In the new era of mortgage technology, even the smallest enhancements can make a world of difference. Today, we’re excited to introduce a feature that promises to simplify and improve the mortgage application process — the Ability to Send Signup Welcome Email via LOCC (Loan Officer Command Center). In this blog post, we’ll explore the significance of this feature and how it is set to transform the world of mortgage technology.

The Pinnacle of Mortgage Technology

Mortgage technology has come a long way in streamlining and simplifying the complex mortgage application process. From online document submission to automated underwriting, technology has revolutionized the way lenders and borrowers engage with the mortgage journey. In this digital age, staying at the forefront of technological advancements is essential for anyone involved in the mortgage industry.

Introducing the Ability to Send Signup Welcome Email via LOCC

The recent introduction of the Ability to Send Signup Welcome Email via LOCC marks a significant milestone in the mortgage technology arena. This feature is designed to benefit both lender users, such as Loan Officers (LOs) and Loan Officer Assistants (LOAs) and borrowers by facilitating smoother communication and access to crucial information.

Key Features and Benefits

Let’s delve into the key features and benefits of this new capability:

1. Streamlined Communication

- Lender users, including LOs and LOAs, can now easily send or resend the “Signup Welcome Email CoBrowsing” directly via the LOCC.

- This feature eliminates the need for separate email communications and provides a streamlined channel for welcoming borrowers, co-borrowers and non-borrowing entities (NBEs) to the mortgage process.

2. Enhanced Accessibility

- Borrowers, co-borrowers and NBEs who may not have received the initial welcome email or encountered issues accessing their loan dashboards can benefit from this feature.

- It ensures that all relevant parties have access to the essential information required for a smooth mortgage journey.

3. Error Resolution

- In cases where the initial welcome email was not received or ended up in spam folders, lender users can easily resend the email to ensure borrowers are well-informed and ready to proceed.

- Additionally, if there were errors within the mortgage technology platform that prevented email delivery, this feature addresses and rectifies such issues.

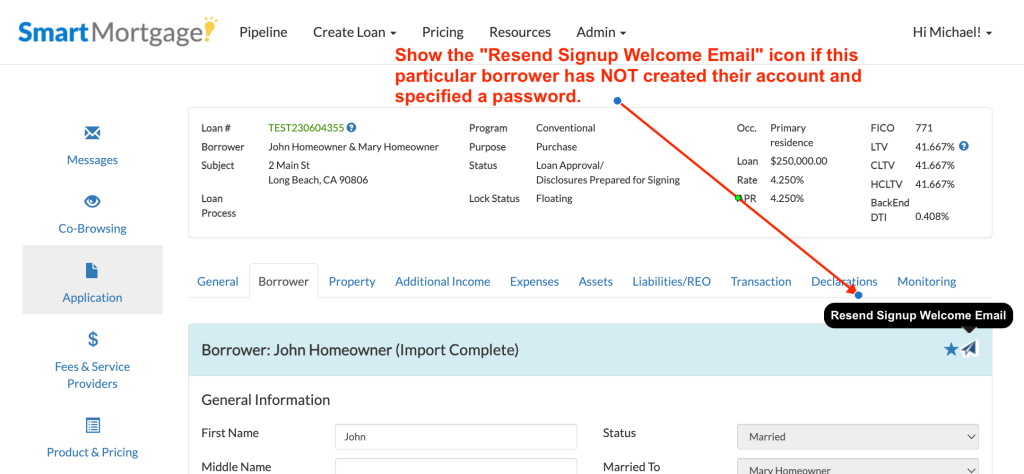

4. Flexibility and Smart Functionality

- The system is designed to be intelligent and adaptive. It can determine whether a specific borrower, co-borrower, or NBE has already been provisioned in Besmartee.

- For users who haven’t created their accounts yet, the feature allows for the seamless resend of the welcome email. For those who have, it offers the ability to reset passwords.

5. Role-Based Access

- Access to this feature is role-based, ensuring that only users with the necessary permissions, such as the “Send Reset Password Loan” permission, can utilize it.

- This security measure enhances the control and integrity of the mortgage technology platform.

Elevating Mortgage Technology: Introducing the Ability to Send Signup Welcome Email via LOCC

Why This Feature Matters

The Ability to Send Signup Welcome Email via LOCC is not just another technical update; it’s a testament to the commitment of the mortgage technology community to improving the user experience. Here’s why this feature matters:

1. Enhanced User Experience

This feature simplifies interactions for both lender users and borrowers, making the mortgage application process more user-friendly.

2. Communication Efficiency

Effective communication is at the heart of successful mortgage transactions. The feature streamlines communication channels, ensuring that borrowers receive essential information promptly.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

3. Error Reduction

Resending welcome emails and addressing errors promptly reduces the chances of complications and delays in the mortgage process.

4. Accessibility

The mortgage journey should be accessible to all individuals, regardless of their circumstances. This feature promotes inclusivity and equal access to information.

5. Compliance and Security

Role-based access ensures that the feature is used responsibly and securely, aligning with industry regulations and best practices.

The Future of Mortgage Technology

As we introduce the Ability to Send Signup Welcome Email via LOCC, we must acknowledge that this is just one step in the journey of mortgage technology. The industry is characterized by constant innovation and a commitment to making the mortgage application process as seamless and user-friendly as possible.

A Brighter Future for Mortgage Technology

The Ability to Send Signup Welcome Email via LOCC represents a pivotal moment in the evolution of mortgage technology. It reflects the industry’s dedication to enhancing every aspect of the mortgage experience. This feature ensures that users, whether lender professionals or borrowers, have the tools they need for effective communication and access to information.

The mortgage application process is not just about numbers and documents; it’s about empowering individuals and communities to achieve their homeownership dreams. With this new feature, we take a significant step toward ensuring that the path to homeownership is open and accessible to everyone, regardless of their circumstances.

Unlock the future of mortgage technology with BeSmartee—your gateway to a more efficient and accessible homeownership journey. Take the first step today!