The mortgage industry is in a digital revolution, with mobile mortgage apps at the forefront of this transformation. Gone are the days of cumbersome paperwork and lengthy in-person meetings; digital solutions are reshaping how lenders, buyers, and real estate professionals interact. According to Fannie Mae, the adoption of digital mortgage technology has skyrocketed, with over 95,000 eNotes registered in 2019 alone—a staggering 500% increase from the previous year.

This surge signals a shift in how mortgages are processed and highlights the growing demand for streamlined, user-friendly solutions that simplify the borrowing experience. In response to these market shifts, BeSmartee’s Bright Connect product has emerged as a leading native mobile mortgage app designed to streamline the loan process for borrowers, originators, and referral partners.

Table of Contents

Why Use a Mobile Mortgage App?

Before diving into the details of Bright Connect, it’s important to understand why mobile mortgage apps have become essential tools for borrowers and loan officers alike. Traditionally, the mortgage application process has been considered cumbersome and time-consuming, often requiring multiple documents and in-person meetings. However, mobile mortgage apps have revolutionized this process by offering:

- 24/7 access: Users can access their loan applications anytime, anywhere, making it easier to manage their mortgage on the go.

- Real-time updates: Notifications keep borrowers and loan officers in the loop about the loan’s progress, reducing delays and confusion.

- Document management: Securely upload and access required documents directly through the app, eliminating the hassle of paper files.

- Enhanced communication: Direct lines of communication between borrowers, loan officers, and real estate agents ensure that all parties are informed and involved throughout the loan process.

What is Bright Connect?

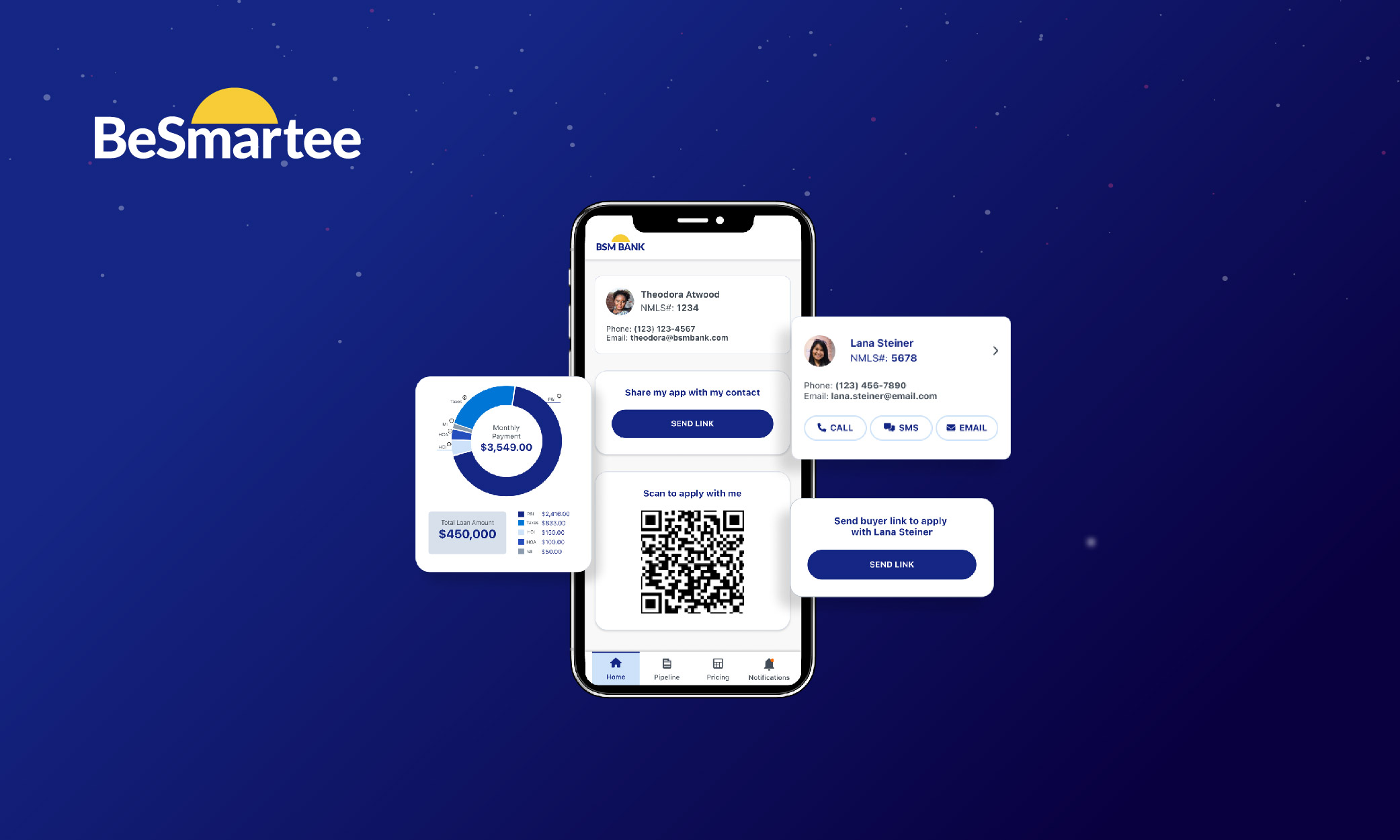

Bright Connect is a native mobile mortgage app developed by BeSmartee to enhance the efficiency and transparency of mortgage origination. The app integrates seamlessly with BeSmartee’s mortgage point-of-sale (POS) solution, Bright POS, providing users with an intuitive and user-friendly interface to streamline mortgage transactions.

Bright Connect offers a range of features that make it a standout in the mobile mortgage app market:

- Seamless loan application process: Borrowers can complete the loan application process through the app. This includes filling out forms, uploading necessary documents, and signing disclosures — all from the convenience of their mobile device.

- Real-time status updates: The app sends instant notifications to keep borrowers informed on the progress of their loan, from submission to approval.

- Collaboration with referral partners: Bright Connect enables better collaboration between loan officers and real estate agents, enhancing the overall experience for all stakeholders involved in the mortgage process.

- Secure document storage: All documents uploaded through the app are securely stored, ensuring both borrowers and lenders can access them when needed without security concerns.

The Bright Connect Experience: Streamlined for All Users

The hallmark of Bright Connect is its simplicity and convenience for all users, whether they are borrowers, loan officers, or referral partners.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

- For borrowers: Bright Connect eliminates the need for in-person meetings and manual paperwork. The app allows borrowers to complete their loan applications, upload necessary documents, and receive real-time updates on their loan status—all from the comfort of their mobile device. This leads to faster approvals and a more transparent process overall.

- For loan officers: Loan officers can manage multiple clients at once, track each loan process step, and stay updated through instant notifications. The app reduces the need for back-and-forth emails, allowing loan officers to work more efficiently.

- For real estate agents: Bright Connect fosters better communication between agents and loan officers, ensuring all parties are aligned and working toward closing deals faster. Agents can track loan statuses directly within the app, giving them valuable insights to inform their clients.

Why Bright Connect is the Future of Mortgages

In a rapidly changing mortgage industry, adapting to new technology is crucial. Bright Connect streamlines the mortgage process and enhances the borrower experience. With real-time updates, secure document management, and seamless collaboration between all parties, the app transforms how mortgages are originated.

Adopting a mobile mortgage app like Bright Connect means:

- Faster Loan Approvals: With automated workflows and real-time updates, delays are minimized, allowing loans to be processed more quickly.

- Increased Transparency: Borrowers, loan officers, and agents have complete visibility into the loan status, reducing the risk of miscommunication.

- Greater Convenience: With Bright Connect, the entire mortgage process can be managed from a mobile device, providing users with flexibility and ease of access.

Roundup

Bright Connect is just one of the innovative solutions BeSmartee offers to improve the mortgage experience. As a leader in digital mortgage solutions, BeSmartee empowers lenders to deliver faster, more efficient service while ensuring a seamless borrower experience.

If you’re ready to take your mortgage experience to the next level, explore Bright Connect and other digital solutions from BeSmartee. Contact us to learn more or request a demo to see how our solutions can transform your mortgage originations. Don’t miss out on the future of mortgages — connect with BeSmartee today!