputs

Inconsistent spreadsheets or analyst-driven templates introduce risk. A good tool produces standardized spreads every time, making reviews faster and ensuring data aligns across deals.

Standardization helps with:

- Portfolio consistency

- Faster approvals

- Cleaner audits

- Smoother reviews for credit managers

4. Flexibility Across Borrower Types

Lenders need a tool that adapts to different industries and business structures. A rigid system may work for a subset of deals but break down when files deviate from the norm.

Prioritize tools that handle:

- Multiple business entities

- Mixed personal and business financials

- Affiliates or guarantor analysis

- Multi-year comparison

Flexibility ensures the automation supports your workflow rather than forcing you to restructure it.

5. AI-Assisted Classification (Used Responsibly)

Some platforms integrate light AI to classify line items, identify anomalies, or support narrative generation. This can improve accuracy and save time, but it should not replace human judgment.

Look for AI that supports analysts without controlling the decision. Examples include:

- Suggested line item classification

- Auto-detected inconsistencies across statements

- Optional narrative prompts

AI should assist, not dominate.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Common Red Flags to Avoid

When comparing vendors, certain signals indicate a tool may create more work than it eliminates.

1. Requires Extensive Template Customization

If your team must maintain or update templates manually, the automation will quickly become a burden.

2. Accuracy Drops with Scanned Documents

Commercial lenders deal with real-world borrower files. A tool that struggles with scans, multiple entities, or handwritten notes limits efficiency.

3. Outputs Change Depending on the Analyst

A spreading tool should standardize, not amplify variation.

4. No Support for Multi-Statement Reconciliation

Income statements and balance sheets should connect automatically. If totals need manual reconciliation, the tool is incomplete.

5. Slow Processing Times

Anything that adds friction kills adoption.

By recognizing these red flags early, lenders avoid implementing tools that ultimately add complexity to the credit process.

How Automation Bridges the LOS Gap

A loan origination system collects documents. It does not interpret them.

This is where many lenders experience workflow slowdowns. Once tax returns or financial statements are uploaded, analysts still need to:

- Scroll through PDFs

- Pull out line items

- Recreate spreadsheets

- Apply formulas

- Reconcile totals

- Build memos

The LOS gives structure to the intake, but it does not prepare data for underwriting. Automated spreading tools bridge this gap by converting raw financials into usable analysis quickly and consistently.

Practical Example: Automation That Handles Real Financial Complexity

FlashSpread is a useful example of what modern spreading automation looks like when these criteria are applied effectively.

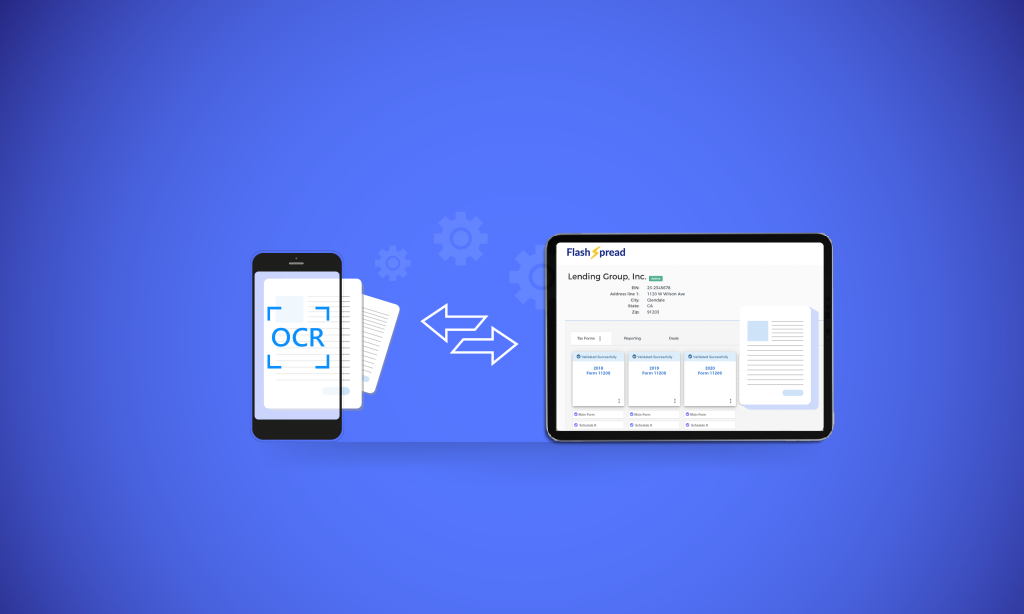

FlashSpread uses Optical Character Recognition (OCR) to extract data from tax returns, income statements, and balance sheets. It also incorporates a small machine learning layer to help classify unstructured data and improve long-term accuracy. It handles scanned documents, mixed financials, and multi-entity structures without requiring custom templates.

Key strengths aligned to the criteria in this guide:

- Reduces spreading time from hours to minutes

- Automatically organizes personal and business financials

- Produces standardized outputs for easier reviews

- Supports both structured and unstructured data

- Offers clean ratio and analysis outputs for SBA and commercial deals

- Integrates with LOS workflows where lenders push tax returns in and receive completed spreads back

This is the type of functionality lenders should look for when evaluating tools. Not the brand name, but the ability to eliminate manual prep and strengthen the underwriting workflow at scale.

Q&A: Common Questions About Automated Financial Spreading

Q. Does automated financial spreading work for complex or multi-company tax returns?

A. Yes. Modern spreading platforms are designed to interpret and map financial data from multiple entities or counterparties and convert them into standardized output ready for analysis, reducing much of the manual reconciliation burden.

Q. How reliable is OCR/AI when documents are scanned or low-quality?

A. Tools trained specifically on tax forms perform well even with older scans. Lenders should still review numbers, but automation significantly reduces common extraction errors.

Q. Can automation support both income statements and balance sheets?

A. Yes, a complete spreading tool captures both and aligns them so totals and ratios make sense. This gives analysts consistent, ready-to-review financials across every borrower file.

Roundup

Selecting an automated financial spreading tool is not just about features. It is about reducing manual work, improving consistency, and giving analysts more time to focus on judgment-driven credit decisions. The right solution strengthens underwriting without disrupting existing workflows. The wrong one adds complexity and slows teams down.

By knowing what to prioritize, what to avoid, and how automation fits between your LOS and your credit analysis, lenders can choose technology that truly supports growth.

Curious how automation supports both major financial statements without sacrificing accuracy? See what modern spreading looks like in practice.