The mortgage industry is transforming rapidly, necessitating modern solutions that cater to the needs of loan officers, real estate agents, and borrowers.

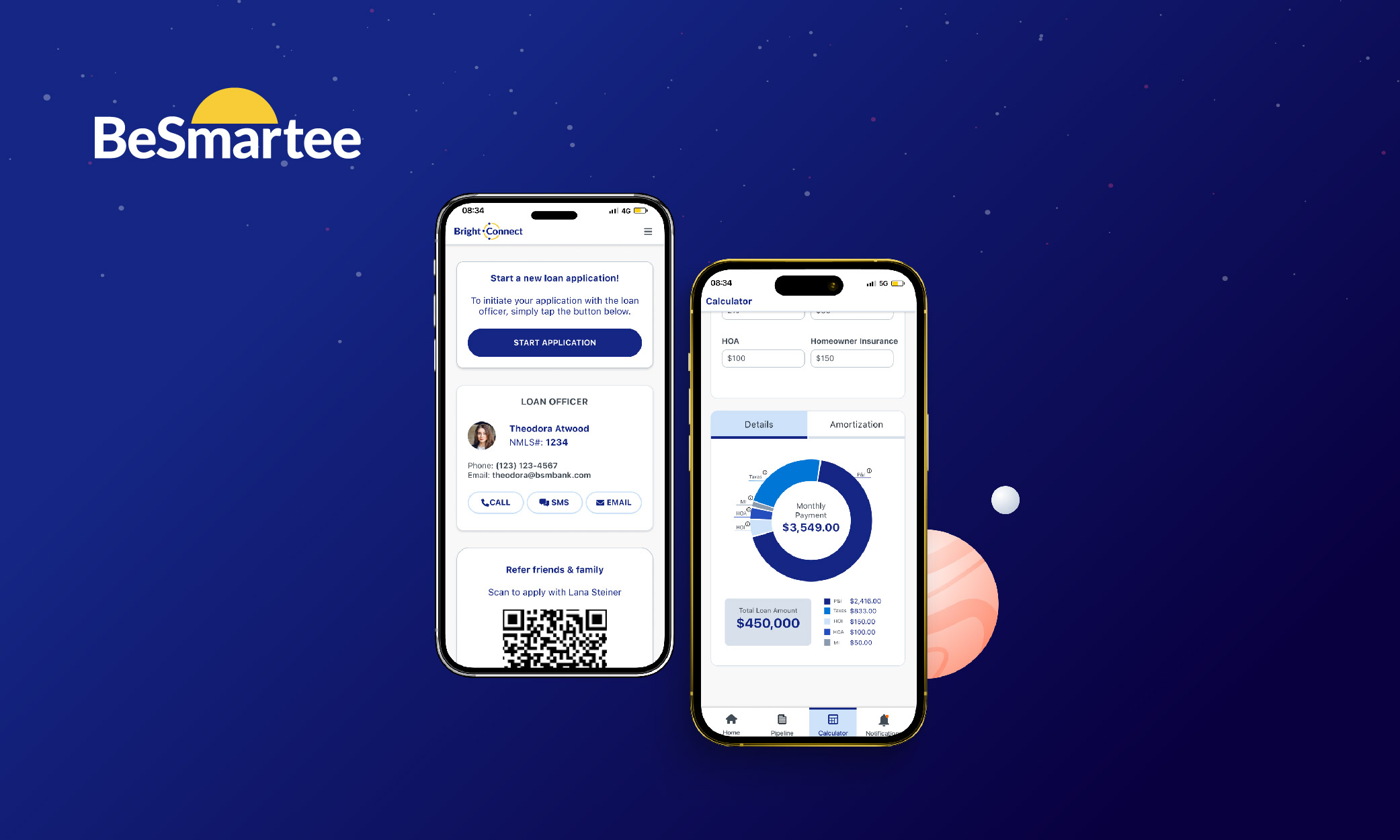

According to recent data, more than 90% of consumers spend their mobile time using apps, reflecting mobile applications’ critical role in today’s business environment (RipenApps Technologies). Bright Connect stands out in this landscape, providing loan officers with a robust, intuitive mobile mortgage app that caters to their needs.

Table of Contents

The Ultimate Mobile Mortgage App Experience

Bright Connect is more than just a mobile mortgage app; it’s an entire ecosystem built to enhance connectivity, improve efficiency, and elevate the borrower experience. Whether you’re a seasoned loan officer or new to the industry, Bright Connect equips you with the tools and features to stay ahead of the competition and deliver exceptional service.

Seamless Connectivity and Communication

One of the standout features of Bright Connect is its ability to foster seamless connectivity between loan officers, real estate agents, and borrowers. The app’s user-friendly interface and robust communication tools ensure you can effortlessly stay in touch with your clients and partners.

- Instant Notifications: Stay informed with real-time notifications about important updates, such as new borrower sign-ups, completed applications, and loan status changes. This feature lets you respond promptly and keep the loan process moving smoothly.

- Digital Business Cards: Generate more opportunities and expand your network with digital business cards that can be easily shared with potential clients and partners.

- Streamlined Referrals: Strengthen relationships and grow your business with streamlined referral processes, making it easier than ever to connect with new prospects.

Comprehensive Loan Management

Bright Connect offers a robust suite of tools for loan management, enabling loan officers to handle every aspect of the mortgage process efficiently.

- Pipeline Management: View all leads and loans in one place. The pipeline page provides detailed information about each lead and loan, including borrower contact details, loan status, and referral timestamps.

- Loan Dashboard: Access comprehensive loan details and take action to move loans forward. The dashboard includes loan numbers, borrowers’ names, subject property addresses, and loan statuses.

- Document Management: Easily manage documents with features like photo submission and e-signature capabilities. This ensures all necessary documentation is collected and processed quickly, reducing delays and improving the borrower experience.

Advanced Pricing and Comparison Tools

Pricing is a critical aspect of the mortgage process. Bright Connect offers advanced tools to help loan officers provide accurate and competitive pricing to their clients.

- Product & Pricing Engine (PPE): Retrieve live pricing results based on specific loan scenarios. The app’s pricing page takes in various inputs, such as home price, down payment, mortgage term, interest rate, and more, to generate accurate pricing results.

- Comparison Tool: Compare up to five loan products and provide detailed comparisons to borrowers. This feature helps borrowers make informed decisions and increases their confidence in choosing the right loan product.

Empowering Real Estate Agents and Borrowers

Bright Connect isn’t just for loan officers; it also empowers real estate agents and borrowers with features designed to improve their experience and facilitate smooth transactions.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Real Estate Agents

- Account Management: Real estate agents can easily manage their accounts, modify details, and assign or remove loan officers as needed.

- Pre-Qualification Letters: Agents can generate and update pre-qualification letters on the go, expediting the process and providing timely updates to their clients.

- Pipeline Management: View and manage all leads and loans they have initiated or referred, ensuring transparency and efficiency in the referral process.

Borrowers

- Account Registration: Borrowers can self-register for an account via invitation from a loan officer or real estate agent, streamlining the initial setup process.

- Loan Dashboard: Access detailed loan information, view documents, and track loan status. The dashboard is dynamic, providing relevant information based on the borrower’s journey in the loan process.

- Notifications: Receive real-time updates about loan status changes, document requests, and more, keeping borrowers informed and reducing anxiety throughout the process.

Award-Winning Excellence

BeSmartee’s mortgage product suite has been recognized through numerous industry awards, underscoring its impact and innovation in the mortgage industry. Some of its notable accolades include:

- HW Tech 100: 2019, 2020, 2021, 2022, 2023, 2024

- The Stevie® Awards: 2021, 2022, 2023

- Stevie People’s Choice TPO: 2022

- Titan Business Awards: 2022

These awards reflect BeSmartee’s commitment to delivering cutting-edge technology and exceptional service to mortgage lenders.

The Future of Mortgage Origination

As the mortgage industry evolves, staying ahead of the curve requires embracing innovative solutions that enhance efficiency, improve communication, and provide a superior borrower experience. Bright Connect is the mobile mortgage app that meets these demands, empowering loan officers to excel and succeed.

By leveraging Bright Connect, loan officers can streamline workflows, stay connected with clients and partners, and provide a seamless, efficient mortgage experience. The app’s comprehensive features, user-friendly interface, and award-winning excellence make it the best choice for mortgage professionals looking to elevate their business.

Ready to transform your mortgage business with Bright Connect? Experience the ultimate mobile mortgage app and take your loan officer capabilities to the next level. Contact BeSmartee today to request a demo and see how Bright Connect can empower your team, streamline your processes, and enhance your borrower experience.