HUNTINGTON BEACH, Calif., August 9, 2022 — Mortgage software front runner BeSmartee elevates its industry-leading mortgage point-of-sale (POS) solution to serve consumers seeking home equity loans (HELOAN) and home equity lines of credit (HELOC).

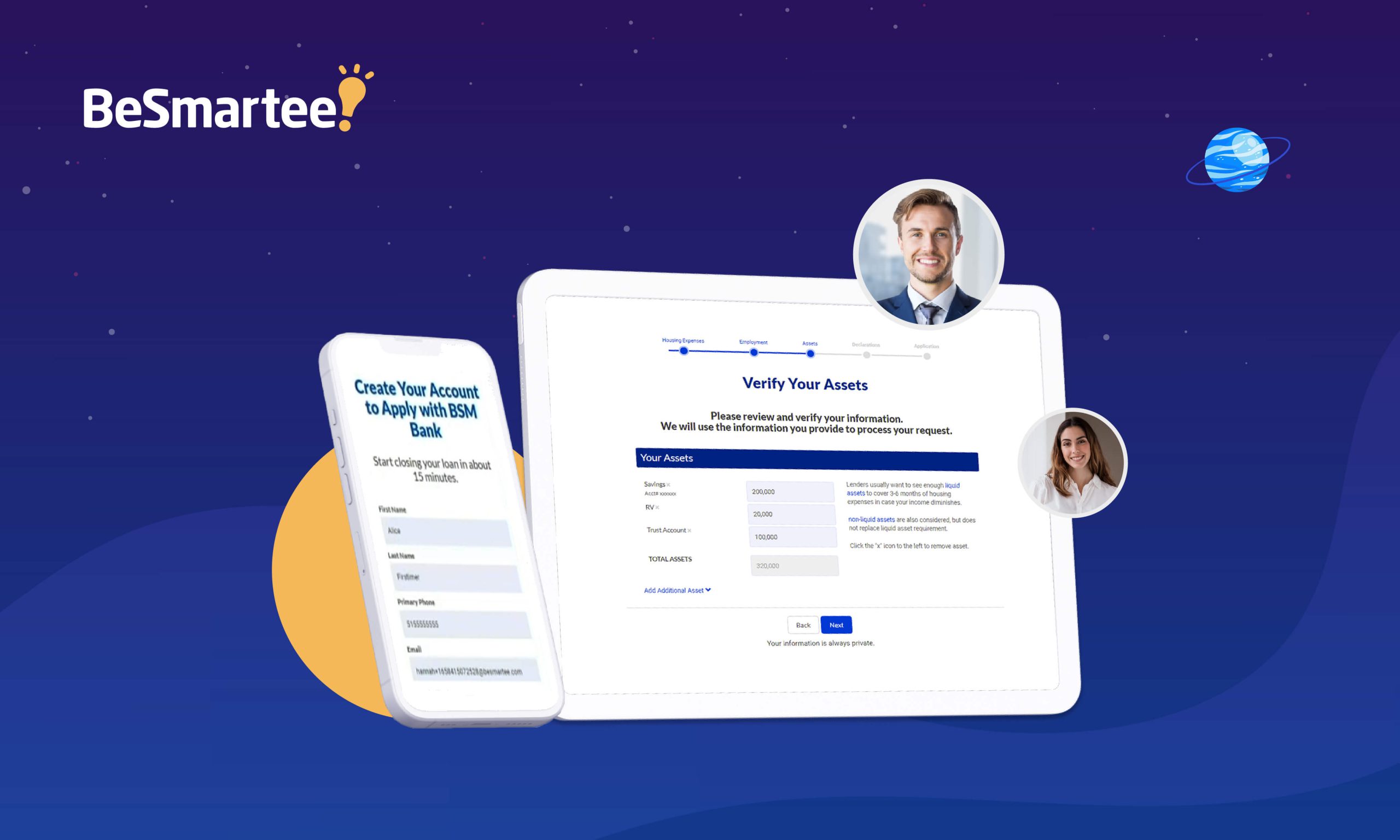

Web-based and mobile responsive, the revolutionary BeSmartee Home Equity POS is easily accessed from any device, offering reliable self-service tools built to satisfy today’s borrowers and lenders HELOC/HELOAN requirements.

According to Black Knight’s Mortgage Monitor report, US homeowners have $11 trillion in tappable equity ($207k per borrower). Credit unions are using the demand for HELOC and HELOANs to their advantage.

“FMFCU offers HELOCs and fixed-rate home equity installment loans, and recent demand has been tremendous. Rising rates have caused a shift away from first mortgages to home equity loan options. We’ll see if that trend continues as rates rise across the board for all loan types,” said Marty Burke, VP/Mortgage Development Officer at Franklin Mint FCU.

“We do offer home equity loans, which have picked up quite a bit. Our home equity portfolio has grown 15% year-over-year, 10% year-to-date, and 20% annualized. So a substantial amount of that growth has occurred during this period of frequent rate increases,” said Ben Teske, EVP/CLO of Greater Texas FCU.

Additionally, a recent HousingWire article reported that both Rocket and loanDepot announced that they are also diversifying their product offerings with home equity loans and lines of credit in response to the fall in mortgage originations.

Subscribe to BeSmartee 's Digital Mortgage Blog to receive:

- Mortgage Industry Insights

- Security & Compliance Updates

- Q&A's Featuring Mortgage & Technology Experts

Featuring global configurations, lenders are free to structure the software to better suit their business needs. Further, the platform’s user-friendly design guides borrowers, helping them successfully reach their financial goals – whether it be to consolidate debt, make home improvements or access home equity for other purposes.

“BeSmartee continues to add value to lenders through new products and features that exceed user and market demands,” said Veronica Nguyen, Co-founder and Executive Vice President of BeSmartee.

Transforming the traditionally drawn out second mortgage process, BeSmartee’s flexible, frictionless and fully automated Home Equity POS solution ensures a fast, easy and transparent lending experience for all.

About BeSmartee

Leading fintech firm BeSmartee is transforming the financial services industry with its award-winning, web-based digital mortgage platforms for banks, credit unions and non-bank lending institutions. BeSmartee delivers a complete digital mortgage experience that goes deeper into the origination process to help lenders convert higher and close faster — making a once tedious, paper-laden process fast, easy and transparent for all. For more information, visit http://www.besmartee.com.