As 2022 gains momentum, it’s a good time to assess the trends that will dominate and transform the commercial banking space in 2022. It will come as no surprise that much of the innovation we will see today and in the near future will be driven by advanced, digital technologies.

In this blog post, we will cover what to expect in the year to come:

- The drive toward digital services via SaaS applications

- Fintech’s dominance in banking

- Alternate lending for SMEs

- Optimized workflows through digitization

- New ways to parse and process credit data

How tech manifests in the commercial banking space; however, will impact everything from manual entry and paper trails to large-scale financial ecosystems. Let’s look at the top trends in commercial baking for 2022.

Table of Contents

Platformication

With the advent of PSD2 in the EU and similar, open banking protocols around the globe, banks can now leverage open APIs, allowing them to partner more effectively with third parties developing innovative fintech solutions. This systemic turning point has also been enabled by the emergence of customizable cloud infrastructures that are available at a more affordable entry point than in the past.

Large banks already digitizing key offerings within their institutions are increasingly aware of the fact that they can further leverage digital services via various aaS applications. With these service models in play, financial institutions can attract a more diverse and wide-reaching customer base without extensive upfront cap spend.

Fintech Completes the Transition into Commercial Banking

Until very recently, fintech had been limited to the retail banking space, making only small forays into commercial banking via offerings focused on process improvements. Now, with the increasing popularity of B2C super-apps, fintech innovators are developing complex ecosystems that deliver everything from payment and transfer services to CRM and ERP solutions.

Alternative Lending

While the fallout from the pandemic was not as severe as that experienced during the Great Recession, many traditional lenders switched to the back foot and were hesitant to fund loans to small to medium-sized enterprises.

Alternative lenders have stepped in to fill in this gap, developing tech-driven, user-friendly offerings to SMEs. The loan process involves fewer steps and can even leverage data gleaned in real-time from an operation’s invoices to run a credit assessment. With a transactional value of 9.6 billion USD in 2020, the alternative lending space is only expected to grow as more SMEs bypass traditional lenders for fintech alternatives.

Optimized Workflows & Processes

Low-paper processes are transforming the back office, simplifying workflows and lowering operational overhead. Traditional financial institutions have long been the home of extensive paper documentation.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

As digital platforms gain more real estate in the space, many of these legacy workflows are only holding banks back. Digitizing existing records, leveraging ML and AI to process and evaluate data, allows institutions to process loan and mortgage applications more quickly and onboard customers more efficiently.

New Credit Data

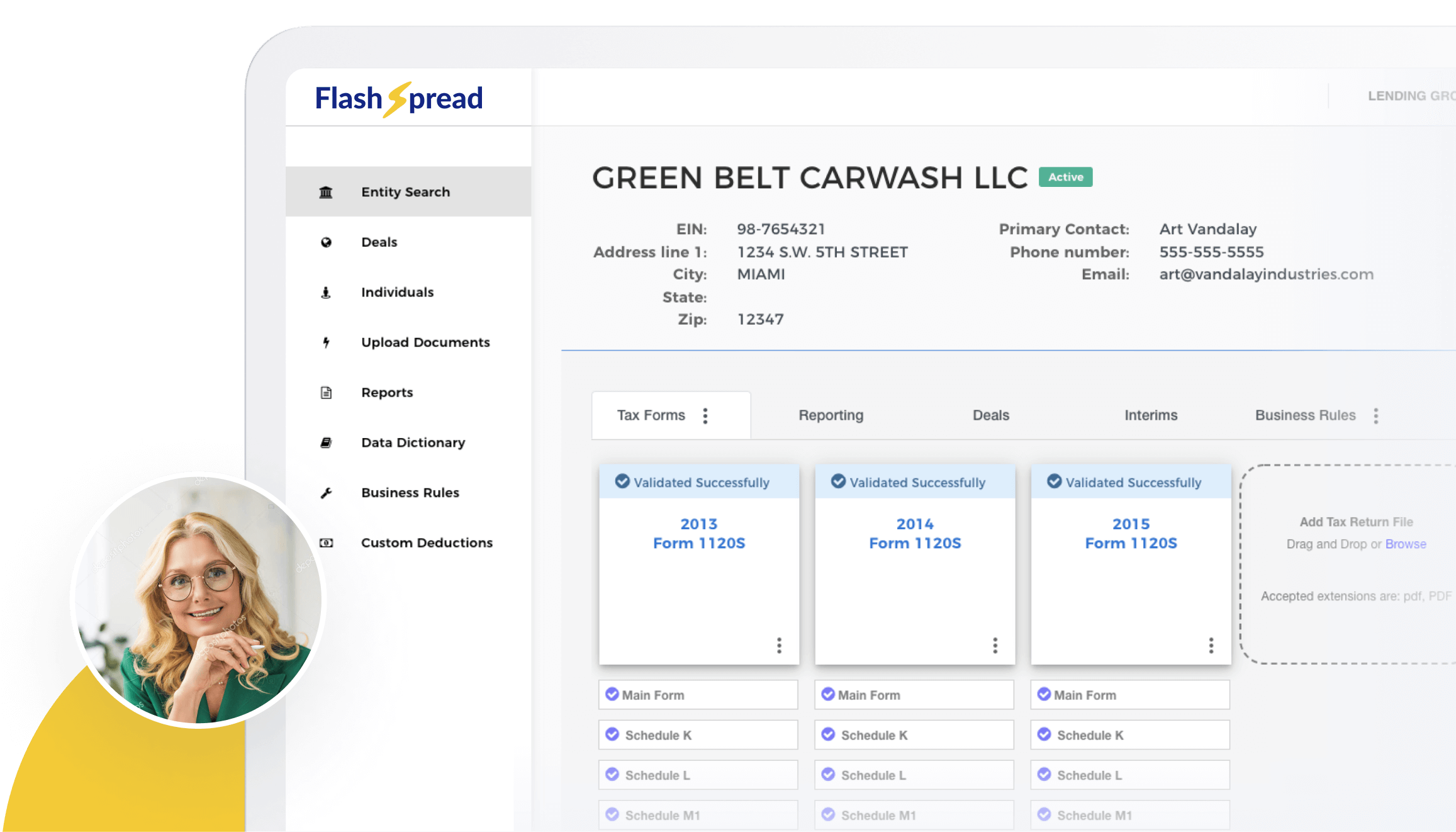

Commercial lending is turning to alternative credit data in order to drive more effective credit decisions. Central in this is a shift from Descriptive to Predictive analytics when assessing a credit file. Innovative solutions such as FlashSpread are also offering new and faster ways to integrate data into credit decisions.

What’s more, today’s SMEs are generating sizable digital footprints, providing a large and dynamic new pool of data for determining credit worthiness. Data points with this approach can total in the hundreds, a far cry from the 8 to 10 variables considered under traditional credit scoring models.

Smart Contracts

Blockchain has gone a long way toward righting the “wrongs” of the analog, paper-based financial protocols, reducing the risk of fraud and supporting a quicker exchange of monies. With this tech at its core, smart contacts are defining new paradigms for 2022.

With smart contracts, banks will be better able to clear trades quickly and streamline settlement activity. These blockchain-driven solutions can also reduce costs via increased efficiency and provide greater transparency for parties on either end of a trade or transaction.

Roundup — “Trends” in 2022 Mean Systemic Change

Calling the shifts that will take place in the months to come “trends” shortchanges their true, systemic impact. What the commercial banking space can expect in 2022 is the continuation and consolidation of new digital paradigms that will define a new normal.

Digital solutions, open banking and advanced automation will be at the heart of every financial services (FS) institution and within every financial transaction. How institutions engage with these trends in 2022 will go a long way toward defining their relevance in the commercial banking space and their resiliency in the coming decade.

To learn more about how FlashSpread will serve as a key player in the transformation, schedule a demo today.