In today’s financial world, businesses increasingly rely on technology to streamline their processes. According to a report by McKinsey, businesses that leverage advanced analytics and automated tools can reduce their financial processing costs by up to 40% and improve decision-making speed by up to 50%.

One area that has seen significant advancements is the automation of financial statement spreading. Once manually intensive and prone to errors, this process has been revolutionized by automated platforms offering speed, accuracy, and efficiency.

But with so many options available, how do you choose the correct automated financial statement spreading platform for your needs? This blog will compare top solutions, highlighting their features, benefits, and potential drawbacks.

Table of Contents

What is Automated Financial Statement Spreading?

Before diving into the comparison, it’s essential to understand what automated financial statement spreading entails. Financial statement spreading transfers financial data from a company’s financial statements into a standardized format, which is then used for analysis and decision-making. This process is crucial for lenders, analysts, and financial institutions as it helps assess a business’s creditworthiness and financial health.

Automated financial statement spreading platforms simplify this process using advanced algorithms and machine learning to extract, categorize, and analyze data quickly and accurately. These platforms reduce the time and effort required and minimize the risk of human error.

Key Features of Automated Financial Statement Spreading Solutions

When comparing different solutions, there are several key features to consider:

- Data Accuracy and Reliability: The primary purpose of using an automated solution is to ensure that the data extracted from financial statements is accurate and reliable. Look for solutions that have a proven track record of delivering high-quality data.

- Speed and efficiency: Time is of the essence in financial analysis. The solution should be able to process large volumes of data quickly without compromising accuracy.

- User interface and experience: A user-friendly interface is essential for ensuring the solution is easy to navigate and use. Consider solutions that offer intuitive dashboards and customizable features.

- Integration capabilities: The solution should be able to integrate seamlessly with other financial tools and software you may be using. This ensures a smooth workflow and avoids the need for manual data entry.

- Customer support and training: Even the best solutions can have a learning curve. Ensure the provider offers comprehensive customer support and training to help you get the most out of the software.

- Cost-effectiveness: Finally, consider the cost of the solutions. While investing in quality software is essential, it should also offer good value for money.

Top Automated Financial Statement Spreading Solutions

FlashSpread

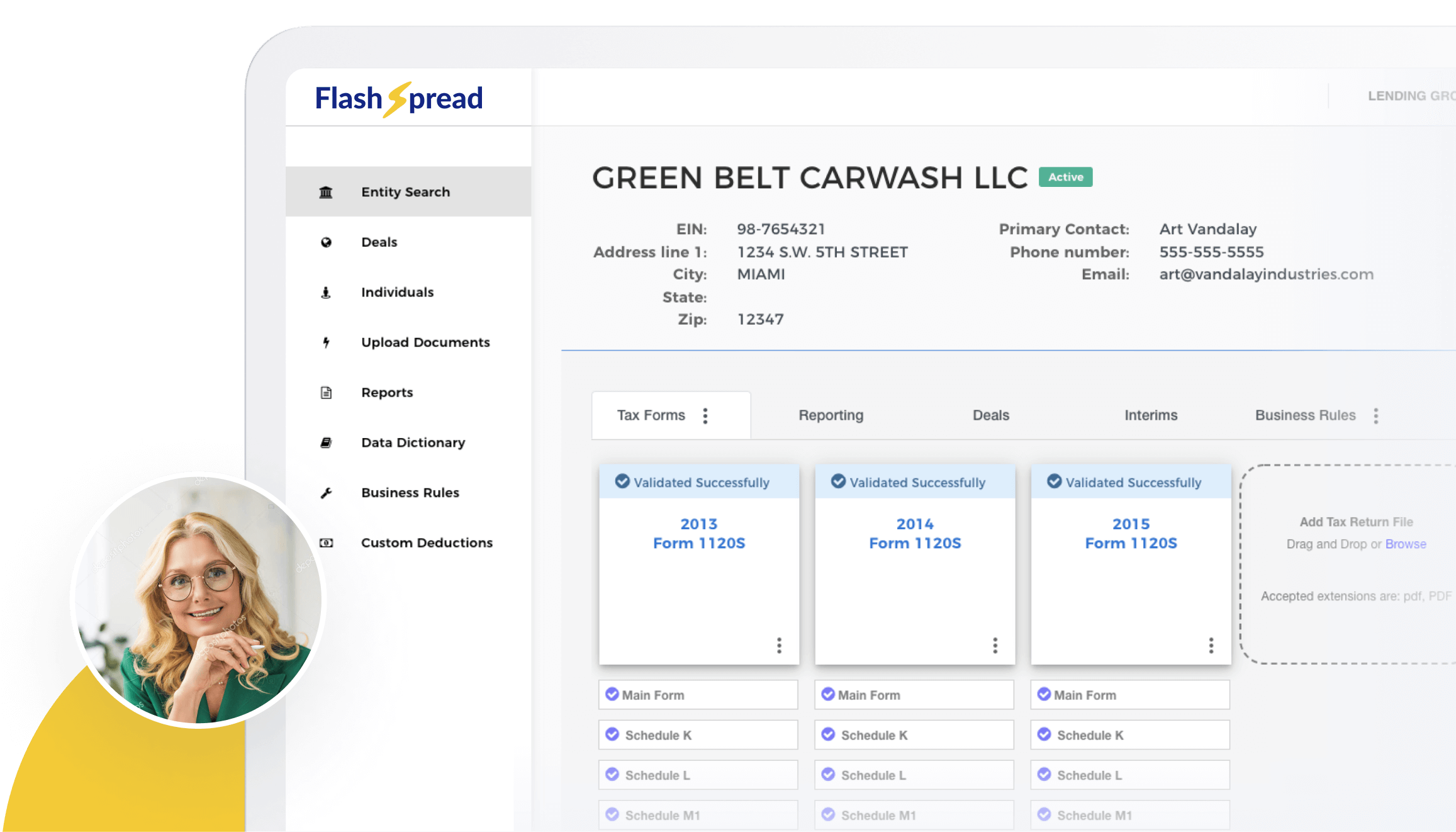

FlashSpread is a leading automated financial statement spreading solution designed to streamline the tax return analysis process. It stands out for its ability to quickly and accurately spread financial statements in just a few clicks. With FlashSpread, users can extract data from various financial documents, including PDFs and scanned images, making it highly versatile.

Key Features:

- AI-Powered data extraction: FlashSpread uses advanced AI algorithms to extract data with high accuracy, even from complex and unstructured financial documents.

- Configurable spreading templates: Users can create and configure templates to fit their needs, ensuring the spread output is tailored to their requirements.

- Seamless integration: FlashSpread integrates easily with existing loan origination systems (LOS) and other financial tools, enabling a smooth workflow.

- User-friendly interface: The solution offers an intuitive interface that requires minimal training, making it easy for users of all experience levels to operate.

- Comprehensive reporting: FlashSpread provides detailed reports and analytics, giving users insights into the financial health of businesses at a glance.

Pros:

- High accuracy in data extraction

- Quick processing times

- Easy to use with minimal training

- Strong integration capabilities

Cons:

- Not integrated into every single LOS

- Currently doesn’t handle CPA, audited, or reviewed statements, but will in the future

Moody’s CreditLens

Moody’s CreditLens is another popular solution known for its robust financial analysis capabilities. It offers a range of features designed to help lenders make informed credit decisions.

Key Features:

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

- Advanced financial analysis: CreditLens provides deep financial analysis tools, allowing users to evaluate businesses’ financial health comprehensively.

- Integration with Moody’s Analytics: The platform integrates with Moody’s proprietary analytics tools, providing users with access to a wealth of data and insights.

- Flexible data entry options: Users can input data manually or through automated extraction, offering flexibility in using the solution.

- Customizable workflows: CreditLens allows users to create customized workflows, ensuring the platform meets their needs.

Pros:

- Strong financial analysis tools

- Integration with Moody’s analytics

- Flexible data entry options

Cons:

- More complex interface that may require extensive training

- Higher cost compared to other solutions

Abrigo

Abrigo, a leader in financial technology, offers a comprehensive suite of tools for financial institutions, including the well-regarded Sageworks and Banker’s Toolbox platforms. These tools are now integrated under the Abrigo brand, providing a powerful combination for automated financial statement spreading, credit risk analysis, and regulatory compliance.

Key Features:

- Automated financial spreading: Abrigo’s solution offers automated financial statement spreading with high accuracy, reducing manual effort and speeding up the analysis process.

- Credit risk analysis: Built-in tools for assessing credit risk make it easier for lenders to evaluate the financial health of businesses and make informed decisions.

- Regulatory compliance and fraud detection: Banker’s Toolbox, now part of Abrigo, includes features that help financial institutions meet regulatory requirements and detect potential fraud, adding an extra layer of security.

- Integration with core banking systems: Abrigo seamlessly integrates with core banking systems, ensuring that data flows smoothly across platforms and enhancing the overall efficiency of financial operations.

Pros:

- Comprehensive financial analysis and credit risk tools

- Strong focus on regulatory compliance and fraud detection

- Seamless integration with existing banking systems

Cons:

- The platform’s wide range of features may be overwhelming for institutions

- Higher cost compared to other solutions

- Does not support scanned documents or financial statements

Finagraph

Finagraph is another innovative solution in the automated financial statement spreading space, known for its focus on small and medium-sized enterprises (SMEs). The solution is designed to make financial analysis more accessible and actionable for businesses that may not have the resources of larger institutions.

Key Features:

- Real-time financial data: Finagraph offers real-time financial data extraction and analysis, giving users up-to-the-minute insights into a business’s financial health.

- SME focus: The solution is tailored to meet the needs of small and medium-sized businesses, making it easier for them to manage and analyze their financial data.

- User-friendly interface: Finagraph is designed with simplicity in mind, offering an intuitive interface that requires minimal training, making it ideal for users with limited financial expertise.

- Integration with accounting software: Finagraph integrates seamlessly with popular accounting software like QuickBooks, streamlining the data extraction process and reducing the need for manual entry.

Pros:

- Excellent for SMEs with specific needs

- Real-time data extraction and analysis

- Easy integration with accounting software

Cons:

- Lack of some advanced features needed by larger institutions

- Limited customization options for more complex financial analysis

- Does not support scanned documents or financial statements

Roundup

Selecting the right automated financial statement spreading solution for your commercial lending business depends on your specific needs and the size of your institution. For those seeking a user-friendly, highly accurate, and efficient solution, FlashSpread is an excellent choice. It offers a balance of advanced features and ease of use, making it suitable for institutions of all sizes.

Don’t let outdated methods slow you down. Experience the power of FlashSpread today and see how it can transform your financial analysis process. Contact us to schedule a demo and take the first step toward “Click. Spread. Done.”