The commercial lending industry is undergoing a seismic shift, driven by rapid technological advancements. According to a 2023 McKinsey report on “The Great Banking Transition,” it is time for financial services institutions to prioritize investment into emergent and next-generation technologies to remain future-proof and relevant. In response to this growing demand, financial spreading solutions have emerged as a transformative tool in the commercial lending industry.

FlashSpread, a leading financial spreading solution, stands at the forefront of this change. Let’s dive into commercial lending technology trends, focusing on how FlashSpread is shaping the industry.

Table of Contents

The Evolution of Financial Spreading Solutions

Before we dive in, it’s essential to understand the evolution of financial spreading solutions in commercial lending. Traditionally, financial spreading — analyzing financial statements to assess a borrower’s creditworthiness — was labor-intensive. It required manual data entry, extensive spreadsheet work, and significant human oversight, often leading to errors and inefficiencies.

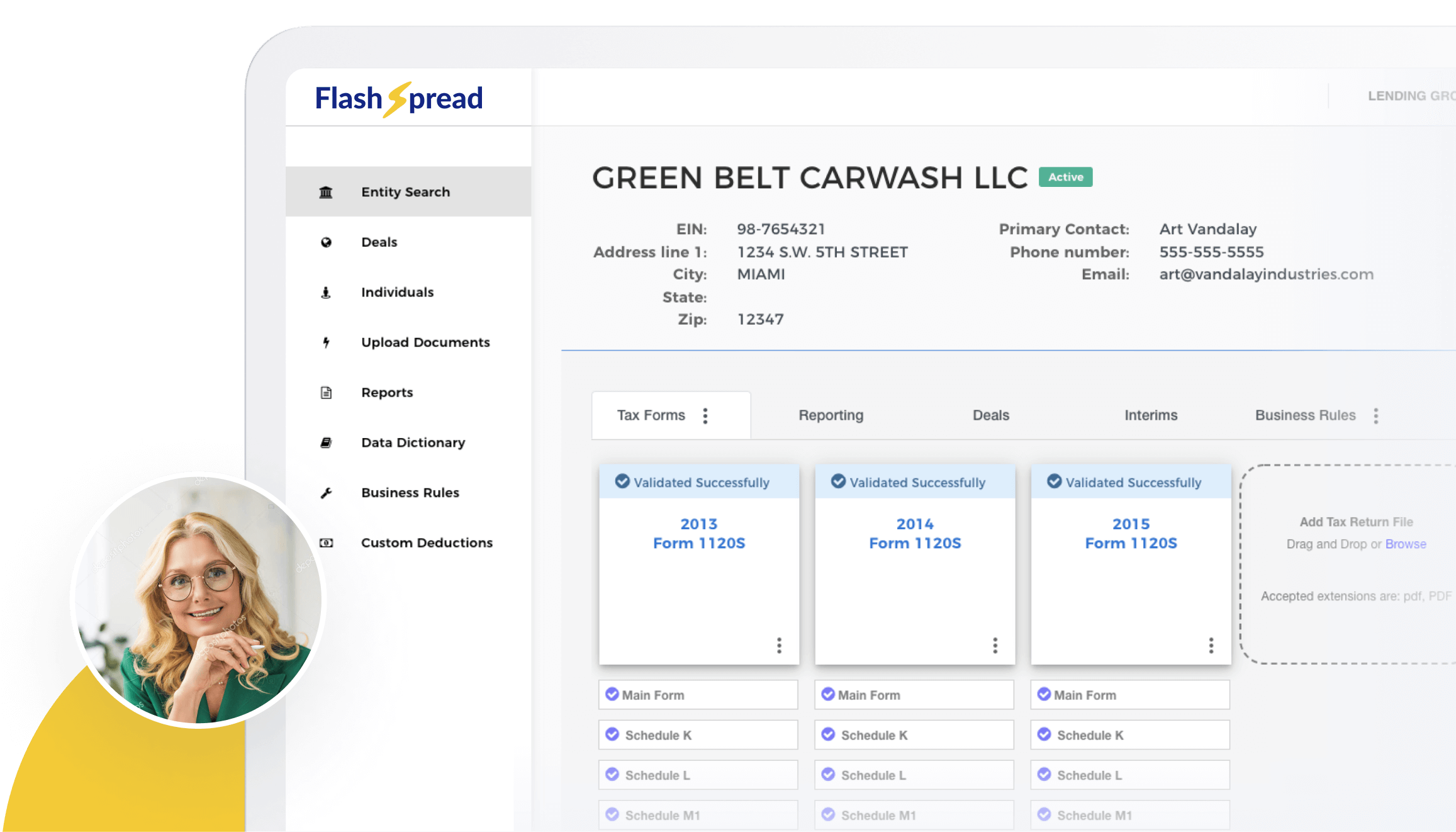

The introduction of automated financial spreading solutions transformed this landscape. These technologies use sophisticated algorithms and artificial intelligence (AI) to automate financial data extraction, interpretation, and analysis. FlashSpread, for example, leverages AI and machine learning to provide lenders with accurate, real-time financial spreads, reducing the time and effort required for credit analysis.

Future Trends in Financial Spreading Solutions

As we look ahead, several key trends are poised to shape the future of financial spreading solutions in commercial lending.

Increased Automation and AI Integration

Automation and AI will continue to drive the evolution of spreading solutions. Advanced AI models are increasingly adept at handling complex financial data, identifying patterns, and making predictive analyses. Future spreading solutions will leverage these capabilities to provide more accurate and insightful financial assessments.

FlashSpread is already a leader in this area, using AI to automate data extraction and analysis. As AI technology advances, FlashSpread can offer even more sophisticated tools, such as predictive credit scoring and real-time risk assessment.

Enhanced Data Analytics and Insights

The future of spreading solutions lies in their ability to provide deeper insights through enhanced data analytics. By integrating big data analytics, these solutions can offer a more comprehensive view of a borrower’s financial health, considering a broader range of data points and trends.

FlashSpread invests heavily in data analytics to offer lenders a holistic view of their borrowers. By combining traditional financial data with alternative data sources, such as social media activity and market trends, FlashSpread can provide a more nuanced understanding of credit risk.

Cloud-Based Solutions and Mobility

Cloud technology is revolutionizing financial services, offering unprecedented flexibility and scalability. Cloud-based solutions enable lenders to access data and tools from anywhere, facilitating remote work and collaboration.

FlashSpread has embraced cloud technology, offering a robust, cloud-based spreading solution that ensures data security and accessibility. This trend will only grow as remote work becomes more prevalent, making cloud-based solutions a standard in the industry.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Blockchain for Enhanced Security and Transparency

Blockchain technology holds significant potential for improving the security and transparency of spreading solutions. By providing an immutable ledger of financial transactions and data, blockchain can enhance the accuracy and trustworthiness of financial spreads.

User-Friendly Interfaces and Integration

As technology becomes more sophisticated, there’s a parallel demand for user-friendly interfaces that simplify complex processes. Future spreading solutions will focus on intuitive design and seamless integration with other financial systems, such as loan origination and management platforms.

FlashSpread is committed to enhancing the user experience by continuously refining its interface and ensuring seamless integration with other financial tools. This focus on usability ensures that lenders can quickly adopt and benefit from advanced spreading technologies.

The Impact of Spreading Solutions on Commercial Lending

The advancements in spreading solutions are not just technological—they have profound implications for the commercial lending industry. Here are some of the critical impacts:

Improved Efficiency and Productivity

Automated spreading solutions drastically reduce the time and effort required for financial analysis. This allows lenders to process more applications in less time, improving overall productivity and enabling them to serve more clients.

Enhanced Accuracy and Reduced Risk

By eliminating manual data entry and leveraging AI for analysis, spreading solutions like FlashSpread significantly reduces the risk of errors. This enhances the accuracy of credit assessments, leading to better-informed lending decisions and reduced risk for lenders.

Faster Decision-Making

The speed and accuracy of automated spreading solutions enable lenders to make faster credit decisions. This is crucial in a competitive market where timely responses can distinguish between winning or losing a client.

Better Customer Experience

With faster, more accurate credit assessments, lenders can provide a better customer experience. Borrowers benefit from quicker loan approvals and more transparent communication, leading to higher satisfaction and loyalty.

Scalability and Growth

Automated spreading solutions allow lenders to scale their operations more effectively. By efficiently handling larger volumes of data and applications, these solutions support growth and expansion in the lending business.

Roundup

Are you ready to revolutionize your commercial lending operations with the latest spreading technology? Join the ranks of forward-thinking lenders leveraging FlashSpread’s cutting-edge solutions to enhance efficiency, accuracy, and customer satisfaction. Contact FlashSpread today to schedule a demo and discover how our innovative spreading solution can transform your lending process. Embrace the future of commercial lending with FlashSpread and stay ahead of the curve!