Commercial lending focuses on assessing the creditworthiness of businesses to determine if issuing a loan is in the best interest of the bank. Many commercial lenders continue to use manual, paper-based loan approval processes. As a result, their decision times are slow and errors are often present.

In this blog post, we will cover:

- Accelerating the commercial lending cycle

- Reducing costs associated with the lending process

- Enhancing accuracy in the processing of financial data

- Increasing customer satisfaction with a faster, simpler underwriting process

The processes that a financial institution uses can impact underwriting performance metrics. By introducing automation into the commercial lending process, financial institutions can greatly enhance the performance of their underwriting teams.

Let’s take a closer look at four key benefits of using automation in commercial lending.

Table of Contents

Accelerate the Commercial Lending Cycle

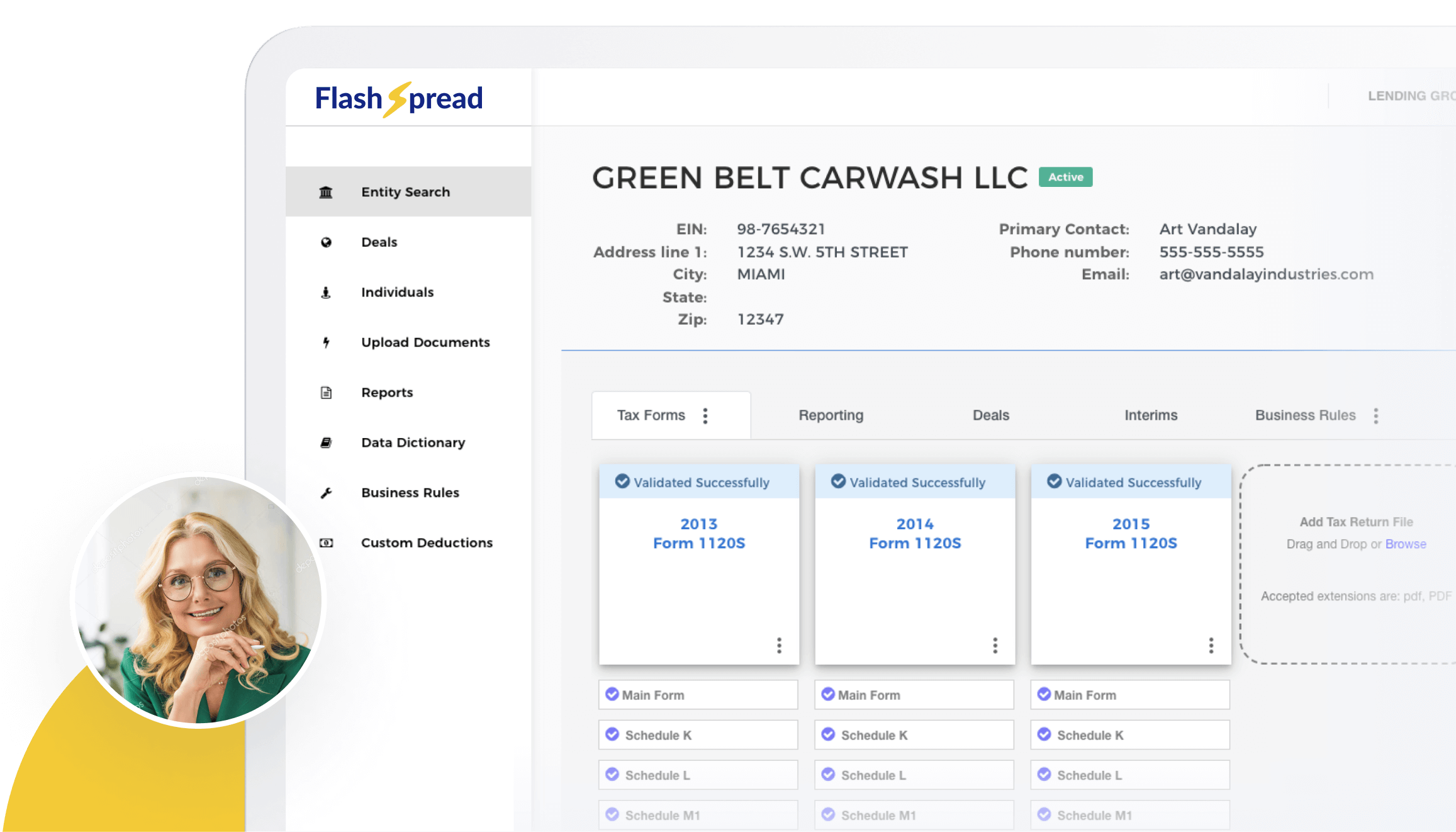

Automation enables a far more productive commercial lending cycle. For example, by using an automated platform, financial statement spreading occurs instantaneously, which allows commercial lenders to assess the creditworthiness of the business in a matter of minutes.

This gives more time back to commercial credit analysts to conduct critical activities such as ratio analysis and forecasting. The overall effect of automation in commercial lending is that it shortens the lending cycle substantially.

Cost Reduction

When it comes to the commercial loan underwriting process, time is money. Without automation, lenders spend a great deal of time spreading financial data only to find out that the business is not creditworthy. This wasted time takes away from valuable time that could be spent closing high quality deals. With automation, commercial lenders can cut costs by generating revenue with much greater efficiency.

Enhanced Accuracy

Manual processes used in commercial loan underwriting are prone to errors. When errors occur, they can take a long time to fix, which cuts into productivity and drives down revenue.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

With automated loan processing, accuracy is greatly enhanced because the potential for human error is removed for large portions of the commercial underwriting process. Additionally, commercial lenders can spend less time training employees to prevent errors because there are fewer manual tasks involved.

Increased Customer Satisfaction

Business owners often feel that the process of obtaining a business loan is complex. They complain that the application process is difficult and the time it takes to receive a credit decision is too long. By using an automated commercial lending platform, this perception is being radically transformed in a positive way.

Since the automated platform digitizes the business owner’s paper documents, such as tax returns, the process is much simpler and faster. Plus, the business owner’s data is more secure as automated commercial lending platforms use bank-level data security technologies. The result is business owners receive an expedited credit decision with much less hassle involved, which results in increased customer satisfaction.

Roundup

Automation is rapidly transforming the small business and commercial lending process. Many traditional commercial lenders are starting to adopt automation platforms in their underwriting processes.

Commercial lenders are increasingly recognizing the opportunity to increase productivity and customer satisfaction using automation. These lenders are also enjoying substantial cost savings and time being added back to their calendars for more valuable activities.

For more information on FlashSpread’s automated commercial lending platform, schedule a demo with one of our specialists today!