The commercial lending industry is facing a period of flux heading into 2023. The long recovery from the pandemic is finally settling down and the businesses that survived are getting back to their normal operations.

Through April of 2021, more than 200,000 businesses closed their doors for good due to COVID-related financial difficulties, and the ones that remain continue facing staffing, inflation and supply chain issues.

Despite these setbacks, the 5-year outlook currently looks strong. Keep reading to learn more about the 5-year commercial lending forecast, including what impact interest rates, inflation and a possible recession might have on business growth across commercial office, retail and multifamily rental industries

Table of Contents

Commercial Lending Interest Rates, Inflation and Recession

Interest rates have continued to rise, with the Federal Reserve raising them in 2022 up three-quarters of a percentage point for a total increase to date of 3.75%; this is the steepest rate growth since the 1980s and part of the Fed’s continued efforts to curtail inflation.

The Congressional Budget Office projects that while one more rate hike may come before the end of the year, they don’t anticipate increases to continue. In fact, interest rates should remain steady throughout 2023 as inflation starts to slow and then ultimately settles heading into 2024.

Despite these relatively good outlooks for 2023 and 2024, ongoing inflationary concerns might drive the economy into a recession before everything can level off. In a July 2022 survey, economists stated there is a 52% probability we see a major economic contraction within 18 months.

Even so, commercial lending and investing hasn’t slowed. Driven by inflation-proof office, retail and multifamily rental growth, the long-term outlook is strong even without bringing commercial mortgages into the mix. Instead, look for your main business to come from renovations and new business lending.

The Great Office Resurgence

Forget the Great Resignation; office life is gradually getting back to normal amid a resurgence of return-to-work mandates from large corporations like Apple and small businesses alike. 84% of metro areas reported increased occupancy in Q1 of 2022, and while there still isn’t the same demand for new office space, the businesses that remain are renovating both their spaces and their policies to be more employee-friendly.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Remote work is likely here to stay, though not in a full-on pandemic way. Hybrid work will continue to be in demand, but landlords are willing to consider mixed or alternative uses for newly-vacant office space. So, even though the long-term analysis is still out on total remote work, commercial building leasing is in for a promising few years.

Retail and Restaurant Reboot

Retail shops, grocery stores, and restaurants face the greatest recovery hurdles in our post-Covid world. UBS analysts expect to see an additional 40,000 to 50,000 retail closures through 2026, in an economy that increasingly prefers either one-stop shopping or the convenience of e-commerce.

Even with pandemic challenges, reduced staffing, and supply chain issues, grocery stores continue not just to survive, but also to thrive. One way this could impact lending going forward is the re-emergence of shopping plazas anchored by grocery stores. Particularly in so-called food deserts, or areas without grocery stores, developing such a mixed-use property could solve not only food scarcity but also revive lower-income areas that couldn’t support their local businesses through the pandemic.

Around 80,000 restaurants nationwide fell victim to pandemic closures in 2021, and the industry as a whole, like grocery stores, faces prolonged staffing and supply inconsistencies. There is no way to predict how long these issues will continue. Lending to restaurants going forward is, thus, unpredictable. But restaurants in those same mixed-use development centers as grocery stores likely have a higher chance at success over 5 years.

Multifamily Real Estate

Multifamily real estate continues to boom, especially outside of major, high-priced urban areas. Inflation is quashing home sales, which then is driving demand for rentals. Commercial lending will take two tracks going forward: new loans to developers to build new properties and loans to existing property owners for renovations. Even though multifamily lending experienced a small drop throughout 2022, largely due to the effects of inflation, economists anticipate the demand for loans will bounce back in 2023 and 2024 as interest rates continue to stabilize.

Growth Forecast Changes

Commercial lending as a whole continues trending upward despite post-pandemic challenges. The industry must remain flexible, however, because as time goes on borrowers’ needs may change. Recession, or unanticipated interest or inflation growth beyond 2024 could change this forecast.

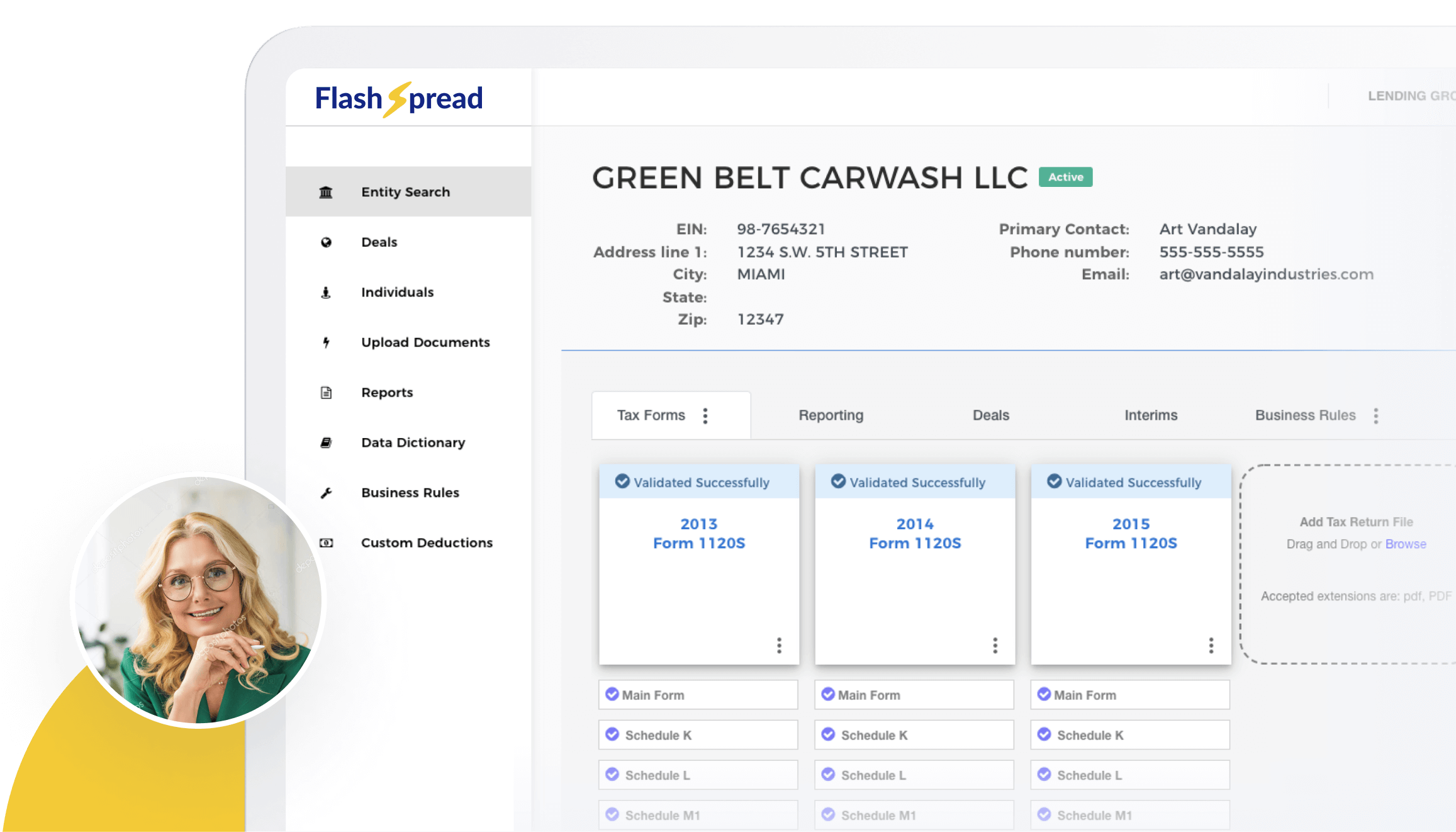

Contact FlashSpread today to learn how FlashSpread‘s solution can transform your commercial lending process!