SBA lending has seen significant growth in recent years, but it’s also becoming more competitive than ever. According to Bankrate, the SBA approved over $27.5 billion in 7(a) loans in 2023, showing a 10% increase from the previous year. This demand surge means lenders must adapt to new trends and technologies to remain competitive.

As borrowers seek faster approval times and personalized service, the landscape of SBA lending is shifting, and staying ahead requires a proactive approach.

Table of Contents

Digital Transformation in SBA Lending

Digital transformation has revolutionized many sectors, and SBA lending is no exception. The manual processes that once defined SBA loan origination and approval give way to automation and digital tools. From loan application to closing, lenders increasingly utilize software to streamline the process, reducing human error and improving efficiency.

With borrowers expecting faster service, SBA lenders must adopt digital solutions to remain competitive. Online portals allow applicants to submit documents and check their loan status in real time. At the same time, automated underwriting platforms enable quicker decision-making.

Lenders should consider adopting comprehensive loan origination platforms that integrate all aspects of the SBA lending process, from application to servicing. This speeds up the process and offers borrowers a seamless, user-friendly experience.

Personalization and Customer Experience

While technology is essential, the human element in SBA lending remains critical. Providing a personalized customer experience can set a lender apart as competition grows. Borrowers seek personalized advice, especially when navigating the complexities of SBA loans. Lenders who can deliver tailored solutions and guide borrowers through the process will stand out in a crowded marketplace.

The SBA lending process can be intimidating, particularly for first-time borrowers. Personalized service and advanced digital tools can help build trust and long-term client relationships.

Leveraging data analytics to understand borrower profiles better allows lenders to offer more customized loan products and advice. Training staff to provide exceptional customer service can also significantly impact borrower satisfaction and loyalty.

Risk Mitigation and Credit Analysis Automation

In today’s rapidly shifting economic landscape, robust risk management is more critical than ever. Lenders need to ensure they can accurately assess the creditworthiness of small businesses, many of which may have volatile cash flows or limited credit histories.

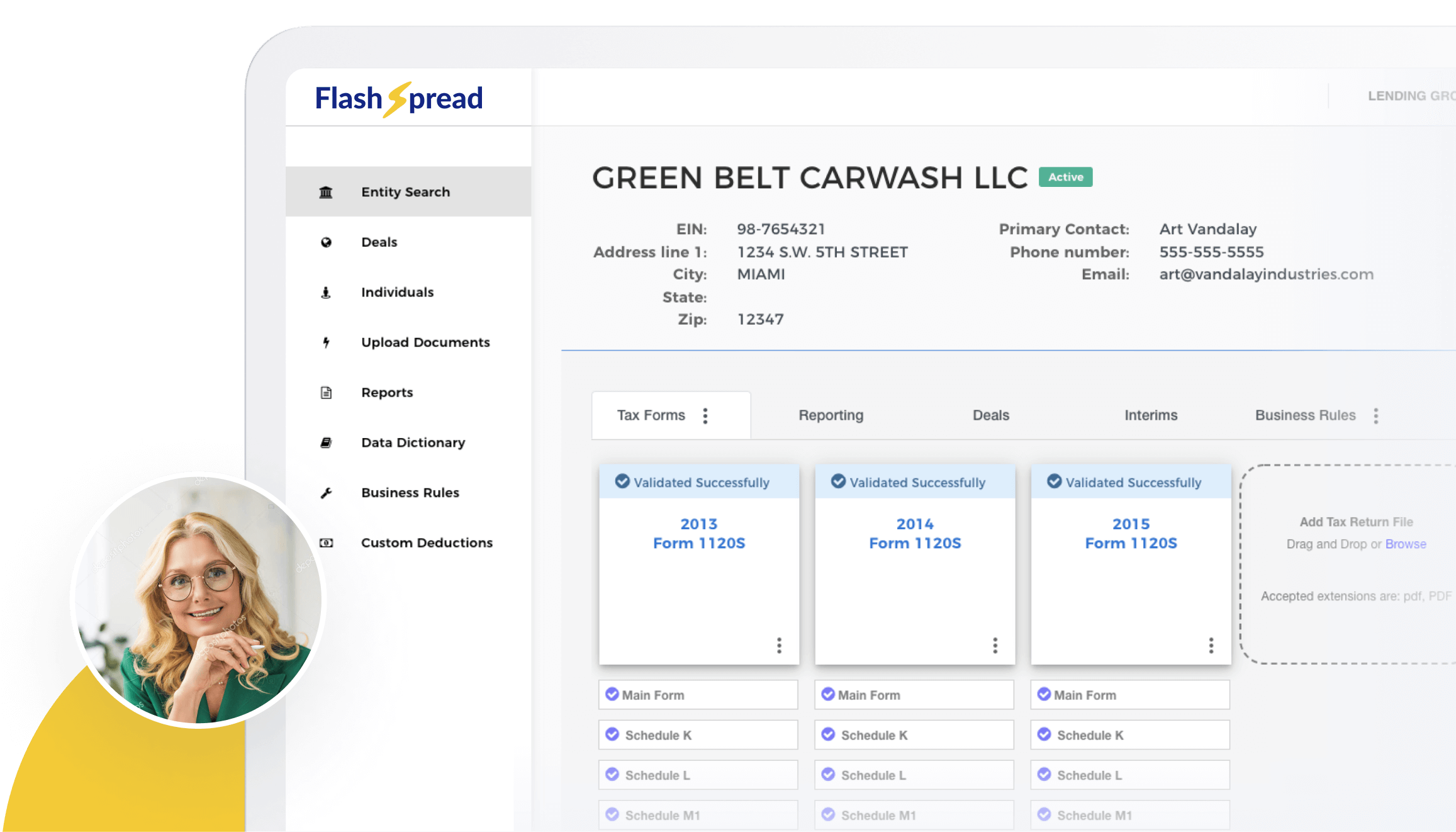

This is where automated credit analysis tools, like FlashSpread, play a vital role. By automating financial statement spreading and risk assessment, lenders can evaluate a borrower’s financial health more accurately and efficiently.

Manually spreading financial statements is time-consuming and prone to errors. Automated solutions improve the accuracy of risk assessments, enabling lenders to make faster, more informed decisions.

Integrating automated financial spreading platforms into underwriting can help lenders mitigate risk while accelerating loan approvals. FlashSpread, for instance, allows lenders to analyze borrower financials with precision, reducing the likelihood of bad loans and improving portfolio performance.

Increased Focus on SBA 504 and 7(a) Loans

While the SBA 7(a) loan program has long been the most popular, the SBA 504 loan program has gained significant traction in recent years. With businesses eager to invest in real estate, equipment, and other fixed assets, SBA 504 loans are becoming increasingly attractive due to their lower interest rates and long-term benefits.

Lenders who diversify their SBA offerings by promoting 7(a) and 504 loans will capture a broader market. Borrowers are becoming more aware of the advantages of 504 loans, and lenders that can educate clients on the benefits of both programs will remain competitive.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Offer various SBA loan products to meet different borrower needs, and ensure that loan officers are well-versed in the nuances of 7(a) and 504 loans. This expertise will help them guide borrowers to the right product for their business goals.

Navigating Regulatory Changes

Regulatory updates continually impact the SBA lending landscape. From loan limit adjustments to eligibility criteria changes, staying compliant with SBA regulations is crucial for lenders. Recent initiatives to support minority-owned businesses, startups, and underserved communities have opened new opportunities for SBA lenders.

Non-compliance with SBA regulations can lead to significant penalties, including the loss of SBA guarantees. Understanding the latest regulatory changes is critical to maintaining a healthy SBA lending portfolio.

Lenders must stay informed about the latest regulatory changes and ensure their processes align with SBA requirements. Utilizing loan origination systems that are regularly updated to reflect new regulations can help ensure compliance. Additionally, training staff on regulatory changes will ensure that loan officers can accurately advise borrowers and avoid pitfalls.

Sustainability and Social Impact in SBA Lending

Sustainability and social responsibility have become top priorities for many businesses, including small enterprises. Lenders who can offer SBA loans tailored to companies focusing on sustainability, green initiatives, or social impact will have an edge in the current market.

Consumers and investors are increasingly drawn to businesses prioritizing environmental and social responsibility. Lenders that support these businesses by offering tailored financing options will be viewed as partners in their growth.

Develop loan programs that cater to businesses with sustainable or socially responsible business models. Promote these loan products through marketing and education efforts to attract borrowers who align with these values.

Partnerships and Collaboration

In an evolving SBA lending landscape, partnerships between lenders and FinTech companies are becoming more prevalent. Collaborations with financial technology providers allow traditional lenders to access cutting-edge tools and services without developing them in-house.

FinTech partnerships can enhance a lender’s ability to process SBA loans more quickly and accurately. From underwriting tools to customer relationship management platforms, these partnerships allow lenders to compete with tech-savvy rivals.

Explore partnerships with FinTech companies to integrate new technologies into your SBA lending process. Look for tools that complement your existing processes, such as FlashSpread’s automated financial spreading software, which can dramatically reduce the time spent on financial analysis while improving accuracy.

Stay Competitive in SBA Lending with FlashSpread

The SBA lending landscape is rapidly evolving, and staying competitive means adopting the latest technology, providing personalized service, and mitigating risk through better credit analysis. FlashSpread is the perfect partner for lenders looking to enhance their SBA lending capabilities.

Our automated financial spreading software streamlines the loan underwriting process, allowing you to quickly and accurately assess borrower financials, reduce errors, and close loans faster. Ready to take your SBA lending to the next level? Contact us today to learn how our platform can help you stay ahead in a dynamic market.