Perhaps you’ve been hearing more buzz lately about the future of financial statement spreading for commercial lenders. Despite financial statement spreading being a common practice for most lenders, few are aware of ground-breaking technology that can automate the process.

In this blog post, we will cover:

- Why borrower financial statements are crucial for determining risk

- What exactly financial spreading means

- How the FlashSpread platform automates the financial spreading process

Financial statement spreading, also commonly referred to as tax return spreading by commercial lenders, is a labor-intensive process. Even though financial statement spreading takes a lot of time, lenders continue to do it because it’s vital for determining whether to fund commercial loans.

Let’s take a closer look at why financial statement spreading is important, what it is and how the process is now being automated by the FlashSpread platform.

Table of Contents

The Importance of Financial Statement Spreading

Borrowers’ financial statements are critical documents that contain financial data about their businesses. The most common financial statements used by businesses and lenders are the income statements (also known as a profit and loss statement), the balance sheet and the statement of cash flows. Businesses often report these statements monthly, quarterly and yearly.

Financial statements are one of the best representations of how much sales and profit a business makes every year. Commercial lenders use this information to analyze the borrower’s credit and determine whether or not they will issue a business loan.

For commercial lenders to be able to analyze a borrower’s financial statements properly, they have to take the financial statement data and process it into more granular level data. This process is called financial statement spreading.

What is Financial Statement Spreading?

During the automated spreading process, information is transferred from a borrower’s financial statements into the lender’s financial analysis spreadsheet or software program. By transferring the borrower’s past financial statements, and even tax documents from prior years into the lender’s financial analysis program, the credit analysts at the lending institution can spot year-over-year trends and gain a much deeper understanding of the borrower’s financial condition.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Financial statement spreading produces many granular reporting outputs that are very useful for lenders. Lenders compare these output reports against benchmarks as a standard against which to compare the borrower being examined to other borrowers.

Lenders then add up these output reports and ratios to make a final determination on whether to fund the loan in question. These reports and ratios also help the lender to know how much of the business can be liquidated in a worst-case scenario, where the borrower defaults on the loan.

At the end of the day, financial statement spreading is all about reducing risk for lenders by giving them the pieces of critical financial data that they need to make good business decisions for their institutions.

While this is immensely valuable for lenders, it’s traditionally been a manual and time-consuming process that is prone to errors. Furthermore, financial statement spreading can be problematic when it comes to conforming to Generally Accepted Accounting Principles (GAAP). For example, long-term liabilities may now be spread as current liabilities and current assets may now be spread as non-current assets.

The good news for lenders is that financial statement spreading software is now being introduced to automate the process.

Groundbreaking Financial Spreading Automation for Lenders

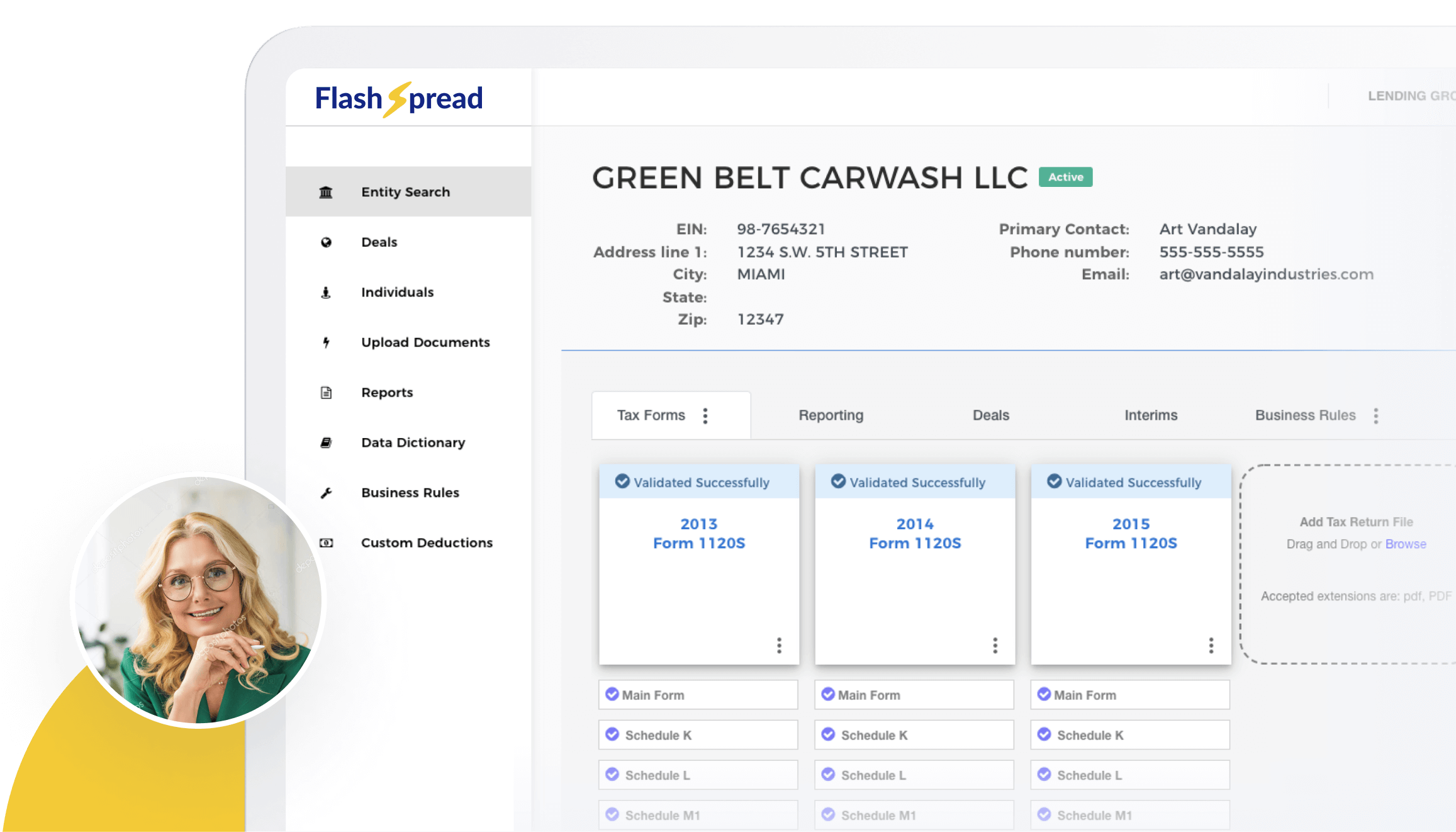

With FlashSpread’s ground-breaking financial statement spreading software platform, borrowers’ scanned tax returns can be instantly converted into comprehensive financial reports with minimal human interaction. This next-generation technology allows lenders to make fast, error-free credit decisions that help ensure the future solvency of their institutions.

The days of spending hours doing financial spreading manually only to deny a loan are over. Schedule a demo today!