If you’re an SBA lender, you know that the process of getting a SBA loan approved and funded can be lengthy. But with FlashSpread, you can speed up the process by removing the manual parts of the process and replacing them with an augmented approach to financial spread creation and analysis.

Speed is of the essence for SBA loans. Accelerating the approval process can make all the difference for small businesses that need access to capital quickly. And it helps your bottom line by empowering you to approve more creditworthy and capable small business owners faster, and with greater certainty of their ability to repay the SBA loan.

Keep reading to learn more about this amazing software and how it can help your SBA loan process.

The Challenge of SBA Loans

SBA lenders often have a difficult time approving loans for small business owners. The SBA loan process can be complicated and time-consuming, and it can be hard to know whether or not a small business owner will be able to repay the SBA loan.

SBA lenders also have to worry about the possibility of fraud. For example, small business owners may exaggerate their income or falsify information on their applications to get a SBA loan. As a result, SBA lenders often have to carefully review applications and make sure that they approve loans only for those small businesses likely to succeed.

While the SBA loan approval process can be challenging, SBA lenders play an essential role in supporting small businesses and helping them grow. That’s why software like FlashSpread is so important because it helps SBA lenders work more efficiently, with less risk in their SBA loan approval decisions, and do so quicker than ever before.

What Is FlashSpread and How Does It Work?

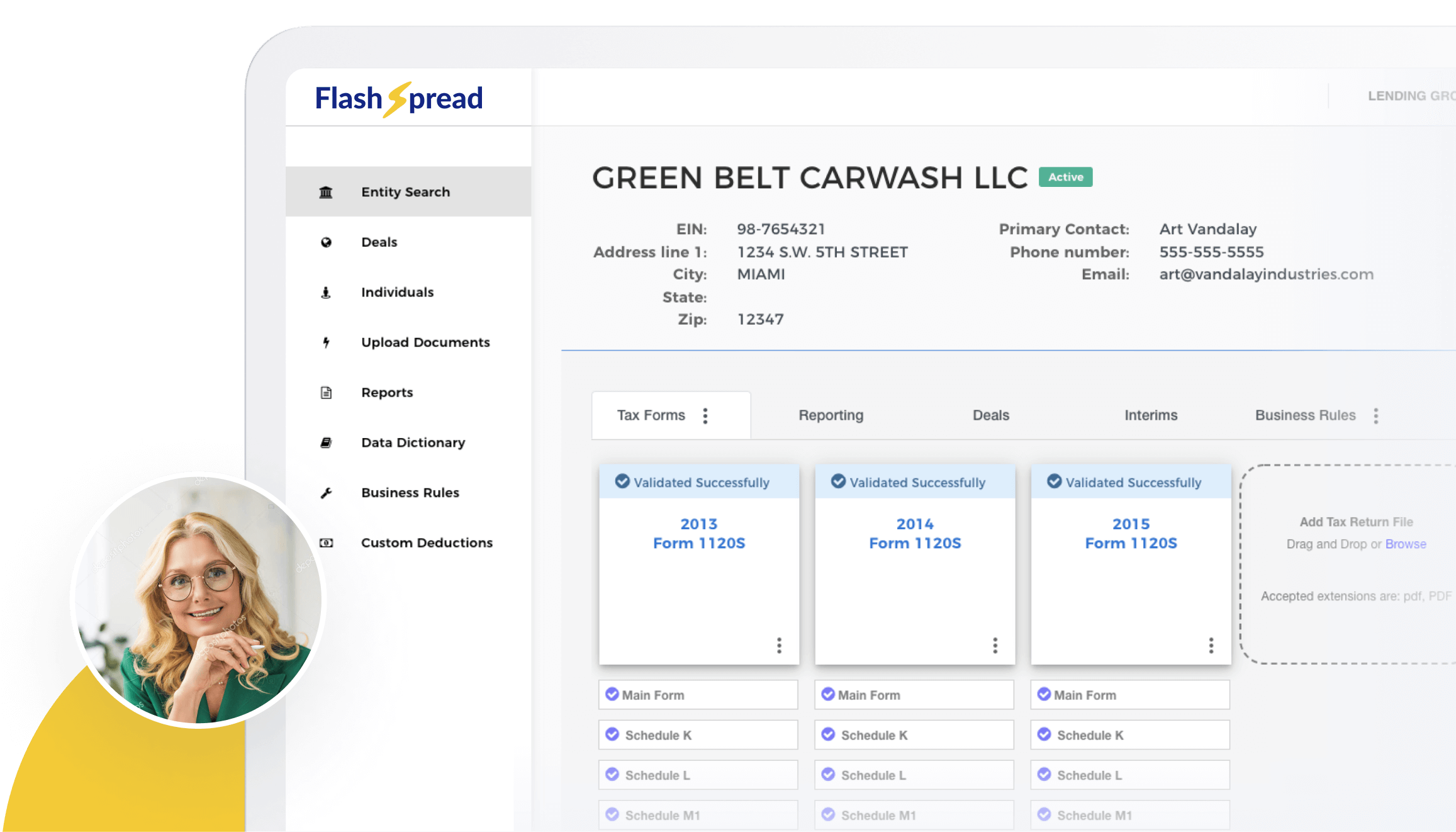

FlashSpread is a cutting-edge software that allows lenders to “scrape” data off scanned tax returns. This unique and innovative technology makes it possible for lenders to access a wealth of financial information instantly and effortlessly.

Then the software presents the data in various financial reports, including a global analysis. This makes it possible for lenders to quickly and easily review the financial situation of small business owners and make informed decisions regarding SBA loan approval.

This helps SBA lenders accelerate the lending process by reducing the time spent on data entry and analysis. Something that previously had to be done manually, and was a very slow process with the risk of human error. The new process takes all the financial data that potential borrowers present and processes it in minutes instead of hours, presenting a very clear analysis of the potential borrower’s financial health.

Because the entire process can be done more quickly, efficiently and reduces the risk of human error, more small business owners can get the financing they need in a timely manner.

How Does FlashSpread Benefit Lenders?

There are many benefits that FlashSpread offers to SBA lenders. But, perhaps the most important benefit is that it helps you work more efficiently and with greater accuracy. In addition, because the software can quickly process data and generate financial reports, you’ll be able to make quicker decisions about SBA loan approval. It also provides a consistent view across all loans making the analysis process even more efficient.

This is extremely beneficial for small business owners who need access to capital quickly. By being able to approve loans more quickly, you’ll be able to help more small businesses grow and succeed. In addition, FlashSpread can help lenders improve their overall loan portfolio health by identifying and addressing early warning signs of financial trouble. This helps lenders reduce their losses from loan defaults, saving them a significant amount of money.

Using FlashSpread to Streamline the SBA Loan Process

The first step in using FlashSpread is for lenders to input data about potential borrowers into the software. This data can be gathered from various sources, including public records, financial statements, and tax returns.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Once the data has been entered, FlashSpread will automatically generate financial reports for the lender to review. These reports will provide a clear and concise overview of the potential borrower’s financial situation.

The lender can then use these reports to decide whether or not to approve the loan. By using FlashSpread, lenders can save a significant amount of time and money while reducing the risk of loan defaults.

FlashSpread is an essential tool for any lender that offers SBA 7(a) loans. This innovative software makes it possible for lenders to quickly and easily review a potential borrower’s financial situation, making the decision-making process much quicker and easier.

Reducing Risk and Making Informed Decisions

At the end of the day, financial statement spreading is all about reducing risk for SBA lenders by giving them the pieces of critical financial data that they need. This helps them to make informed decisions regarding your loan.

Another benefit of FlashSpread is that it can help you reduce the risk of fraud. As mentioned earlier, small business owners may try to falsify information on their loan applications to get approved.

However, with FlashSpread, you’ll be able to quickly and easily review the financial data of potential borrowers. This will help you identify any red flags or inconsistencies that may indicate fraud.

When lending money, there is always some degree of risk involved in the business world. However, by conducting a thorough analysis of a potential borrower’s financial statements, lenders can minimize this risk and make sound decisions about whether or not to extend a loan.

When you use FlashSpread software to help create your financial reports, you benefit from an automated system that will do all the heavy lifting for you. This means that you can spend less time on data entry and more time analyzing the information to make the best decision about approving a loan.

How FlashSpread Can Benefit Your Lending Process

FlashSpread is essential for any lender offering SBA 7(a) loans. It helps reduce the risk of loan defaults by providing a clear and concise overview of the potential borrower’s financial situation.

In addition, FlashSpread can help improve the overall loan portfolio health by identifying and addressing early warning signs of financial trouble. This helps lenders save time and money while reducing their losses from loan defaults.

To learn more about how FlashSpread can help your business, please visit our website or contact us today.